Pound / Euro Forecasts 2022: Latest from Swedbank

- Written by: Gary Howes

Image © European Central Bank.

Pound Sterling will find little support from a Bank of England that lifts rates before, and more, than its Eurozone counterpart according new analysis from a major Scandinavian lender.

New foreign exchange research and forecasts issued by Swedbank - one of of Sweden's largest retail banks - finds that interest rate hikes at the Bank of England will be "no panacea" for Sterling as the UK's economy will endure subdued economic growth rates over the medium term horizon.

The Pound fell sharply in the first week of November after the Bank of England kept the Bank Rate unchanged at 0.10%, defying investor expectations for a hike.

The disappointment and associated pullback in investor expectations for future interest hikes pulled the Pound lower against the Euro, Dollar and other major currencies.

"GBP has been volatile in the wake of a roller coaster in the UK rate market. The Bank of England (BOE) governor Bailey shook up expectations by indicating an early rate hike could

be warranted to anchor inflation expectations," says Anders Eklöf, Chief FX Strategist at Swedbank.

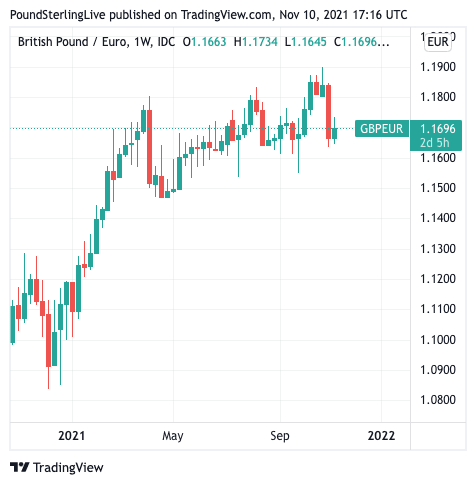

Above: GBP/EUR experienced its second-largest one-week decline owing to the Bank of England's decision to keep rates unchanged.

- GBP/EUR rates at publication:

Spot: 1.1684 - High street bank rates (indicative band): 1.1375-1.1457

- Payment specialist rates (indicative band): 1.1580-1.1626

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

But Eklöf says the main take away from the November policy update was that the Bank pushed back the 100 basis points of hikes priced in over the next year.

Markets had not only expected a 2021 rate hike but also a series of subsequent hikes that would take the Bank Rate to over 1.0% in 2022, levels seen before the great financial crisis.

Economists are of the view that such expectations are unrealistic as this would represent significant monetary tightening, to the extent that the UK's economic growth would be seriously compromised.

"Hikes in that magnitude would risk undershooting the target in two years as growth returns to potential and energy price inflation fades," says Eklöf.

Raising interest rates is a potent source of support to a currency when those interest rate rises are a response to an economy that is enduring such strength that it risks overheating.

GDP released on Thursday November 11 serves as a reminder that the UK economy is in no such position: The ONS reported the UK economy grew 0.6% in September as economic activity recovered further from August's 0.40% growth. The market was looking for a reading of +0.40%.

But the data were largely softer than analysts had been expecting: the economy grew 1.3% in the third quarter, which is softer than the 1.5% the market was looking for and below the 1.5% the Bank of England had forecasted.

Annual GDP read at +6.6% which was softer than the +6.8% anticipated.

Worryingly, business investment was very week coming in at just +0.4% quarter-on-quarter in the third quarter, the market was expecting a reading of +0.2%.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"We doubt that GBP will profit much from early rate hikes as it will not be a function of strength in the economy, but early signs of speed limits in the economy post the pandemic/Brexit," says Eklöf.

Swedbank's medium-term expectations for the Euro vs. Pound are that it will ultimately remain confined to a range against the Euro but will trend weaker vs. Dollar and Canadian Dollar.

"With potential growth post-Brexit at 1-1.5 percent, fiscal policy stimulus fading and the persistent current account deficit, the UK is in no need of a stronger currency. The UK is a net importer of energy, but less so than the EU," says Eklöf.

While the outlook for the UK economy and Sterling is constrained, so too is that for the Eurozone and Euro.

Swedbank say they expect "the EUR to remain an underperformer in G10".

Key headwinds to the single-currency include:

- supply disruptions in the manufacturing sector

- weaker export demand from China

- the rise in energy prices

- rising Covid cases and the introduction of partial restrictions

As such Swedbank hold a Euro to Pound exchange rate forecast of 0.85 for the next twelve months, which translates into a Pound to Euro exchange rate of 1.1765.

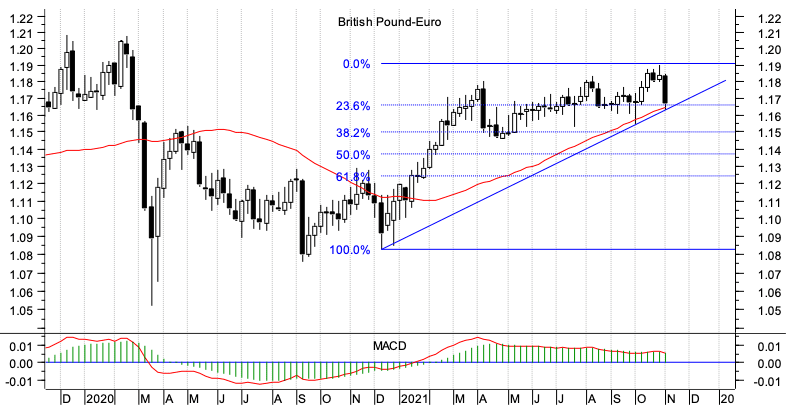

GBP/EUR fell 1.50% in the previous week and has since been looking to stabilise around the 1.17 area, a decline that technical analysts says diminishes a once bullish setup.

"Sterling/Euro recently ran up to a trading high of 1.19 – its highest reading in more than a year and a half – but the bullish sentiment that drove it up to that level evaporated last week as traders reacted to the Bank of England’s decision to leave rates on hold," says Bill McNamara, head of The Technical Trader.

Above image courtesy of The Technical Trader.

McNamara says the scale of the previous week's slump "looks like a pretty clear signal that the rally is over for now".

He observes the appearance of bearish divergence on several technical indicators on the charts as underpinning this view.

"Further near-term weakness is possible and the next target is the September low, at 1.157 (which was also a support area back in July); if that fails to hold the April low, at 1.146 or so, could come into play," says McNamara.