Pound-Euro Week Ahead Forecast: Looking to Steady at 1.1650 but Upside Likely Limited

- Written by: James Skinner

- GBP/EUR supported above 1.16, may steady near 1.1650

- But upside limited as analysts, investors remain cautious

- Market’s expectations of Bank Rate still too high for 2022

- Signs of GBP/USD reversal & rebound support GBP/EUR

Image © Adobe Images

The Pound to Euro exchange rate starts the new week hobbled by the market response to last week’s Bank of England (BoE) monetary policy decision but it could be likely to stabilise above the nearby 1.1650 level over the coming days, albeit with only limited upside potential.

Pound Sterling reached a low of 1.1635 against the Euro on Friday after falling from near 1.18 in the hours before November’s Bank Rate decision from the BoE forced the market to recognise mistaken assumptions about the outlook for interest rates in the UK.

Sterling rebounded tepidly ahead of the weekend but had taken a pummelling when the BoE left Bank Rate unchanged at 0.10% and reiterated a policy assessment that continued to point toward the early months of the new year for any change to interest rates.

“The BoE’s decision to keep monetary policy unchanged surprised markets. But it was in line with our expectations and with the MPC’s earlier guidance that it wanted to see evidence regarding the impact of the end of the furlough scheme before hiking. We narrowly favour a February rate increase over December,” says Andrew Goodwin, chief UK economist at Oxford Economics.

Investors had expected Bank Rate to rise in November after paying too little attention to September’s announcement, which made clear the BoE’s desire for clarity on the employment situation before any decision to begin paring back the support provided to the economy through interest rate cuts back in 2020.

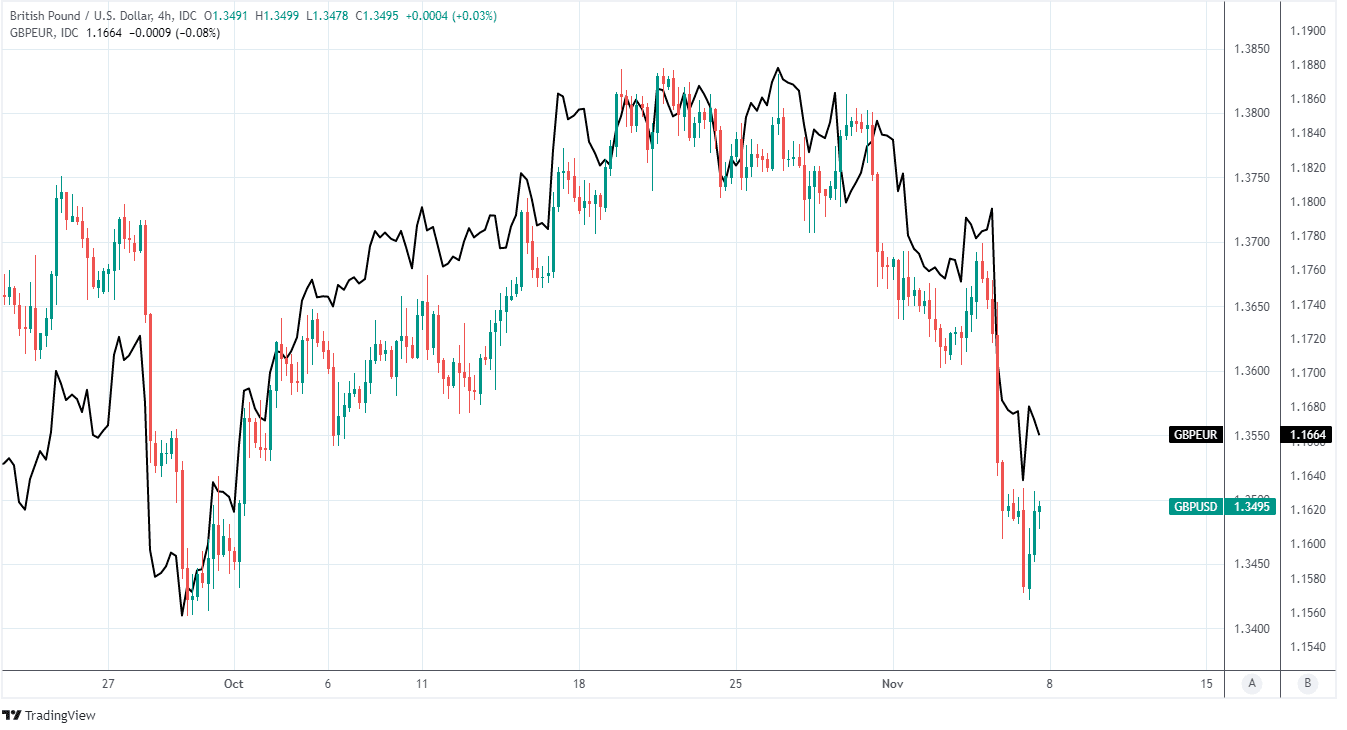

Above: GBP/EUR shown at 4 hour intervals with GBP/USD.

- Pound to Euro rates at publication:

Spot: 1.1686 - High street bank rates (indicative band): 1.1377-1.1459

- Payment specialist rates (indicative band): 1.1580-1.1630

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The BoE is seeking to understand the impact that September’s end to the furlough scheme had on overall employment before making any changes to its interest rate, but this data will not begin to be available until December at least and with much of it coming only after then in January and February.

“The BoE is still on track to tighten by 65bps to 90bps next year (0.75% or 1.00%) so we think this leg lower in the GBP against the EUR and JPY should reverse through the next few months and into 2022. Against the USD, however, upside remains more limited as markets may begin to price in more Fed hikes next year,” says Juan Manuel Herrera, a strategist at Scotiabank.

BoE policymakers have been reluctant to begin reversing the cuts that took Bank Rate from 0.75% to 0.10% last year without first knowing that employment levels and the job market have weathered September’s withdrawal of support from HM Treasury.

This always ruled out a November interest rate rise and made December, if not February 2022 or some other time afterward, the more likely of candidates.

“We’ll get two jobs reports (as well as two inflation reports) before the next BoE meeting on 16 December, and we expect the dataflow to prove all in all supportive for a 15bp December hike. A December move is still not fully priced in by the GBP money market, which suggests there is some moderate room for sterling to benefit from hawkish re-pricing,” says Francesco Pesole, a strategist at ING.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Pesole and the ING team said on Friday that lingering prospects of a December rate rise could support the Pound-to-Euro rate during the weeks ahead and are forecasting it for a recovery to around 1.1764, or at 0.86 in EUR/GBP terms by year-end.

Others are less optimistic about the outlook for Sterling however, and have cited the market’s medium-term expectations for Bank Rate as likely to ensure the Pound-to-Euro rate remains suppressed near 1.1637 over the coming months.

“We think there is still some premium in GBP left to be unwound as investors adjust to a less aggressive policy response over the next few meetings, and the market will likely continue to price some risk of less policy support for the Euro area periphery against elevated inflation prints into the December ECB,” says Michael Cahill, a G10 FX strategist at Goldman Sachs, in a Friday research note.

Even after last week’s crashing and banging, the market was still looking on Friday for Bank Rate to rise to 1% before the end of 2022 and despite this level of rates having been almost ruled out by the BoE's latest forecasts and Governor Andrew Bailey in Thursday’s Monetary Policy Report press conference.

"It is likely that for inflation to return to target in a timeframe that should help to keep medium-term inflation expectations anchored will require Bank Rate to rise. That said, I would caution against views on the scale of an increase that would be likely to push inflation below target in future by increasing slack in the economy," Governor Bailey had said in a partial conclusion of his opening remarks at the press conference.

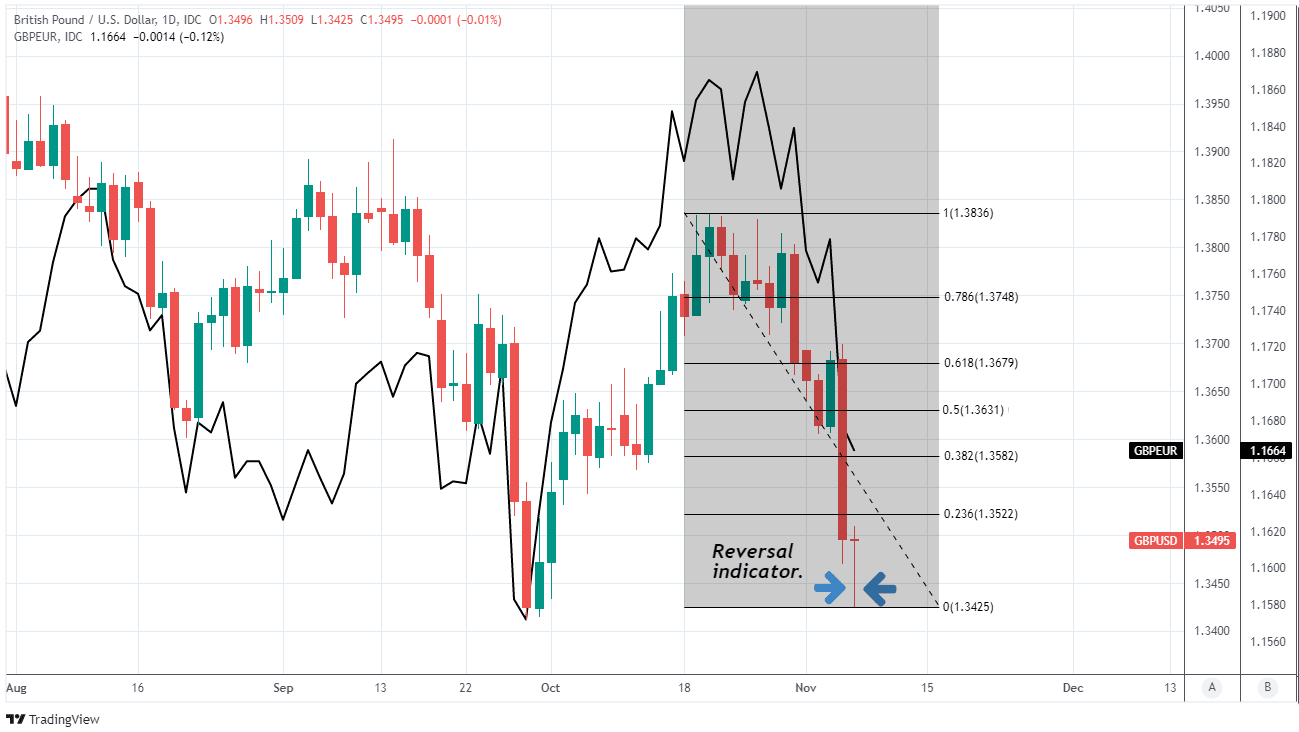

Above: GBP/USD with ‘dragonfly doji’ candlestick on daily chart and Fibonacci retracements of mid-October decline indicating possible short-term resistances to any GBP/USD rebound. GBP/EUR shown in black.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

There is little in the calendar to guide Sterling or expectations for BoE policy until the UK’s third-quarter GDP data is released on Thursday at 07:00, which will be important for determining how much further the economy has left to go before it recovers the GDP that was lost amid attempts to contain the coronavirus.

“We expect there to have been a modest acceleration in September, with GDP estimated to have risen 0.6% m/m, leaving output just 0.2ppts short of its February 2020 pre-pandemic level. Our bullish call on September’s data is almost entirely due to our expectation of stronger output in the health sector, reflecting a near 30% m/m increase in Covid tests that month,” says Oxford Economics’ Goodwin.

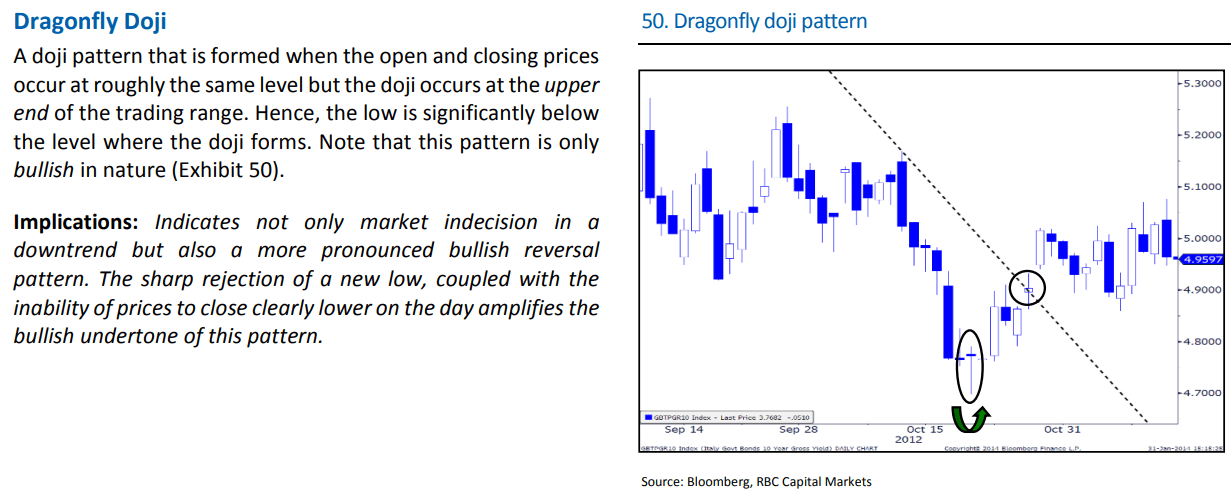

The limited economic calendar could mean that what matters most for the Pound-to-Euro rate over the coming days is how GBP/USD trades after leaving behind it on the daily chart last Friday what looked to be a “dragonfly doji” candlestick, which is a reversal indicator to technical analysts.

The Pound-to-Euro rate always closely reflects the relative performances of GBP/USD and EUR/USD, and would be likely to stabilise or recover alongside GBP/USD unless the Euro-Dollar rate experiences a sudden bout of strength.

“Note that this pattern is only bullish,” says George Davis, chief technical strategist at RBC Capital Markets, referring to a ‘dragonfly doji’ in an RBC glossary of technical analysis terms.

Source: RBC Capital Markets