Pound-Euro Week Ahead Forecast: Consolidating Gains with UK Economy in Focus

- Written by: James Skinner

- GBP/EUR knocks door of 1.18 & eyes higher levels

- But consolidation may be likely ahead of UK GDP data

- With support near 1.1726, 1.1650 if any weakness seen

Image © Pound Sterling Live

- GBP/EUR reference rates at publication:

- Spot: 1.1795

- Bank transfers (indicative guide): 1.1480-1.1565

- Money transfer specialist rates (indicative): 1.1690-1.1710

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Euro rate enters the new week close to multi-year highs above 1.18 but could be likely to consolidate recent gains beneath there over the coming days as the market awaits Thursday’s GDP data, which will reveal whether the UK’s economic recovery is meeting elevated expectations.

Pound Sterling made a hat-trick of gains over the Euro to end last week close to early April’s multi-year highs just above 1.18, having drawn support in the latter half from from the latest monetary policy decision taken at the Bank of England (BoE).

The BoE formally and pointedly acknowledged for the first time that some “modest tightening” of monetary policy is likely to be necessary in order to bring inflation back to its 2% target over the coming years, meaning its interest rates and the parameters of its quantitative easing programme could be adapted in that time.

“We had been pencilling in the first hike next August but there is now a higher risk it could be delivered sooner,” says Lee Hardman, a currency analyst at MUFG. “We stick to our bullish GBP outlook. We maintain our short EUR/GBP trade idea and expect the pair to fall to fresh year to date lows.”

In addition the BoE detailed plans to eventually extricate itself from the UK government bond market once certain economic and financial preconditions have been met, through a steady reversal of its quantitative easing programme, in a policy turn that could potentially make some of those bonds more attractive to investors.

Last week’s update has been supportive of Sterling as it places the BoE on course to become one of the first major central banks to lift its interest rate coming out of the coronavirus crisis, although the BoE’s interest rate assumptions are contingent on bullish expectations of the economy being met.

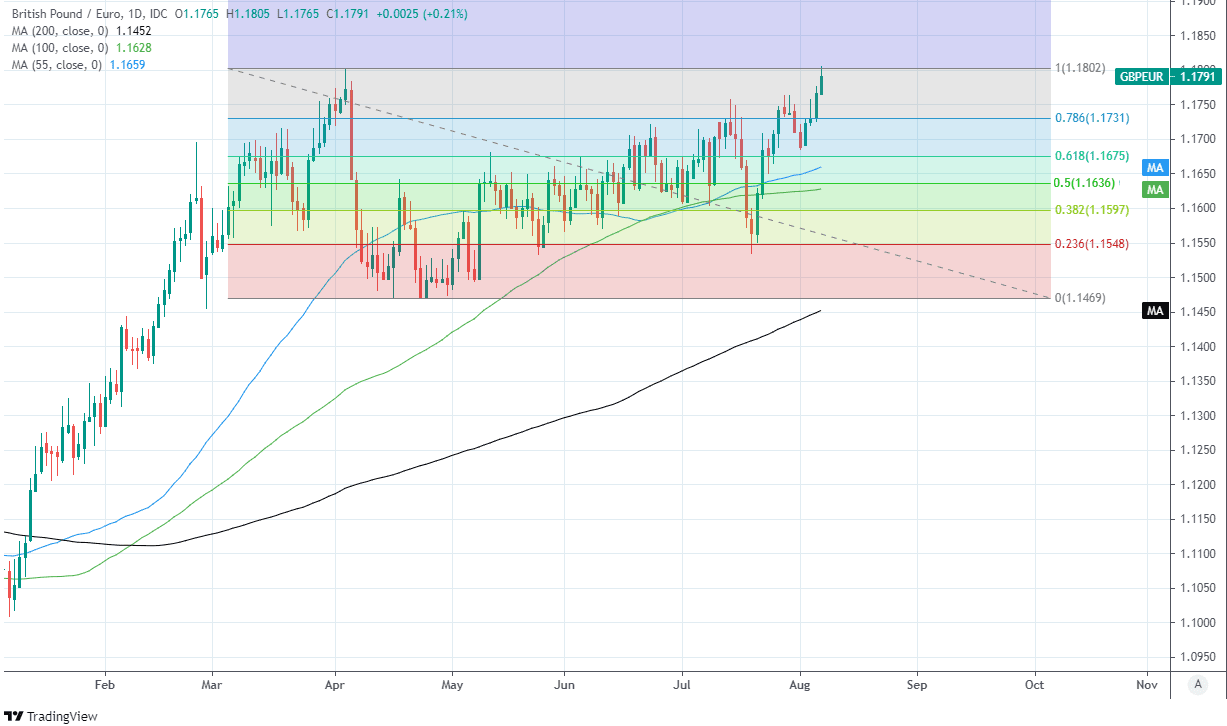

Above: Pound-to-Euro exchange rate shown at daily intervals with Fibonacci retracements of April’s correction lower. Struggling with earlier highs.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The BoE’s upbeat expectations of the economic recovery will be put to their first test at 07:00 this Thursday when the Office for National Statistics releases UK GDP data for the second quarter, which consensus expects will reveal a 4.8% increase for the period.

GDP data covering the month of May missed market expectations and flagged the risk of a second quarter performance that may have underwhelmed, which would be a dampener for Sterling if confirmed this week.

Meanwhile, recent unofficial survey data including July’s Flash PMI surveys from IHS Markit have flagged a possible softening of momentum early in the third-quarter that could have implications for data in the months ahead.

“Despite the high probability that the rebound in activity has paused in the summer months, the release should fuel expectations that the British economy will be back to pre-pandemic levels by year-end,” says Petr Krpata, chief EMEA strategist for FX and interest rates at ING.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The underlying narrative for GBP appears to be by and large positive. EUR/GBP could extend its downward trend after breaking below 0.8500 [GBP/EUR above 1.1764],” Krpata adds.

The real rub for the Pound however is that the BoE is even more bullish than the market consensus, with the bank noting last week that it expects GDP growth of around 5% for the period.

This potentially sets a high bar for the Pound to derive any additional momentum from Thursday's data.

Yet, and also in the event of any corrective setback, the Pound-to-Euro exchange rate benefits from multiple nearby areas of likely technical support on the charts.

“Note that we have now closed below .8503 mid-July low [GBP/EUR above 1.1764] and downside risks remain,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, referring to EUR/GBP.

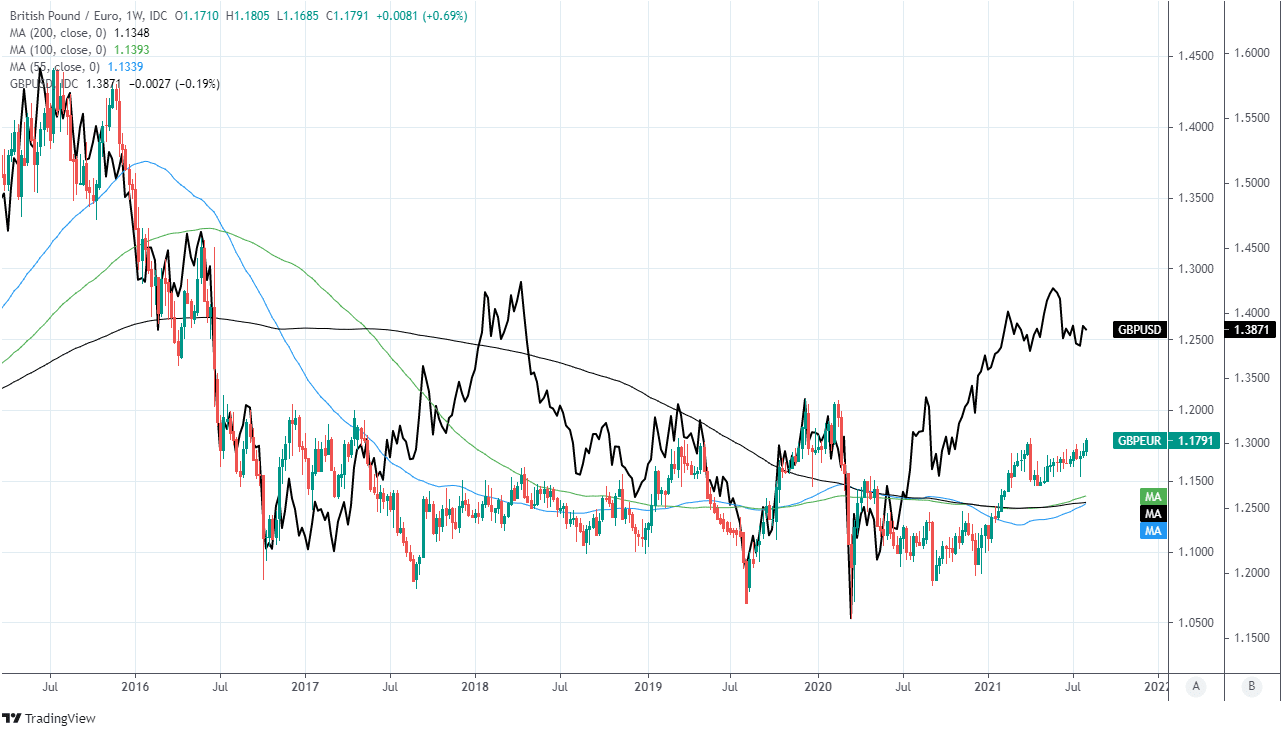

Above: Pound-to-Euro exchange rate shown at daily intervals with Fibonacci retracements of April recovery and selected moving-averages indicating possible areas of support.

“Overall attention remains on the .8471 long term pivot,” Jones says, referring to a level of EUR/GBP that equates to 1.1804 in GBP/EUR terms.

Jones cites the 55-day moving-average around 1.1659 as the first noteworthy level of support that could arrest declines in the Pound-to-Euro rate and warned clients last week that any daily close above 1.1804 could potentially put levels as high as 1.2027 and 1.2137 in the pipeline for Sterling.

Before reaching its 55-day average however, the Pound could potentially find any declines running out of steam around the 23.6% Fibonacci retracement of its April to August recovery at 1.1726 and if not, then further down around the 38.2% retracement located at 1.1677.

With UK GDP data aside there’s little in the economic calendar for either the UK or the Eurozone to give the Pound-to-Euro exchange rate direction any cause to change direction which, in the absence of a big disappointment in Thursday’s GDP data, is another reason for why GBP/EUR could over the coming days consolidate a recent advance that had lifted its 2021 increase to +6.41% by Friday.

“The MPC's forecasts imply markets' expectations for future rate hikes are about right......But the risks to the MPC's economic forecasts now are skewed firmly to the downside,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“We think that CPI inflation will return to the 2% target in Q4 2022, four quarters earlier than the BoE expects. In particular, we think that supply chain issues and strong pandemic-related demand for goods will have eased by early next year, causing core goods inflation to undershoot its long-run average,” Tombs adds.

Above: Pound-to-Euro exchange rate shown at weekly intervals alongside GBP/USD.