Pound Sterling a "Top Pick" with BNP Paribas, Forecast 1.20+ Against the Euro

- Written by: Gary Howes

- BoE to hike rates in Aug. 2022

- Delta variant a blip on economy's radar

- 10% potential upside in GBP/EUR

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1690

- Bank transfers (indicative guide): 1.1380-1.1460

- Money transfer specialist rates (indicative): 1.1586-1.1609

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

BNP Paribas have named the British Pound their "idiosyncratic top pick" in a regular quarterly economic and strategic briefing, saying the UK's economy is likely to outperform its peers and allow the Bank of England to raise interest rates in August 2022.

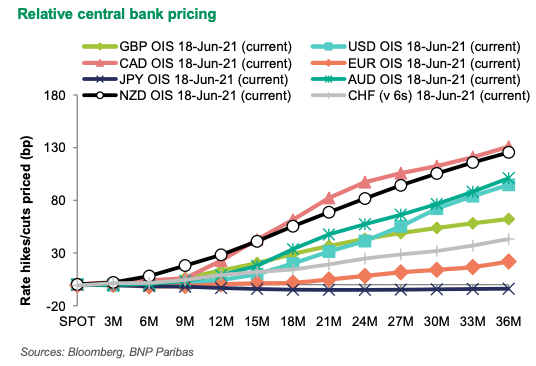

Such a move would ensure the Bank of England (BoE) moves on rates before other central banks including the European Central Bank which is expected to only raise rates in 2024, creating supportive forces for Pound-to-Euro exchange rate (GBP/EUR) valuations.

Indeed, strategists at the France based global lender and investment bank say there could be as much as 10% upside in GBP/EUR on offer over the coming year.

"Our positive view is based on our estimate of GBP’s long-term valuation and our expectation that the BoE will tighten monetary policy faster than the market is pricing in," says a strategy note from BNP Paribas.

Economists say they expect the BoE to be one of the first to move, because it has not changed its monetary policy strategy in a markedly more dovish direction, has little track record of undershooting inflation and has existing forward guidance that puts a lower threshold for tightening than for other central banks.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The call comes ahead of the June 24 meeting of the BoE which will likely see policy makers maintain interest rates and quantitative easing levels unchanged.

As such the June meeting might not offer any fireworks in Pound exchange rates over the near-term and the next significant policy guidance will likely only come at the August meeting when the Bank releases its next Monetary Policy Report.

But the direction of travel at the BoE is nevertheless seen by analysts to be set in a Sterling-supportive direction and BNP Paribas now expect asset purchases (quantitative easing) will end in December, and the first rate hike to take place in August 2022.

"We continue to see the UK economy outperforming consensus expectations this year and next," says Paul Hollingsworth, Chief European Economist at BNP Paribas in London.

"We take better-than-expected data in Q1 and the early indicators in Q2 as signalling both a stronger cyclical near-term recovery and less permanent scarring of supply-side potential. Although the recent extension of coronavirus restriction measures is a net negative, we do not think it fundamentally alters the outlook.

"As a result, we think the economy will regain its pre-pandemic level by the autumn this year and growth will continue at an above-trend pace throughout 2022.

But the optimistic predictions come amidst signs that the pace of the UK's economic recovery might be slowing, driven in part by the delay to the full easing of Covid related restrictions imposed by the government.

This, combined with the growth of the Delta variant of the virus in the country, are said by some analysts to pose a rise to investor and consumer confidence over coming weeks.

"The deterioration in the Covid-19 situation over the last month, and the four-week postponement of the 'Step Four' unlocking, which we think we be delayed again next month, suggest that month-to-month growth in GDP will slow significantly over the summer," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

With consumer and business confidence being a key driver of economic growth there are risks that data disappoints against expectations over coming weeks.

For the Pound this could present headwinds given the foreign exchange market is currently reactive to data surprises, especially if the Bank of England chooses to pick up on the developments and sound a cautious tone at their June 24 meeting.

But a number of economists we follow are of the view any economic slowdown related to the June 21 reopening delay will prove to be shallow as the lion's share of reopening has in fact already taken place.

"Although the recent extension of coronavirus restriction measures is a net negative, we do not think it fundamentally alters the outlook," says Hollingsworth.

"This better backdrop, combined with stronger inflationary pressures, is likely to see the Bank of England take the first steps in normalising monetary policy next year – crucially, before the US Fed," he adds.

With foreign exchange markets increasingly focussed on monetary policy 'normalisation' at central banks - the process of lifting rates from the pandemic lows - the currencies belonging to the first-movers will likely appreciate in value.

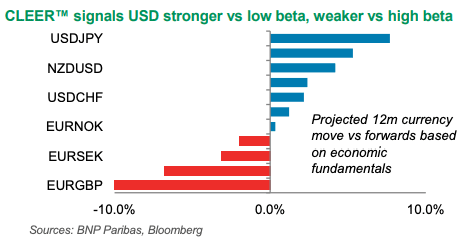

A 2022 move by the BoE is therefore consistent with upside in the Pound and BNP Paribas' CLEER™ valuation model shows a strong signal on Euro-Pound with a potential 10% move in the exchange rate over the next 12 months being possible.

BNP Paribas forecast EUR/GBP to fall to 0.83 by the first quarter of 2022, giving a Pound-to-Euro exchange rate cross of 1.2050.