Modest Growth Returning to the High Street Shows CBI Survey

© Alice Photo, Adobe Stock

A rise in the number of retailers recording higher sales in May compared to those recording lower sales has been reflected in a rise in the balance of the latest CBI Distributive Sales Survey. The findings have helped ease concerns about the state of the UK high street with data showing unexpected resilience amongst consumers after a dismal start to the year.

The Consortium of British Industry (CBI) Distributive Trade Survey balance rose to 11 in May from -2 in April, and was well above the 4 predicted.

The result reflected the 29% of retailers interviewed who said they had seen sales rise in May compared to the 18% who had said they had fallen.

Despite the stronger-than-expected reading, sales remained a little below the long-term average. "Sales volumes remained a little below average for the time of year to the same degree as in April, with a similar picture expected for June," says the CBI report.

Nevertheless, the improving data will give rise to expectations that the mighty British consumer will be able to help the UK economy into a recovery phase over coming months after a dour start to the year.

Retail sale volumes increased for grocers, hardware and DIY, they also grew in the non-store sectors of 'internet' and 'mail-order'.

On the other hand, retail sales fell in the area of specialist food and drink, clothing, footwear, leather goods, furniture, carpets, recreational goods and other 'normal' goods.

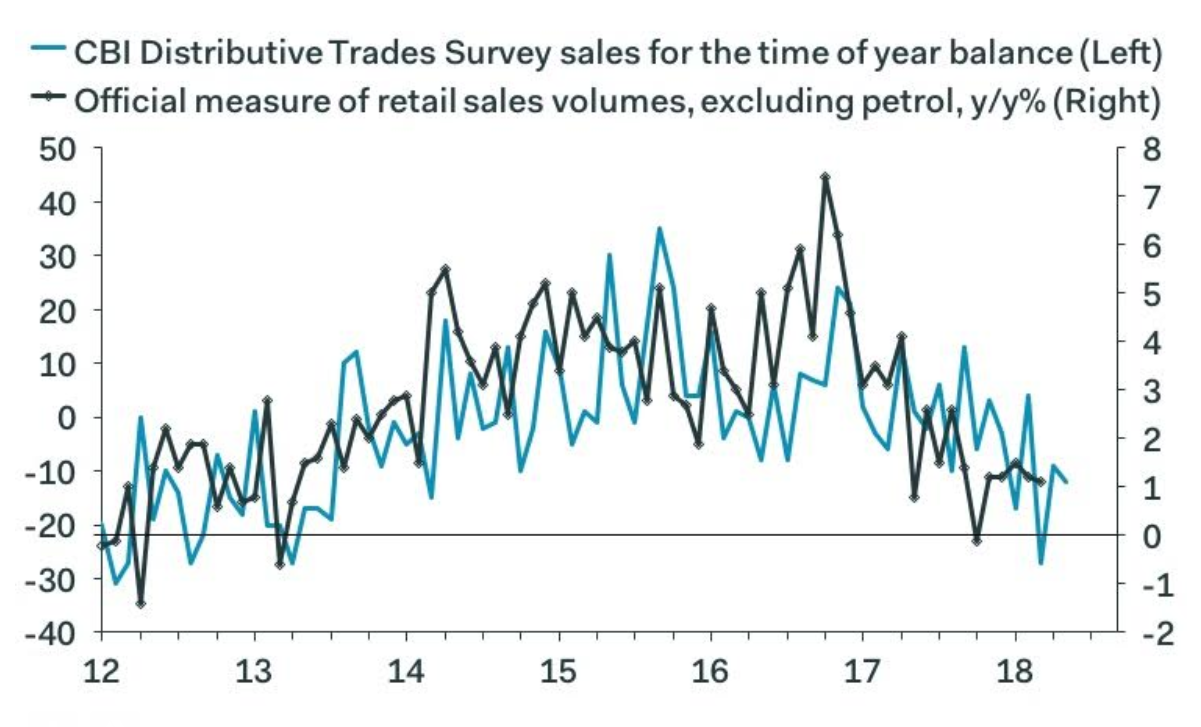

(Image courtesy of Pantheon Macroeconomcs)

The data showed a decline in employment in the sector for the sixth quarter in a row, the rate of the decline was the slowest for a year.

Retailers' outlook for the future was quite pessimistic with expectations of a cut in investment over the next year and the business situation forecast to worsen over the next 3-months.

The CBI blamed the poor start to the year on falling real earnings due to higher inflation. The better May figure may have partly been as a result of the poor April result, which was put down to the early Easter.

"It’s good to see some modest growth returning to the high street after two months of falling sales," says Anna Leach, head of economic intelligence at the CBI.

"Although real wage growth is gradually rising, the pace is gradual, meaning that the squeeze on households from higher inflation and subdued wage growth will persist for some time yet," added Leach.

Although the balance rose from April if fell compared to a year ago, arguably a more accurate reflection of the state of the retail sector.

"The reported sales balance merely matched its 2017 average in April. In addition, the sales for the time of year balance—which has a better relationship with the official data than the headline balance—declined to -12, from -9 in April," says Samuel Tombs, chief U.K. economist at Pantheon Macroeconomics.

"The CBI’s survey provides more evidence that retail sales have recovered at a fairly slow rate from weakness in Q1," adds Tombs.

Sterling did not change after the release which does not normally impact on the currency, continuing to trade at 1.1391 (GBP/EUR) from 1.1384 prior to the release.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here