UK Business Confidence Plummets

- Written by: Sam Coventry

Image © Adobe Images

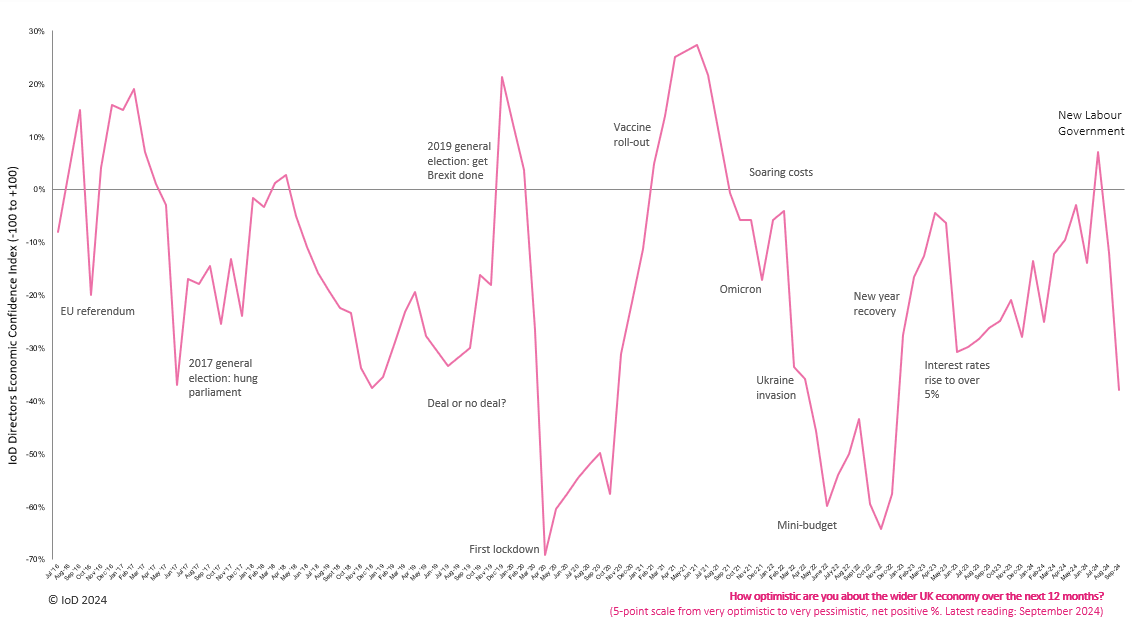

The UK's economic outlook appears increasingly pessimistic as the Institute of Directors (IoD) reports a sharp decline in business confidence, reaching its lowest point since December 2022.

The IoD Directors' Economic Confidence Index fell to -38 in September, a significant drop from -12 in August, which is the lowest reading since December 2022 when it registered -58.

Anna Leach, Chief Economist at the Institute of Directors, stated, “Business confidence and investment expectations both took a further and larger dive in September."

Business confidence drives investment decisions and grows the economy. Falling confidence threatens to freeze the economic recovery that characterised the first half of 2024.

Leach attributed this decline to a number of concerns, including "likely tax increases, the cost of workers’ rights, international competitiveness, broader cost pressures and the general outlook for UK economic growth"

The new government has started its reign by signalling it will make "tough decisions" in the upcoming budget that will involve numerous tax hikes and the ending of various tax relief measures and freezes.

The government also aims to introduce more stringent employment laws, which will make it more expensive and difficult for businesses to hire and retain staff.

Investment intentions also experienced their most dramatic fall since the start of the pandemic, plummeting to -6 in September from +10 in August and +24 in July.

This is the lowest level recorded since September 2020. Business leaders' confidence in their own organisations also fell to +15 in September from +23 in August and +36 in July

Despite the bleak outlook, Leach suggests that upcoming policy announcements concerning "industrial strategy, the business tax roadmap and a likely update to the fiscal rules to better recognise the contribution of public sector investment to the UK’s asset base" could potentially alleviate some concerns and foster a more growth-friendly environment

In addition to the drop in the overall Economic Confidence Index, other notable trends include:

- Headcount expectations continued their downward trend, falling to +6 in September from +10 in August and +24 in July

- Revenue expectations saw a slight dip from +28 in August to +27 in September

- Cost expectations decreased marginally from +83 to +79

- Wage expectations remained largely unchanged at +58, up slightly from +56 in August

- Export expectations held steady, moving from +8 to +9