Service Inflation "Shocker" Leaves Question Marks Over August Bank of England Rate Cut

- Written by: Gary Howes

Wages in the services sector are holding up inflation. Image © Adobe Stock

The odds of a June interest rate cut at the Bank of England have fallen to just 15% from above 50% in the days before Wednesday's UK inflation release.

Money market pricing meanwhile shows an August rate cut is now no longer fully priced by the market, reflecting fears UK inflation will remain perched above the Bank of England's 2.0% target for the foreseeable future.

Pantheon Macroeconomics, the independent research provider, describes the stubbornness of services inflation as "shocking", saying strong wage growth is supporting services inflation, with April's minimum wage hike likely having an impact.

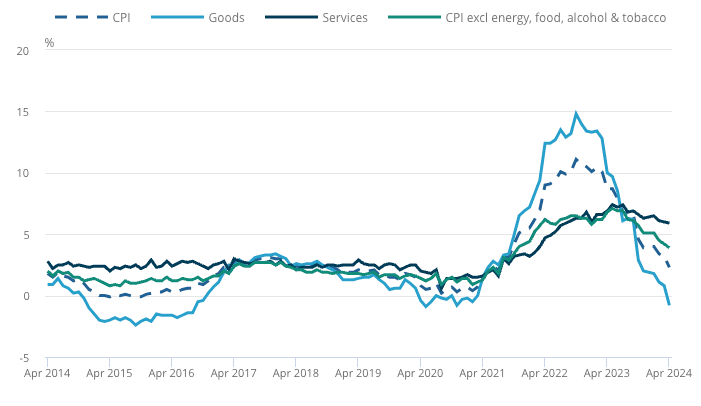

Services inflation printed at 5.9% in April, well above the consensus of 5.4% and the Bank of England's forecast of 5.5%.

"It's no longer likely, we think, that headline CPI inflation will fall below the 2.0% inflation target in the next few months. The services strength in April looks too widespread, so sticky services will likely support inflation slightly above the inflation target. And core inflation looks too high for the MPC to cut interest rates as early as June," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

Above: Services and core inflation are proving stubborn. Image: ONS.

Market expectations for a Bank of England rate cut next month were bolstered by recent comments from MPC member Dave Ramsden, who said he sees risks of inflation surprising to the downside. However, given that risks have clearly proven themselves to the upside, his views won't carry as much weight on the MPC.

"The members of the MPC that were close to switching their vote will now probably want to wait a little longer to confirm that the second-round effects on wages and domestic prices are fading as hoped," says Gabriella Dickens, G7 economist at AXA Investment Managers. "We have changed our call to August, from June."

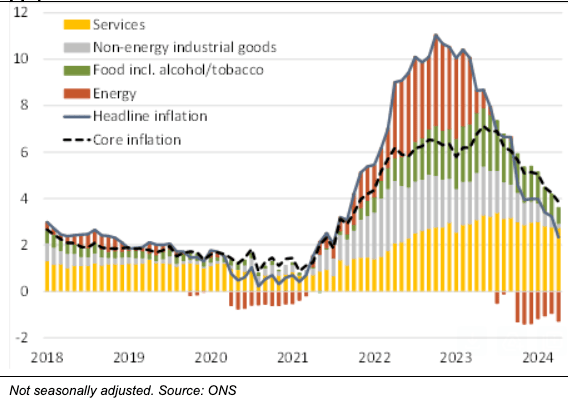

Hopes for a fall to the 2.0% target, or even below, were driven by falling energy bills, which duly dragged the headline rate to within touching distance of the target at 2.3%. The drag provided by energy bills will be limited going forward.

Mechanically speaking, inflation cannot fall to below 2.0% on a sustained basis unless services inflation starts falling on a sustained and meaningful basis:

Image courtesy of Berenberg.

Some economists see services inflation trending lower from here. Paul Dales, Chief UK Economist, says inflation could yet still nip below the 2.0% target soon. "Our forecast is that lower energy prices and a faster fading of persistence (due to the previous weakness of the economy) will mean inflation falls below 2% in the coming months and perhaps even close to 1% later this year".

That said, he says a rate cut in June is unlikely and that a cut in August is also looking a bit more doubtful.

"The BoE may eventually end up cutting interest rates from 5.25% now to 3.00% next year. But we're a bit more worried about that forecast now and it might not happen as soon," he says.

Woods at Pantheon Economics says an August interest rate cut looks much more likely than a June reduction after "services inflation shockingly barely fell in April".

He notes the services surprise was widespread, not just coming from prices indexed to inflation.