Undeniably Strong Wage Data & Unemployment Rates Overstated: Reactions to UK Job Data

- Written by: Gary Howes

Image © Adobe Stock

UK wage pressures are increasing and the official unemployment figures are likely too pessimistic. These are some of the reactions to the UK's latest labour market report.

UK wages, with bonuses included, rose 5.7% 3M/Y in March said the ONS, which was well ahead of the consensus estimate for a 5.3% reading. When bonuses are excluded from the wage data, the figure is even higher at 6.0%.

The Pound has nevertheless fallen following the release of these labour market data, a signal that the market believes the Bank of England is in the mood to cut interest rates, whatever the weather.

George Buckley, an economist at Nomura, says these are undoubtedly strong pay figures that will make it harder for the Bank to justify imminent interest cuts.

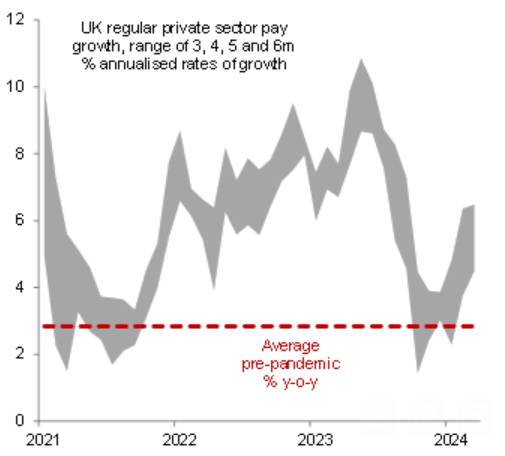

"If we average the monthly rates of pay growth during the first three months of this year, that annualises to 5.8% - the highest rate since last summer."

"It is probably safe to say that the recent direction of travel shown in the chart below is not one that some on the MPC will be comfortable with," he says.

Image courtesy of Nomura.

Next month's data docket will make for uncomfortable reading at the Bank of England as it will show wage pressures remained elevated in April. Buckley says even a modest monthly rise in pay in next month’s April data could see this 3 m/m annualised rate rise to above 7%.

Rob Wood, Chief U.K. Economist at Pantheon Macroeconomics, says wage pressures will remain elevated for some time as April's increase in the 9.8% National Living Wage will add momentum to wages in the coming months.

He explains that employers tend to respond to the uprating by raising wages for employees that are paid slightly more than the legislated minimum.

Wood also says he is sceptical that employment is falling as rapidly as today’s labour market data would have us believe. The ONS itself has warned the reliability of its survey has deteriorated markedly and tends to revise higher initial downbeat estimates.

In addition, Wood says he does not see the surge in redundancies required to signal a marked deterioration in the labour market is underway.

Yet, the Bank of England looks set to cut interest rates as early as June. Following the release of the labour market data, the Bank's Chief Economist, Huw Pill, told an audience that a summer rate cut is likely as the Bank can still cut interest rates without risking spiking inflation.

Pill voted against a cut last week but his latest comments suggest he will lend his vote to a cut even amidst elevated wage pressures.

"The BoE’s communications at its last press conference suggested its reaction function may be more forgiving of still strong but weakening data, so this release neither takes June off the table nor makes it more likely in our view. We think if the data remain strong, the BoE will struggle to justify cutting rates in June and it will only be by August that the data have weakened sufficiently to create the space for a cut," says Buckley.