Record-breaking Tax, Yet Less Spending Per Person: The Horrorshow That Is Britain's Finances

- Written by: Gary Howes

Image © Adobe Stock

According to a new analysis, the UK is locked on a trajectory to hit record taxation, yet less money will be spent per person.

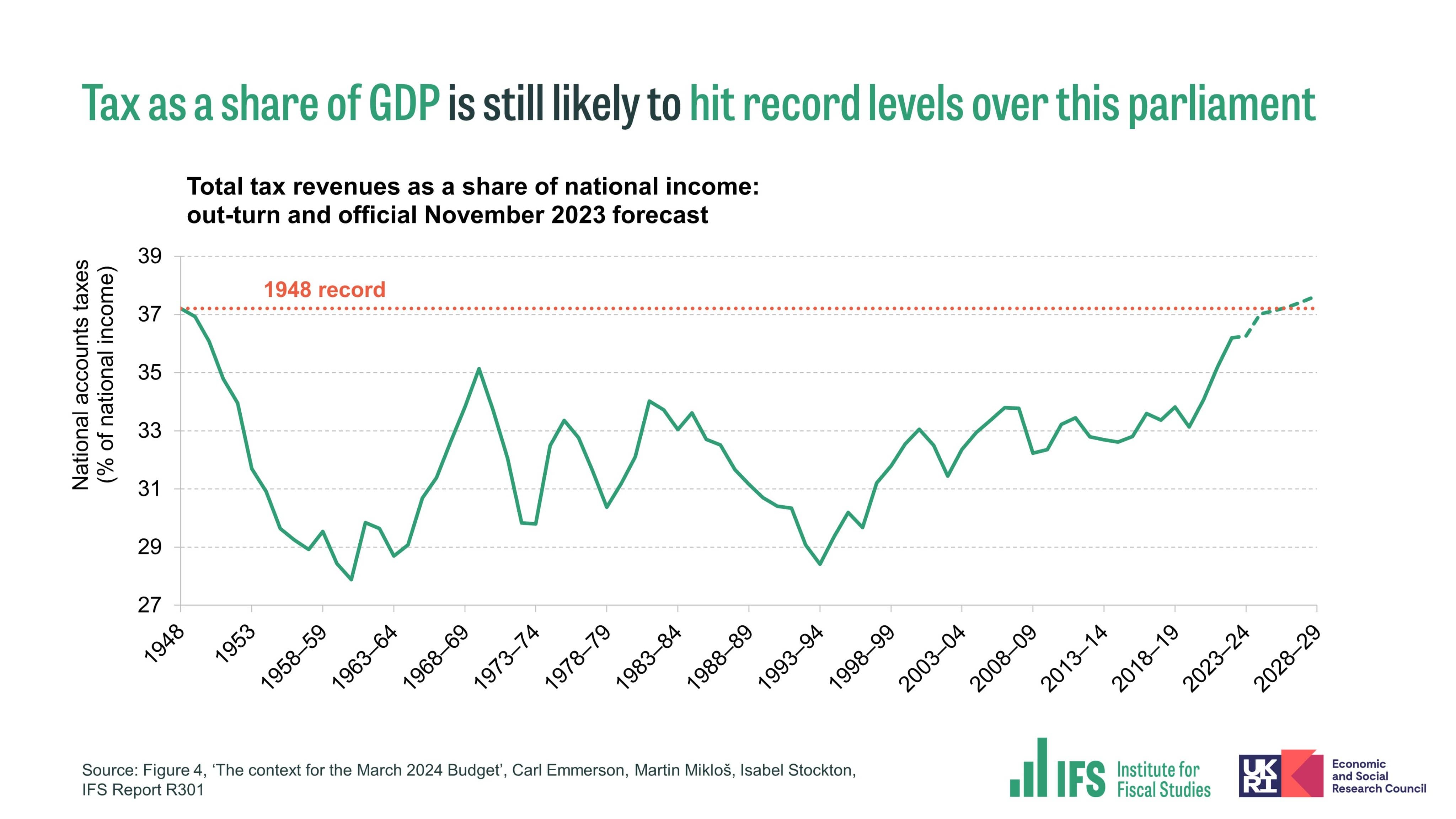

The Institute for Fiscal Studies says the UK will hit the 1948 tax-to-GDP level before the end of the decade, and any new tax cuts announced in next week's Budget would only offset part of the record-breaking increase in tax revenues this parliament.

In a pre-budget research paper, the IFS says taxes this year will be around £66BN higher than they would have been had their share of national income stayed at its 2018–19 level.

Despite a surging tax take, there will be no benefit to the average Brit as the government is now on course to spend £150 less per person on public services by 2028 as a larger population driven by higher immigration stretches departmental budgets.

The IFS says this is down to surging immigration: "New long-term population projections driven mostly by higher expected net migration help increase the size of the economy but will make existing spending plans even more challenging in per-capita terms."

The Chancellor Jeremy Hunt is expected to announce some relatively minor tax cuts, with news media reporting a 1 percentage-point reduction in employee national insurance (NI) likely.

This would follow last Autumn's NI cut, which the IFS said offset only about a quarter of the increase in the tax on labour income from consecutive freezes of thresholds in income tax and NICs since March 2021.

By freezing income tax thresholds, the UK Government has netted significant increases in income tax as workers receive inflation-adjusted wage increases that push them up into higher-paying tax brackets.

In addition, the IFS says if the Chancellor decides to cut taxes next week, he needs to specify where the spending cuts will fall.

The IFS reports current spending and tax plans to imply further real-terms cuts to 'unprotected' public services if the Chancellor is to meet his fiscal rules of bringing debt as a percentage of GDP lower in the medium term.

"These plans lack credibility unless he tells us where these cuts will fall," warns the IFS.

"Just maintaining real-terms spending on these unprotected services would require a £20BN top-up in 2028–29; maintaining it in per-person terms would require £25 billion," adds the IFS.

Reducing the planned growth rate in overall public service spending from 0.9% to 0.75% – as the Chancellor is reportedly considering – would add around £3BN to the cuts facing unprotected areas such as local government, further education, HMRC, courts and prisons.

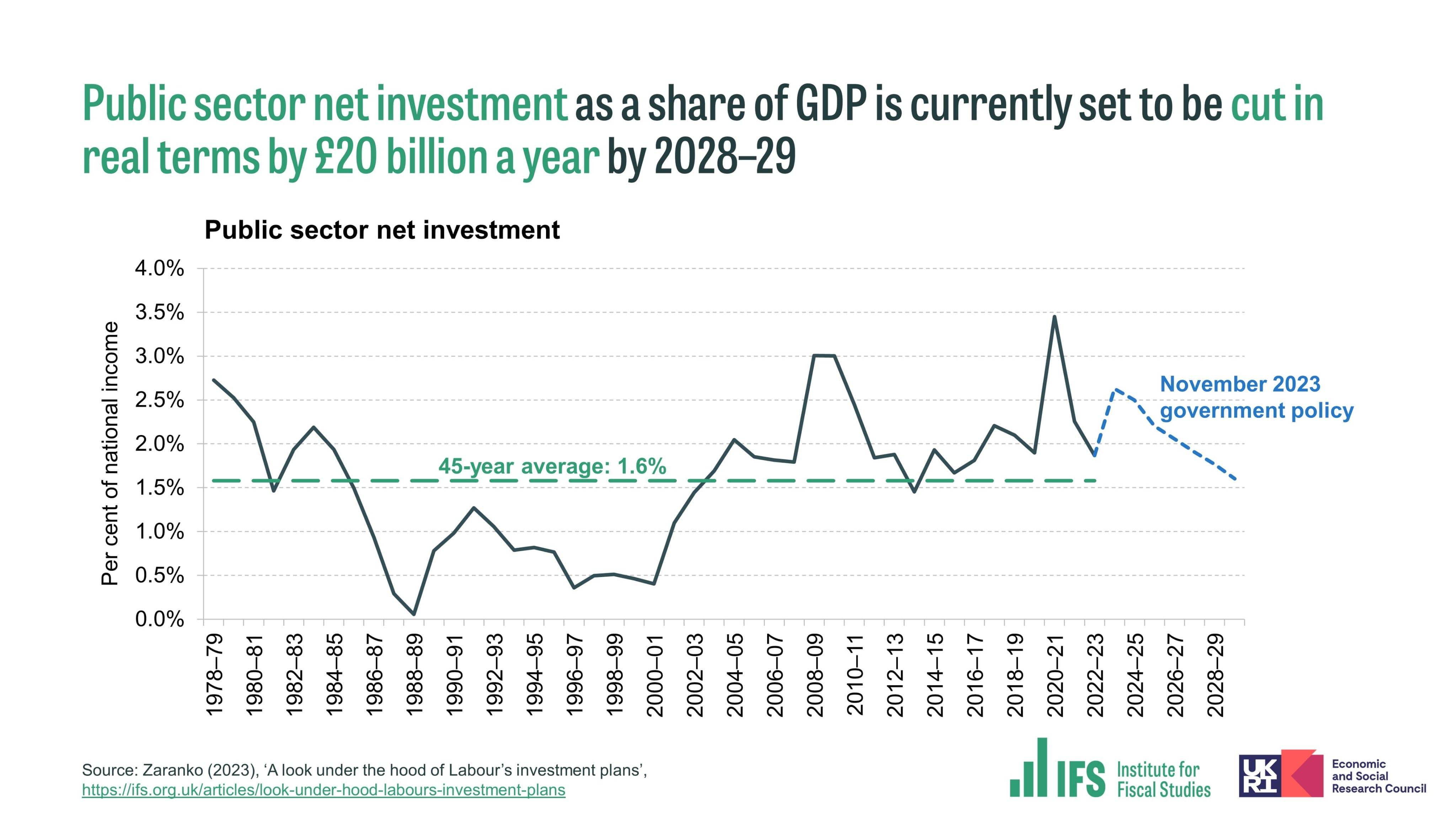

The IFS says current plans imply investment spending being cut as a share of national income by £20BN a year in today’s terms by 2028–29. This is a particularly acute problem for Britain, where the public sector is significantly less productive than the private sector, which requires a real-term investment to fix.

The IFS says planned cuts to investment spending would reverse the big increase in investment spending that has been delivered since 2019, and will not help economic growth.

Government borrowing this year is now forecast to be £113BN, which is £11BN below the £124BN forecast in November 2023, but it would be £63BN more than forecast in March 2022.

Debt interest spending is likely to be forecast to be £10BN less in 2028–29 than was expected in the Autumn Statement, but it remains a big constraint as it is now expected to settle at 2% of national income (£55BN a year) above the pre-pandemic forecast.