Gas & Electricity Price Cuts to Keep Inflation Below 2.0% in 2024

- Written by: Gary Howes

Image © Adobe Images

Gas and electricity prices will fall 12% from April as the decline in global wholesale natural gas prices feeds through to UK households, which should drag inflation to ~2.0%.

Ofgem has announced the energy price cap is set at £1,690 per year for a typical household between April and June, which is £238 lower than the cap set between January and March 2024. And, with natural gas prices continuing to trend lower, an additional cut to energy bills in July is also anticipated, which could mean that UK headline inflation stays at 2.0% or below through 2024.

This is a call made by ING Bank in the wake of Ofgem's February price cap announcement and could mean the Bank of England has increasing scope to cut interest rates over the coming months.

"UK energy prices will fall by 12% in April and it's likely the regulator will lower the price cap again in July. That's set to take headline inflation below 2% in April and we think it will stay below the Bank of England's target for much - if not all - of 2024," says James Smith, Developed Markets Economist at ING Bank.

The decline in energy bills is no surprise to economists who have been monitoring trends in wholesale markets and is why inflation is expected to fall to 2.0% in April, meeting the Bank of England's inflation target. The Bank and other economists anticipate inflation will then creep higher in subsequent months.

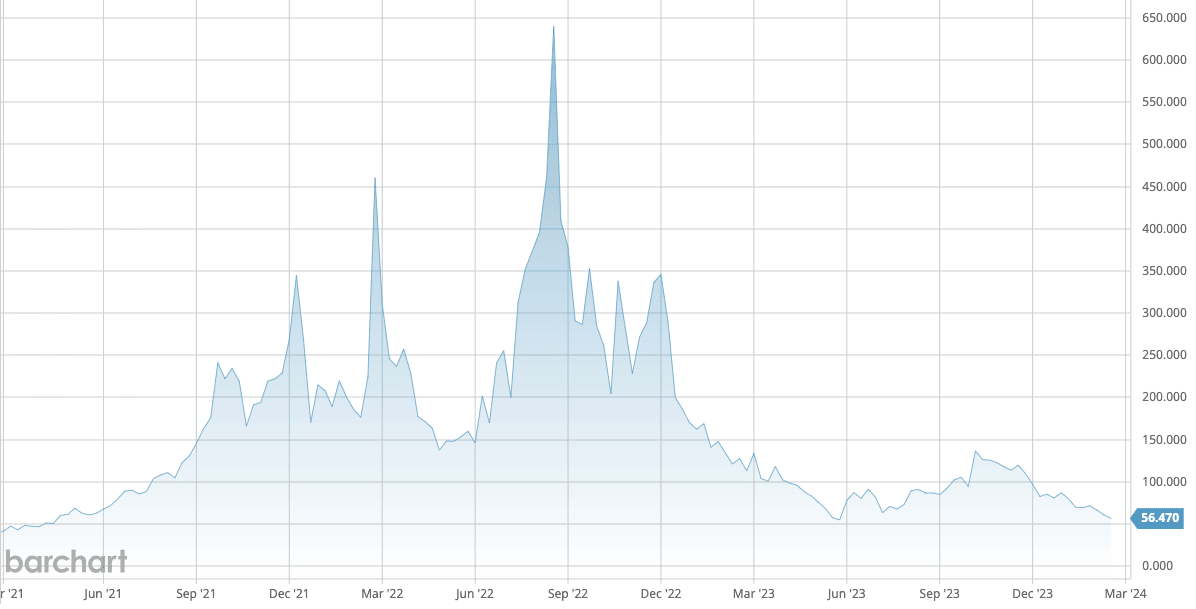

Above: Wholesale natural gas prices have fallen sharply since the crisis caused by the cutting of Russian supplies.

But, ING's prediction would mean the Bank's forecasts that show inflation is to remain 'sticky' are off target.

It also means the Bank will pivot to rate cuts from its 'higher for longer' stance a lot quicker than markets currently anticipate.

Market pricing shows investors are currently fully priced for a June rate cut.

The sharp fall in energy costs will bolster household finances and contribute to expectations for a stronger UK economic performance in 2024.

Despite projecting figures that suggest headline CPI inflation has likely been tamed, ING Bank says the Bank of England will resist cutting until August.

"Services inflation and wage growth are key for the BoE," says Smith, "private-sector wage growth, currently 6.2% - is proving sticky."

The Bank of England is forecasting services CPI to fall from 6.5% to 4.9% in June, something ING agrees with.

"The bottom line is that even with headline inflation set to fall below target in April, the Bank of England will continue to tread carefully as we go into the second quarter. Slow progress on services inflation and wage growth in the near term, coupled with the prospect of tax cuts in March, means we suspect that the second quarter will be too early to see a UK rate cut," says Smith.