Don't Sneer at This Strong Wage Data: Oxford Economics

- Written by: Gary Howes

Image © Adobe Images

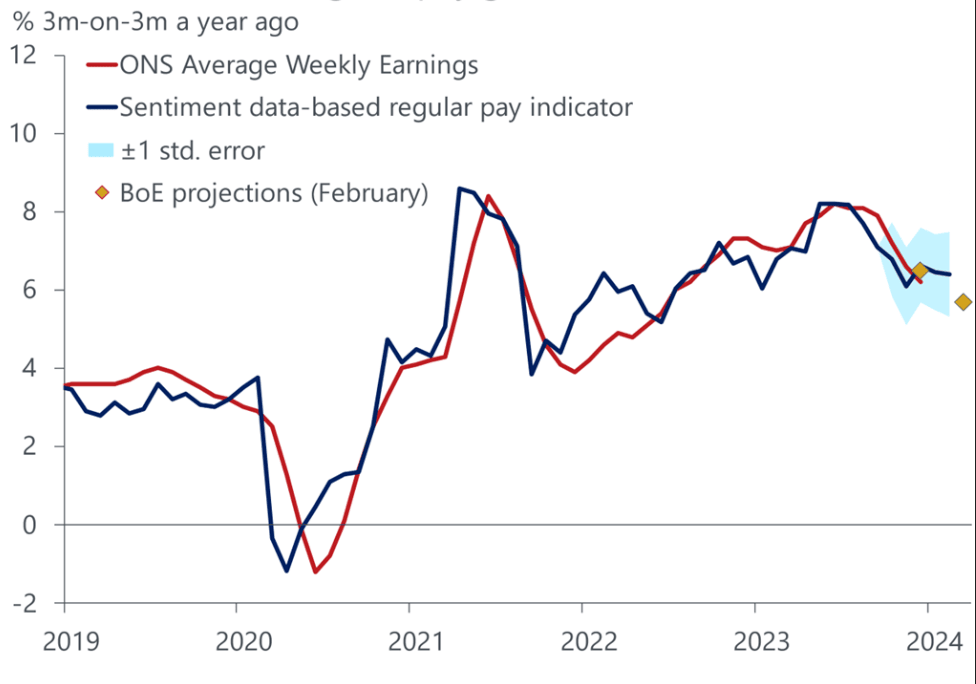

"Our nowcast also suggests that the slowdown in wage growth has faded. We think this combination of a tight labour market and solid wage growth is likely to lead the MPC to take a cautious approach to the timing and pace of rate cuts" - Oxford Economics.

UK wages beat expectations handsomely on Tuesday, but there is no shortage of economists and financial commentators on Twitter who have cast shade on the figures, arguing the ONS labour market survey can't be trusted.

Scepticism has grown owing to the considerable disruptions to the official labour market report as the ONS seeks to improve data collection in the face of demographic changes.

The move was initiated to improve accuracy around the employment/unemployment measure; however, the earnings data has not been impacted by the changes to the labour market survey and is where the market maintains its focus.

The ONS said average earnings, with bonuses included, fell to 5.8% from 6.7% year-on-year in the three months to December, exceeding an expectation for a greater fall to 5.6%. When bonuses are excluded, the rate stands at 6.2%, down from 6.7% but above the expected 6.0%.

Independent research firm Oxford Economics says their own proprietary nowcast tool suggests the slowdown in wage growth has faded, offering credence to the robust nature of the official figures.

"We think this combination of a tight labour market and solid wage growth is likely to lead the Monetary Policy Committee to take a cautious approach to the timing and pace of rate cuts," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The firm's nowcast suggests pay growth is likely to remain at similar levels in the early months of 2024, a picture that is broadly consistent with the results of the pay survey conducted recently by the Bank of England's regional agents.

Above: UK private sector regular pay growth.

For the Bank of England, any stabilisation in pay at current levels threatens a sustained fall in inflation to the 2.0% target and chimes with the Bank's warnings that rates won't be cut anytime soon.

This message is crystalising in financial markets through firming UK rate expectations, swap rates and a rising British Pound, which reached its highest level against the Euro in 25 weeks following the wage and labour market report.

Those commentators who express scepticism at the ONS labour market report say that the UK labour market is looser than officially reported: i.e. unemployment is set to rise, and wages will fall in response.

"I'd stick to using the PAYE data for now - seems far more in line with other surveys/evidence," says Viraj Patel, strategist at Vanda Research, commenting on the official figures. (The PAYE data he references formed the backbone of the experimental alternative labour market dataset the ONS issued in lieu of the traditional survey.)

Patel describes the experimental version as "a good 'true' gauge of the labour market", underscoring his long-held position that a rise in UK unemployment and a corresponding loosening in labour conditions is at hand, allowing the Bank to cut far sooner than consensus is now expecting.

Oxford Economics agrees with the need to monitor numerous data points but argues that these also point to a strong jobs market.

"Our nowcast suggests that conditions are not loosening noticeably," says Goodwin, "wage growth is softer than it was for most of 2023, but it's still double the pace that would be consistent with achieving the inflation target, and our nowcast suggests that the downward momentum has faded in early-2024."

Oxford Economics holds a baseline forecast that assumes that the first rate cut will land in June, with a further two 25bps cuts before the end of the year.

"But the potential for pay growth and services inflation to remain sticky means that the risks are skewed towards the rate cutting cycle starting later and proceeding more slowly," says Goodwin.