Halifax House Prices Give Bank of England Further Reason To Stay Put

- Written by: Sam Coventry

Above: File image of MPC member Sarah Breeden. On Wednesday, she spoke about house prices, pointing to resilient demand.

A surprisingly strong rise in house prices reported by one of the UK's biggest mortgage lenders will likely ensure the Bank of England keeps interest rates at current levels for some months to come.

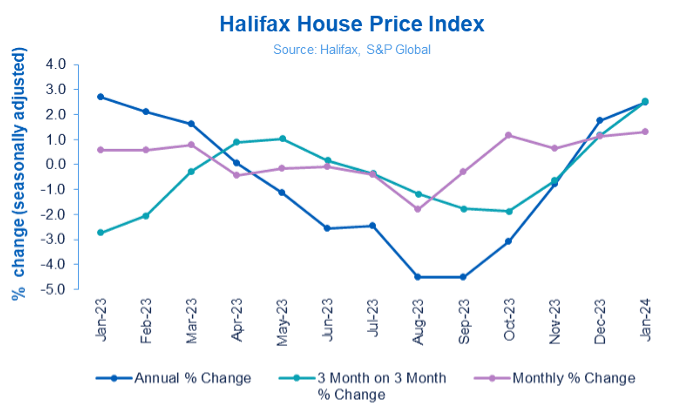

Halifax said Wednesday its measure of UK house price trends revealed a 1.3% month-on-month rise in January, up from 1.1% in December, which trumped market expectations for 0.8%.

"This is the fourth consecutive month that house prices have risen and, as a result, the pace of annual growth is now +2.5%, the highest rate since January last year," says Kim Kinnaird, Director at Halifax Mortgages.

The data speaks of robust demand in the housing sector despite rising mortgage rates following a string of Bank of England interest rate hikes.

These figures will add to a body of economic evidence that cutting interest rates in the near future would risk halting inflation's fall back to the Bank's 2.0% target.

One of the Bank's Monetary Policy Committee (MPC) members, Sarah Breeden, said in a midweek speech that house prices must be watched closely when considering cutting interest rates.

"Resilience in the housing market may prove to be a signal that demand is stronger than we expect," said Breeden in a speech given to the UK Women in Economics Annual Networking Event.

The MPC voted by a majority to maintain Bank Rate at 5.25% in February and said it needs to see further evidence that inflation will fall to the 2.0% target on a sustained basis before cutting interest rates.

Breeden's colleague on the MPC, Swati Dhingra, said a day earlier that interest rates should be cut now because she saw "downside risks" to consumption side demand.

She said her decision to vote for a cut on February 01 was triggered in part by December's poor retail sales figures, which suggested household demand was under pressure.

However, a potential rebound in activity at the start of the new year means Dhingra's call to cut interest rates risks leaving her an outlier on the MPC:

- UK total retail sales increased by 1.2% year on year in January, said the BRC

- UK services activity rose at the fastest pace in 8 months, according to January PMIs

- UK business confidence hit a 2-year high in January, said Lloyds Bank's Business Barometer

- Improving personal finances boosted UK consumer confidence to two-year highs in January said GfK

"We think concerns about the enduring strength of pay growth will lead the MPC to err on the side of caution when it comes to the timing of the first cut," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

"We continue to expect the first rate cut in September, three months later than our forecast for cuts by the Fed and the ECB, reflecting stickier wage growth and services inflation in the UK," says Daniel Vernazza, Chief International Economist at UniCredit Bank in London.

However, UniCredit and other investment banks expect the Bank of England to embark on a relatively rapid series of rate cuts once the cycle begins, with most seeing at least 100 basis points of hikes falling in 2024.