UK Shop Inflation In Another Sharp Fall

- Written by: Gary Howes

Image © Adobe Images

Shop inflation in the UK fell sharply in January, raising hopes that the coming year will finally see the pressures on consumers fade.

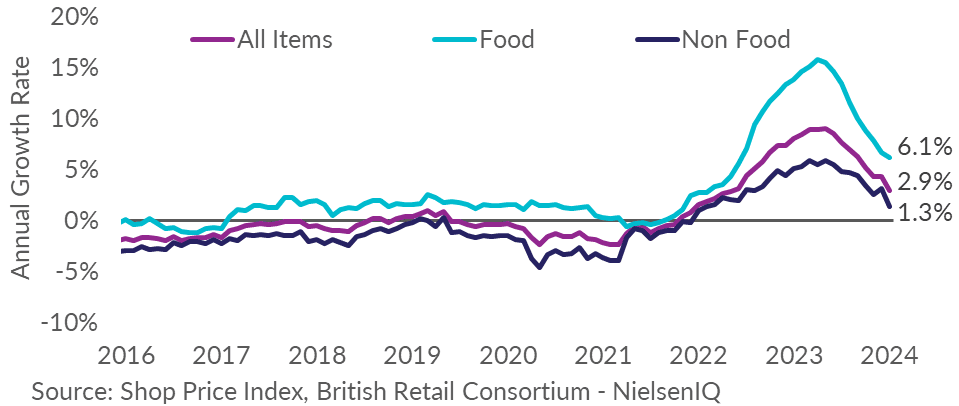

The British Retail Consortium (BRC) said on January 20 that its measure of annual shop price inflation slowed to 2.9% in January, down from 4.3% in December.

This makes for the seventh consecutive monthly decline and the lowest rate since May 2022.

Although inflation has fallen sharply, it must be remembered that it does not mean prices are falling; rather, the pace of increase is stalling.

Food inflation slowed to 6.1% in January, down from 6.7% in December; although still elevated, this is the ninth consecutive month of deceleration that food has seen.

The figure is below the three-month average of 6.8% and food inflation is now at its lowest since June 2022.

BRC chief executive Helen Dickinson said shops offered heavily discounted goods in their January sales to entice consumer spending amidst weak demand.

She noted that the price of milk and tea fell in January compared with the previous month, while increased alcohol duties kept drink inflation elevated.

Commenting on the data, Boylesports says although disposable incomes remain under pressure, the promise of falling inflation points to a better year ahead for the UK consumer.

The BRC reports fresh food inflation fell to 4.9% in January from 5.4% in December, while ambient food decreased to 7.7% in January, down from 8.4% in December.

Non-food inflation reached its lowest level since February 2022, falling to 1.3% in January from 3.1% in December.

GfK reported last week that its measure of consumer confidence revealed another rise in January amidst improved personal finances, taking overall confidence to a two-year high.

At -19, this is the highest level of consumer confidence seen since January 2022.

"Importantly, the view on our personal financial situation for the coming year has gained two points and now stands at zero. This is exciting as it ends 24 consecutive months of negative scores," says Joe Staton, Client Strategy Director GfK.

He explains this significant change is the best single indicator of how the nation’s households feel about their income and expenditure.

"Despite the cost-of-living crisis still impacting many households across the UK, consumers appear to be encouraged by the positive news about falling inflation," says Staton.

Although January has seen some good news for the retail sector, official figures revealed a poor end to 2023, with official UK retail sales reading at -3.2% month-on-month in December, undershooting expectations for -0.5%.

The year-on-year figure stood at -2.4%, which was over 3.5 percentage points below the 1.1% growth the market expected.