UK Economic Forecasts: Some See Growth, Others Recession

- Written by: Gary Howes

Image © Adobe Stock

Some economists are forecasting UK economic growth to pick up through the remainder of 2023, although others warn of a recession taking hold as higher interest rates begin to bite.

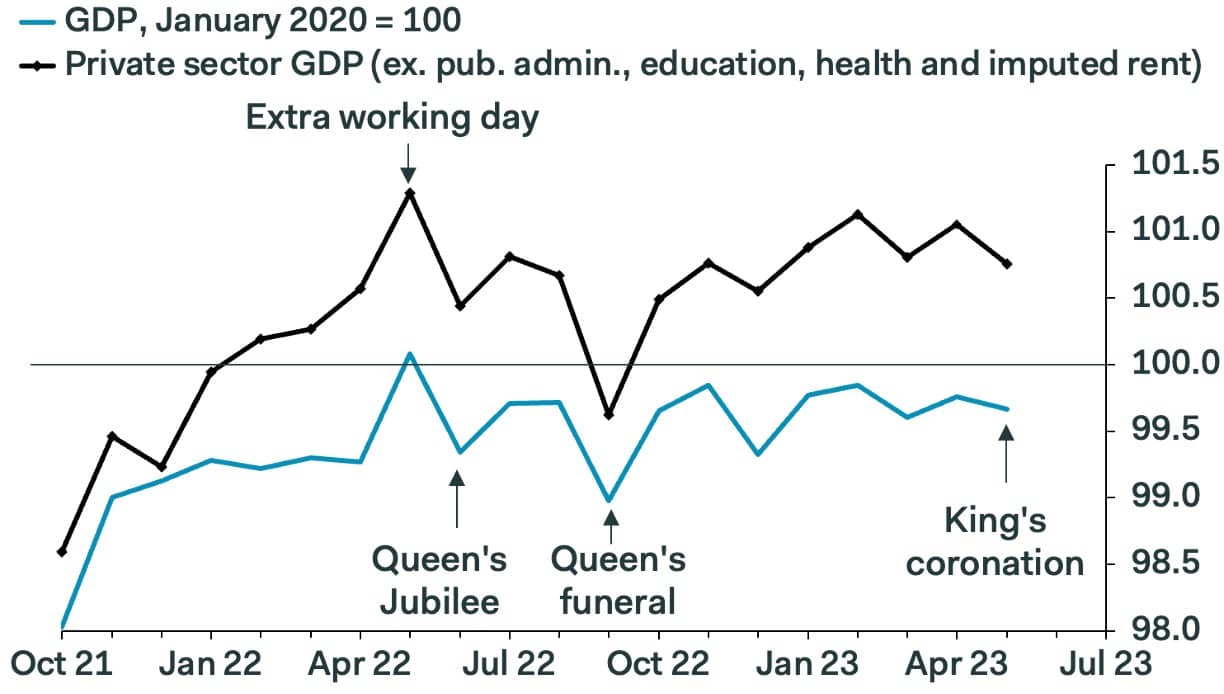

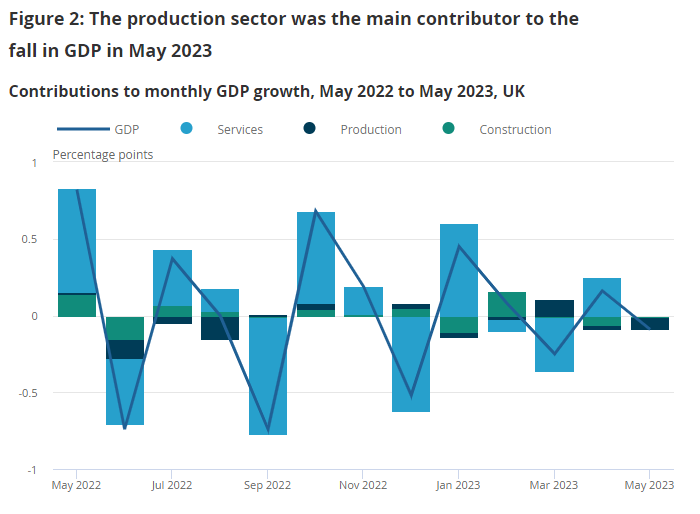

The calls follow the release of official data revealing UK GDP contracted 0.1% m/m in May, weighed down by an extra bank holiday for the King's coronation, but this figure is above consensus expectations for a reading of -0.3%.

The data surprise suggests the economy will potentially avoid recording a negative quarter of growth, defying the consensus expectation held by economists last year that the UK would be in recession through the winter and first half of 2023.

Abbas Khan, economist at Barclays, says the smaller-than-expected decline suggests some underlying resilience in the economy and poses an upside risk to his bank's GDP forecast of 0.0% for the second quarter.

Analysts at Barclays say the better-than-expected print firms their expectation for another 50 basis point hike at the Bank of England in August.

"We still expect broadly flat growth for the rest of 2023 with tailwinds from falling energy bills broadly offsetting the bite from higher rates," says Khan.

But Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the fall in energy bills is one reason why he expects the economy to pick up in the second half of the year.

"Looking ahead, we continue to think that the economy will regain a little momentum in the second half of this year, led by a pick-up in households’ real expenditure," says Tombs.

Image: Pantheon Macroeconomics.

By Tombs' calculations, households’ real disposable income can rise by about 1.0% quarter-on-quarter in the third quarter and by a further 0.5% or so in the final quarter, supported by declining energy prices and stabilising goods prices.

"Mortgage refinancing will deliver only a 0.2pp hit to real disposable incomes every quarter, so it is unlikely to be a decisive drag," he explains.

However, most economists we follow are fixing their gaze on higher UK mortgage rates, reckoning this will make the coming months difficult for the economy.

"We remain less optimistic for subsequent prospects for GDP as one headwind is being replaced by another. A 17% fall in domestic energy prices at the start of the month should provide some respite to the cost-of-living crisis. However higher interest rates now appear to be beginning to bite, most visibly via higher mortgage costs," says Philip Shaw, Economist at Investec.

Recent data from Moneyfacts shows that five-year mortgage rates are currently averaging 6.2% and two-year rates at 6.7%.

"The bottom line is that it will be difficult for the UK to escape a recession over the second half of the year," he says.

Image: Office for National Statistics.

Kallum Pickering, Senior Economist at Berenberg expects the UK to exhibit lacklustre growth until the Bank of England pauses with its rate hike cycle and most of the lagged effect of monetary tightening has passed through the economy.

Berenberg projects real UK GDP growth of 0.4% in 2023, 1.0% in 2024 and 1.7% in 2025.

The consensus - as per Bloomberg polling - expects 0.2% growth in 2023, 0.8% in 2024 and 1.5% in 2025.

"Risks are tilted to the downside in the medium term in case of further upside surprises to inflation – which would likely trigger a higher peak BoE bank rate than we expect," says Pickering.