Business Confidence Jumps to a 13-Month High, Wage Pressures Elevated: Lloyds Business Barometer

- Written by: Gary Howes

Image © Adobe Images

Talk of a UK recession could yet prove premature as a new survey shows UK business sentiment reaches a new 13-month high this month and wage pressures look set to remain high amidst an uptick in employment.

According to the Lloyds Bank Business Barometer, businesses haven't been this chipper since last May as they report a 9ppt improvement in sentiment.

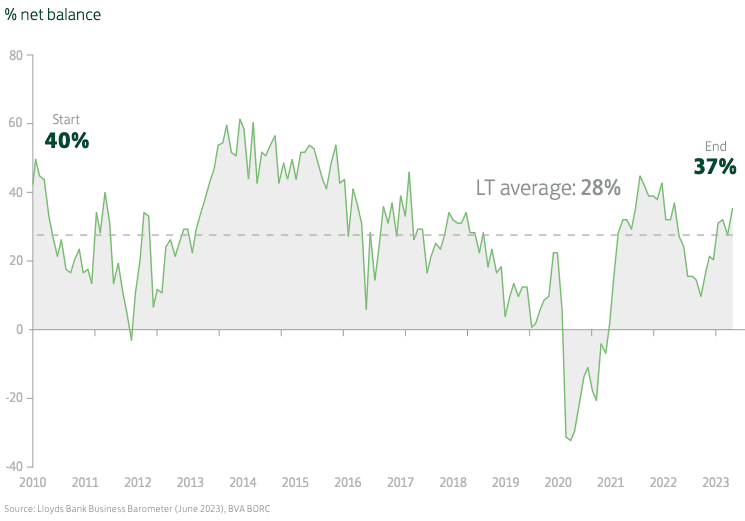

Lloyds reports business confidence in June bounced back after last month's dip and has risen in three out of the last four months. The overall confidence index increased by 9 points, its biggest monthly rise since March, to reach a 13-month high of 37%.

Above: Confidence rising again after last month’s dip: Lloyds Business Barometer.

The findings come a week after the UK's most-watched consumer confidence survey from GfK posted a fifth consecutive monthly improvement.

With both consumers and businesses turning more confident, how does this square with the growing warnings from economists for an imminent UK recession? It doesn't, and there is a risk that warnings of impending UK economic gloom coming from financial news pages and economic forecasters are again being over-amplified.

This was certainly the case at the start of the year when consensus forecast a UK recession in the first half of 2023.

"Business confidence is at its highest for over a year, buoyed by stronger trading prospects and economic optimism," says Hann-Ju Ho, an economist at Lloyds Bank.

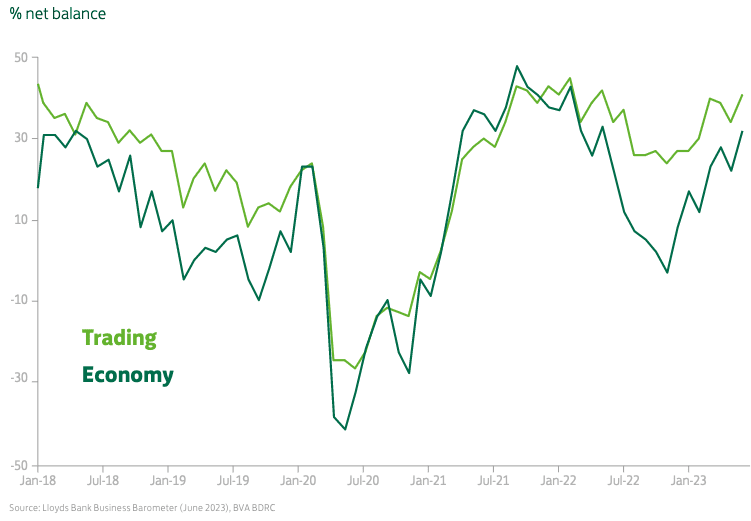

Above: Trading prospects and economic optimism pick up.

Lloyds reports the result was driven by rises both in firms' trading prospects and their optimism regarding the wider economy.

The Barometer also reports the hiring upswing resumed after last month's dip and has risen in six out of the last seven months.

This would suggest the UK labour market remains 'tight', which would keep wages supported. As such, this is a worrying development for the Bank of England which has raised interest rates to 5.0% in an effort to unwind labour market tightness and bring down inflation.

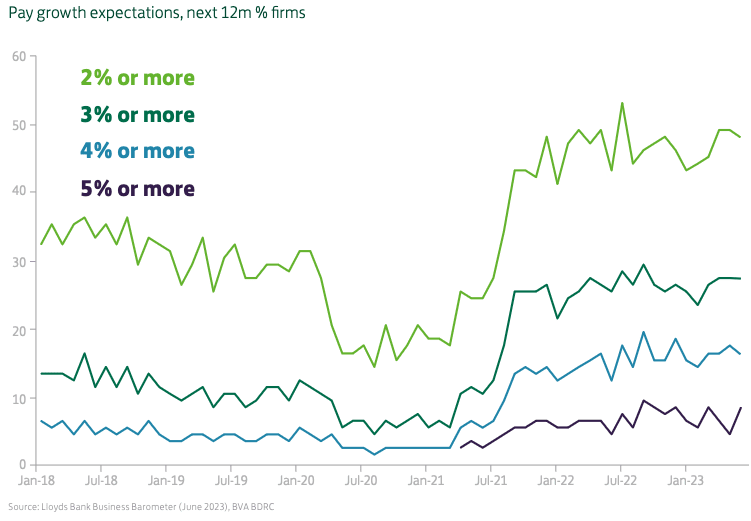

Indeed, the Barometer reports of "tentative signs that wage expectations may have picked up versus Q1."

"Firms’ expectations for average pay growth appear to have picked up compared with the start of the year," says Ho.

Above: Pay expectations stay elevated says Lloyds.

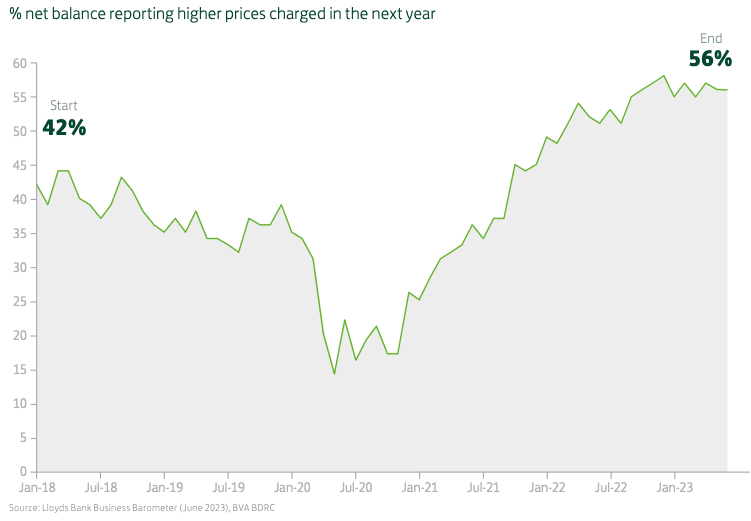

Further signs of persistent domestic inflationary pressures can be found in firms' pricing intentions, which reflect the improved confidence and wage pressures.

The Barometer reveals the proportion of businesses expecting to raise the prices of their goods or services remains elevated at around six in ten.

This month, 59% (down from 60%) plan to increase their prices and 3% (down from 4%) anticipate lower prices. The resulting net balance is unchanged at 56% and continues to fluctuate near the survey's highs.