Great British Public "Steps Up" to Fund an Indebted Government

- Written by: Gary Howes

Above: The government is already a third of a way to hitting its NS&I investment target, just two months into the new fiscal year. Image: NS&I.

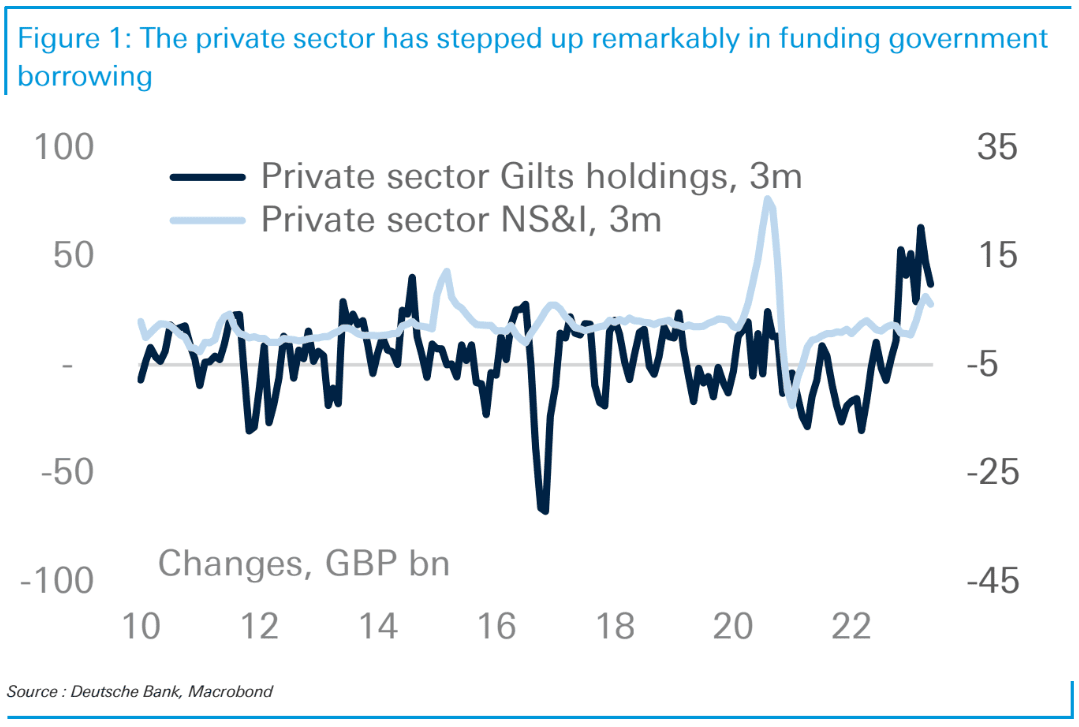

The Great British public has "stepped up remarkably" in funding government borrowing shows a new analysis from Deutsche Bank.

"Heading into the current financial year, there were some serious questions on who will fund the Government's mammoth GBP 251.9bn gross financing requirement," says Sanjay Raja, Senior Economist at Deutsche Bank. "It's the private sector that has stepped up to meet the Government's funding requirement."

"With yields on the rise, private sector holdings of gilts have jumped," explains Raja.

Data also reveal private investors have also put more cash into National Savings & Investment (NS&I).

Raja explains the Treasury will be relieved with the outcome as it suggests there is solid demand for the debt it must issue, particularly given public finance statistics recently revealed the UK's debt burden crept above 100% of GDP in May.

"This is good news. Indeed, in the first two months of the fiscal year, the private sector has absorbed nearly GBP 12bn in gilts. The private sector also invested GBP 2.4bn into NS&I. To put that in perspective, that's almost a third of the DMO's planned NS&I target for 2023/24," says Raja.

Impressively, this milestone has been reached just two months into the fiscal year.

"Altogether, with the BoE no longer a buyer of government debt, the private sector has played its role in funding public borrowing, accounting for nearly 40% of central government's net cash requirement thus far. And we expect the private sector to remain a big buyer of public debt going forward," says Raja.

The findings come on the day the Bank of England released its latest statistical release which revealed households drained a net £4.6BN from savings at banks and building societies, the biggest outflow on record.

The withdrawal could be an indication that consumers are using savings to maintain spending with the higher cost of living.

However, the more likely explanation behind the sudden shift is the recent rise in UK bond yields which makes saving in bonds significantly more attractive than holding them in bank accounts.

Banks have been accused of being slow to pass on higher rates and consumers might simply be going where returns are higher.

The jump into gilts by return-hungry households would underscore this view.

"We mustn't assume withdrawals in May 2023 have been made due to financial hardship alone. Over the past year, Britain's biggest banks have been making billions of pounds by swiftly passing on interest rate hikes to their borrowers but unacceptably slow to pass them on to their savers. With little incentive, it's no surprise that savers are withdrawing money and moving their funds around to find a better deal and help their money go further," says Tobias Gruber, Founder and CEO of mycommunityfinance.co.uk.

Interactive Investor - a retail trading provider - tells Bloomberg it has witnessed an almost tenfold jump in direct bond trading year-to-date when compared with the same period in 2022, with nearly all the activity concentrated in gilts.

Not only is the approximate 5% yield attractive, but they are also exempt from capital gains taxes.

Research from RBC Brewin Dolphin suggests for an investor paying the highest tax rate, a UK gilt maturing in 2024 with a coupon of 0.125% equates to a net annual yield to redemption of 4.59%. The research says for an investor to achieve a similar yield on taxable savings, a savings account would need to pay interest above 8%.