UK Economic Revival to be Driven by Rebounding Consumer Confidence says Berenberg

- Written by: Sam Coventry

Image © Adobe Images

Economists at Berenberg Bank predict consumers will drive the UK recovery from the second half of this year onward and into the next year as they pencil in above-consensus GDP readings.

Holger Schmieding, Chief Economist at Berenberg Bank, believes that UK consumers can anticipate a more favourable year ahead as inflation subsides and real wage growth turns positive.

"Are consumers right to expect things to get easier over the next year? In our view, yes," says Schmieding.

He predicts that as inflation more than halves to around 4.0% year on year by the end of the year, real gross household disposable income will rise solidly, supported by continued employment growth.

Moreover, with the Bank of England (BoE) reaching or nearing the peak of its rate hike cycle, credit conditions are expected to become less restrictive in the second half of the year.

Looking ahead to 2024, Schmieding believes credit conditions will ease further as monetary policy shifts from tight to neutral.

These factors, combined with rising real incomes and improved credit conditions, are anticipated by Berenberg to underpin a robust rebound in discretionary and big-ticket consumption, such as automobiles and home improvements, which were hit hardest over the past year.

Despite the persistent challenges of elevated inflation and higher interest rates, UK consumers are displaying resilience.

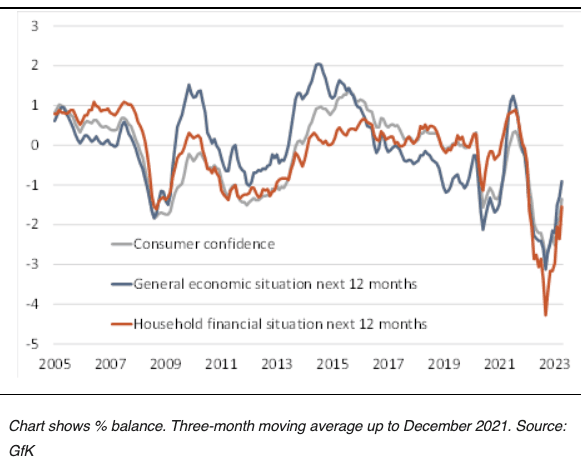

The closely watched GfK consumer confidence index has experienced a notable improvement, rising from -30 in April to -27 in May. Although still below its long-run average of -10, consumer confidence has strengthened in recent months after hitting an all-time low of -49 in September 2022.

Above: From a record low, consumer confidence is rising sharply.

This upturn is driven by enhanced economic outlook perceptions and improved expectations for personal finances, says Schmieding.

Over the past year, UK consumers faced significant difficulties due to overlapping shocks that impacted confidence.

The invasion of Ukraine by Russia disrupted global supply chains, particularly for gas, leading to a surge in inflation and a subsequent decline in real incomes.

Additionally, the Bank of England responded to the inflation surge by intensifying monetary tightening, which limited credit availability and further impacted consumers.

However, despite the ongoing challenges, the expectation of an imminent improvement appears to be lifting sentiment.

Consumers in the UK benefit from substantial excess savings, low consumer debt levels, and a high level of employment, providing them with a cushion against shocks.

These robust fundamentals, coupled with reduced energy wastage, have prevented the winter recession predicted by many analysts, including Berenberg Bank.

Looking ahead, these healthy fundamentals are expected to serve as a springboard for economic recovery, with rebounding house prices in the latter half of the year potentially bolstering net worth and further stimulating consumer demand.

Given the consumer-oriented nature of the UK economy, consumer spending typically leads GDP movements. Schmieding predicts that consumers will drive the recovery from the second half of this year onward and into the next year.

Berenberg Bank's positive consumer outlook supports their above-consensus GDP forecasts for 2023, expecting growth of 0.4% compared to Bloomberg's consensus of -0.2%, and for 2024, with an anticipated growth of 1.5% compared to 0.9%.