UK Private Rental Market Witnesses 4.7% Increase in Prices Over the Past Year, Reports Rentola

- Written by: Gary Howes

Above: Index of private housing rental prices percentage change over 12 months for countries of the UK. February 2022 to February 2023. Image courtesy of Rentola.

Rentola, a property rental site, has released recent data highlighting a 4.7% surge in rental prices within the private rental market across the United Kingdom (UK) over the past 12 months.

This marks a slightly higher increase compared to the previous 12-month period, during which rental prices rose by 4.4%.

The upward trend in rental prices was observed in all regions of the UK, with England experiencing a 4.5% annual increase, Wales seeing a 4.2% rise, and Scotland witnessing a 4.9% surge.

Among the regions in England, the East Midlands displayed the most significant annual percentage change in private rental prices, while the West Midlands observed the lowest change, said Rentola.

In London, rental prices recorded an annual percentage change of 4.6% in the 12 months leading up to February 2023.

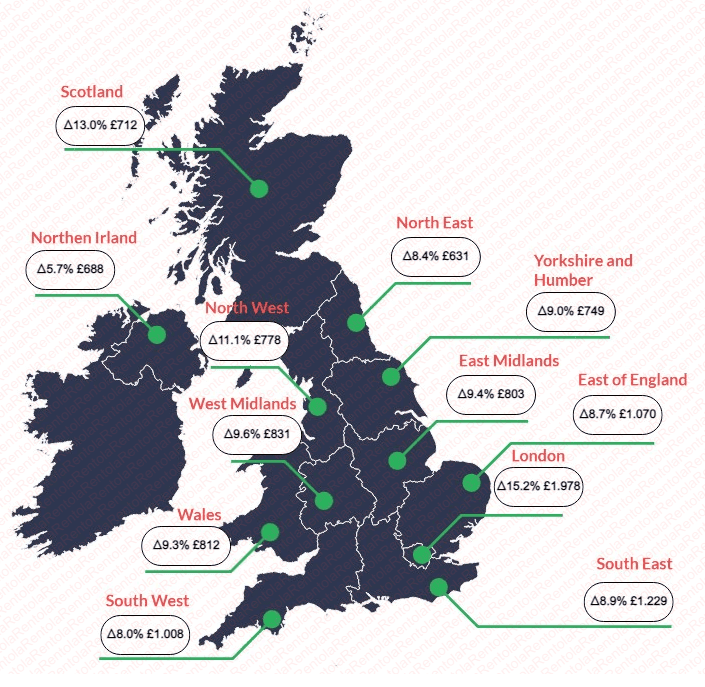

Above: Regional breakdown in rental prices, image courtesy of Rentola.

However, despite the increasing prices seen across the UK, the capital city experienced a drop in rental rates, whereas other regions observed a growth rate in the latter half of 2021.

This growth trend continued into 2022, with all regions, including London, witnessing an increase in the annual percentage change of rental prices. This marks the strongest annual percentage change in London since January 2013.

The North East region stands as the most affordable area to rent a home in the UK, with an average monthly rent of £631.

In contrast, the average rent in London (£1,978) is approximately double that of the North, Midlands, Wales, Scotland, and Northern Ireland.

Among the major cities, Aberdeen, Belfast, Newcastle, Sheffield, and Liverpool boast the lowest rental rates, with average rents below £800 per month.

The East of England demonstrated the smallest proportional increase in rental prices, with rates rising by 4.1% from £1,097 to £1,143. This places the region among the higher-priced areas for renting a property in the UK.

Notably, the greater London area remains the most expensive region for rentals in the UK. Kensington and Chelsea recorded the highest median monthly rent in Inner London at £2,199, while Lewisham had the lowest at £1,300.

In Outer London, Richmond upon Thames had the highest median monthly rent at £1,600, with Sutton reporting the lowest at £1,100. Comparatively, the North East had the lowest median monthly rent in England at £505.

The UK House Price Index, released by the Office for National Statistics (ONS), reveals that average house prices reached an all-time high of £295,608 in November 2022.

Although the average interest rate on a two-year fixed-rate mortgage has decreased to 5.3% as of February 2023, it may still surpass rates paid by some mortgage holders earlier.

Rentola says this could discourage prospective buyers from taking on mortgage debt at higher rates, potentially leading to a softening of the housing market.

The Office for Budget Responsibility (OBR) has predicted a possible decline in house prices, likely occurring in the latter half of 2023, while still expected to remain above the levels of the previous year.