Chancellor Hunt will Have Billions to Play with Next Week

- Written by: Gary Howes

Above: File image of Jeremy Hunt by Simon Dawson / No 10 Downing Street.

Chancellor Jeremy Hunt will have billions of extra pounds at his disposal when he announces the Spring Budget next week, which should afford him the chance to bring relief to certain households and sectors of the economy.

Hunt will find the state of the UK's public finances much improved than at the time of the Autumn Statement when he announced a new round of austerity would be imposed over the coming years in order to regain the trust of financial markets following the brief Truss-Kwarteng era.

"The Chancellor finds himself with billions to spend," says a note from the National Institute of Economic and Social Research (NIESR) ahead of next Wednesday's budget.

The NIESR says a combination of higher revenue and lower spending, together with the more favourable outlook for GDP and interest rates, means that the Chancellor has a large amount of fiscal space.

In its November forecast, the Office for Budget Responsibility (OBR) calculated that the Chancellor could meet his new target of reducing borrowing to under 3% of GDP by 2027-28, with £18.6BN to spare.

He could achieve his new debt target with £9.2BN to spare.

But since November, the deficit on a like-for-like basis has come in £30.6BN and the debt 1% of GDP lower than expected in November.

This adds directly to the fiscal space available for the Chancellor in his March Budget.

Without any change in spending or tax rates, the NIESR now expects the Chancellor to meet his deficit and debt targets with a total of £166.0BN (5.1% of GDP) and £97.5BN (2.9% of GDP) to spare, respectively.

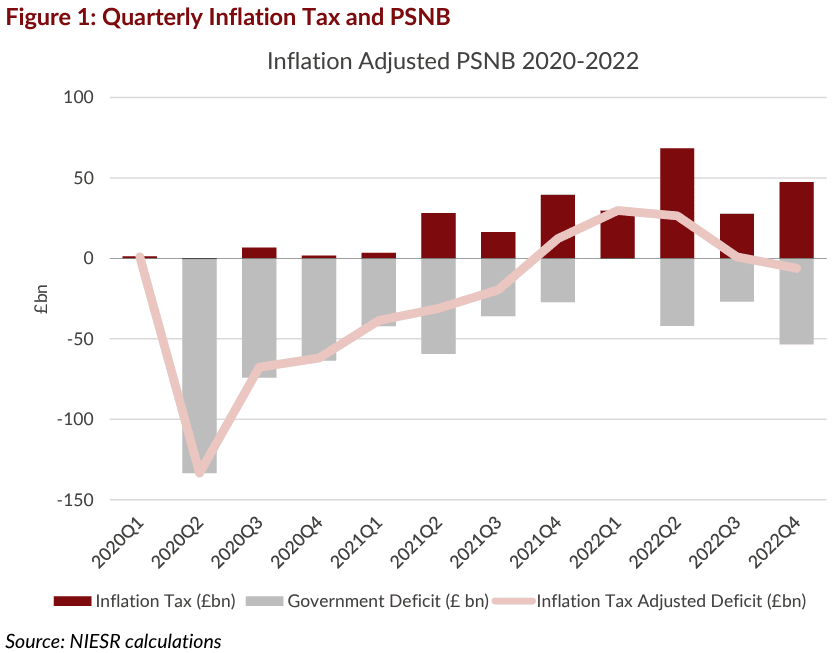

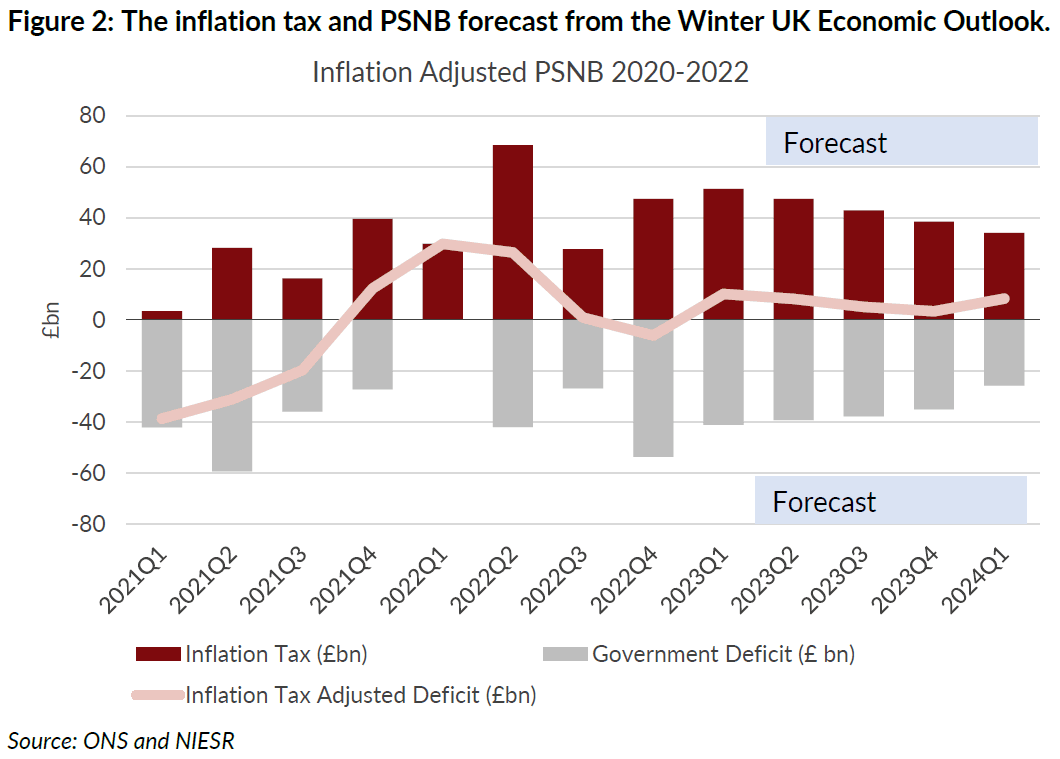

The NIESR's research finds persistent inflation has increased the amount of fiscal space: once adjusted for the inflation tax, which results from the devaluing of nominal government liabilities by inflation, it expects the government to be running a surplus in real terms throughout the 2023-24 fiscal year and the debt-to-GDP ratio to fall over 2023-24. (Explainer: what causes inflation).

Given the situation described above, the NIESR recommends:

» At the macroeconomic level, some of this fiscal space should be used to reduce the planned rise in corporation tax, which would otherwise lower investment and GDP in both the short run and long run, and to increase the amount of public investment. Lower effective corporation tax and increased public investment are both growth-enhancing.

» The Chancellor should allow public-sector wages to rise to catch up with the private sector, given private-sector wages have been rising much faster than public-sector wages of late. We can expect some spillovers from public-sector wage growth to the private sector, but any adverse macroeconomic effects need to be assessed against potential output losses if the public sector lost skilled workers.

» A more targeted approach to provide support for households to deal with the high energy prices: specifically, a combination of an opt-in Social Tariff system and a Variable Price Cap. This is preferable in fiscal terms to a universal EPG, as this might cost as much as £29 billion for 2023-24, and would provide both incentives to users of energy to limit demand, and also more support to those households who need it most.