UK House Price Fall Could Exceed 12%: Reaction to Halifax Data

- Written by: Gary Howes

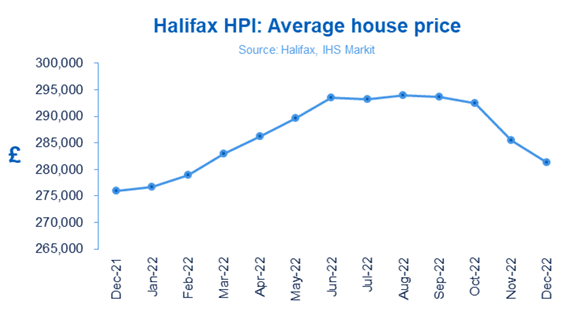

Above: Halifax House Price Index.

Halifax has reported a 1.5% month-on-month decline in UK house prices, lowering the 2022 increase in house prices to 2.0%.

Although house prices in the UK rose in 2022 as a whole, the trend is firmly towards the downside and economists are saying they might have to revise lower their forecasts for the depth of the pullback.

"The abrupt start to the 2023 house price correction means that the risks to our forecast that house prices will drop by 12% from peak to trough lie firmly to the downside," says Andrew Wishart, Senior Property Economist at Capital Economics.

Figures from Nationwide show a 2.5% drop in prices from the 2022 peak but the Halifax house price index is now down 4.3% from the August peak.

"As we’ve seen over the past few months, uncertainties about the extent to which cost of living increases will impact household bills, alongside rising interest rates, is leading to an overall slowing of the market," says Kim Kinnaird, Director at Halifax Mortgages.

Image courtesy of Halifax.

But Kinnaird says some perspective regarding the house price falls is required:

"These trends need to be viewed in the context of historic prices. The cost of the average home remains high – greater than it was at the start of 2022 and over 11% more than house prices at the beginning of 2021."

This edition marks 40 years of the Halifax House Price Index: UK house prices are up 974% since early 1983.

Halifax predicts a reduction in supply and demand overall in 2023, with house prices forecast to fall around 8% over the year.

However, Capital Economics expects a more sizeable 12% correction, warning that it could be even bigger.

"The idea that the housing market can have a 'soft landing' looks increasingly like wishful thinking," says Wishart.

He explains 2023 is likely to be a year of difficult adjustment to the higher interest rate environment.

"While mortgage rates have now started to ease, on average they remain above 5% making buying a home unaffordable for vast swathes of would-be buyers and causing demand to remain extremely weak."

Jonathan Hopper, CEO of Garrington Property Finders, cautions against panic.

"This remains a correction rather than a crash, for the simple reason that supply and demand are both waning together," he says in response to the Halifax numbers.

"Crashes happen when distressed sellers push up the number of homes for sale, prompting prices to plunge amid a glut of supply. Neither of those things is happening at present. Prices are sliding but so is supply, and this delicate balance is limiting the falls in price."

Hopper is more optimistic, saying he sees some New Year signs of cautious optimism – "and we may yet see a spring thaw, if not a bounce.”

But the RICS survey suggests that prices will fall by 2-3% quarter-on-quarter in Q1 and Q2 of this year, which would take the total fall in house prices to about 10% by mid-2023.

"And there is no guarantee it will end there," says Wishart.