UK Government Budget Fallout and the Most Important but Overlooked Reality

- Written by: James Skinner

Image © Gov.uk

The UK government's spending plans and financial market response are both well known by now but there is an important reality that may be going overlooked at HM Treasury and which could jeopardise more than just Downing Street's economic growth targets for the years ahead.

Wednesday's Bank of England (BoE) intervention in the bond market has bought the government some time in the most literal sense but beyond the very short-term, this action cannot do anything other than make a more pressing problem out of an important but overlooked reality.

Even certain hedge fund managers appear not to understand this reality, which is one that could haunt the government as soon as the current quarter.

"Remember that as interest rates go up, the Bank of England finds itself holding lots of government debt, which is going down and on borrowed money, which is going up. What the Government is doing now bankrupts the Bank of England. The Bank of England's probably losing about £32bn a year," one high profile supporter of the government told The Telegraph this week.

Readers should know that it is a mistake to think it would be the BoE losing money due to any rout in the UK government bond market.

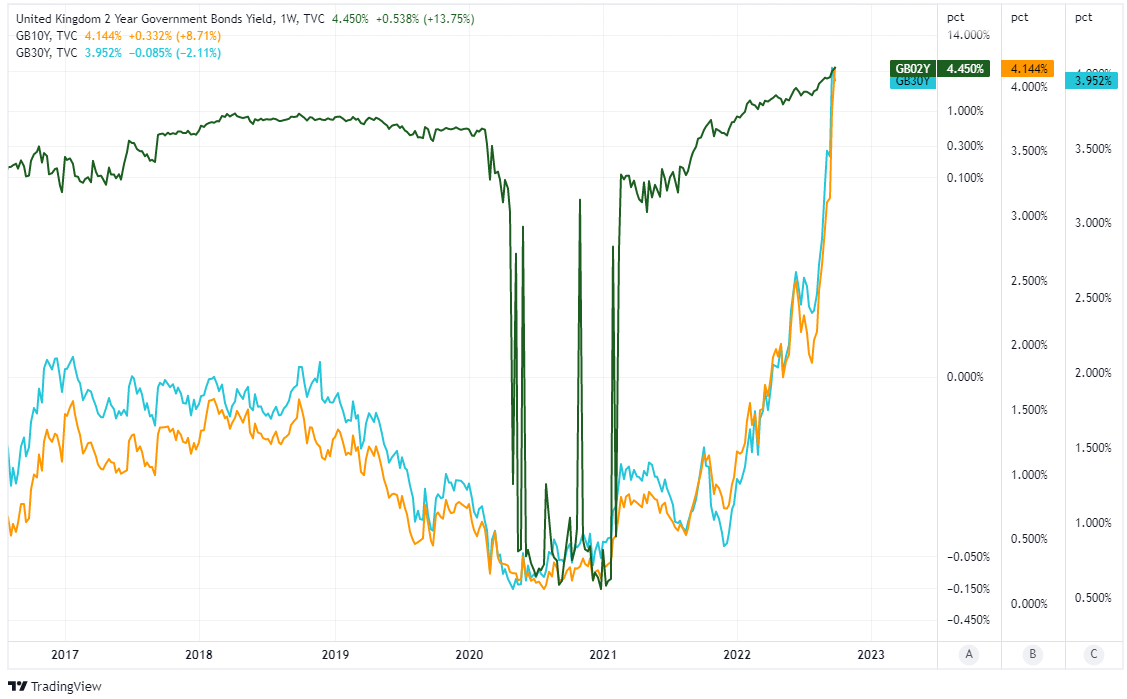

Above: UK government bond yields of various maturities. Click image for closer inspection.

Above: UK government bond yields of various maturities. Click image for closer inspection.

This is because the BoE has always had an indemnity from HM Treasury to protect it against losses arising from the government bond holdings acquired under the various quantitative easing programmes carried out over the years.

That has never been a problem for anybody before now but it becomes a most important reality in any environment like the present where the BoE is looking to raise interest rates and sell down its bond portfolio due to high levels of inflation.

"The operation will be fully indemnified by HM Treasury," the BoE said of its Wednesday operation in the government bond market.

The BoE's indemnities mean that losses arising from its actions in the market will have to be reimbursed to the bank and out of the very same revenues the government is currently looking to shrink through its tax cuts.

These have been given an evidently big thumbs down by the bond market and that is even more important now in light of the below from Tuesday's BoE statement, which makes clear the risk of bond market losses resuming or perhaps even growing in the near future.

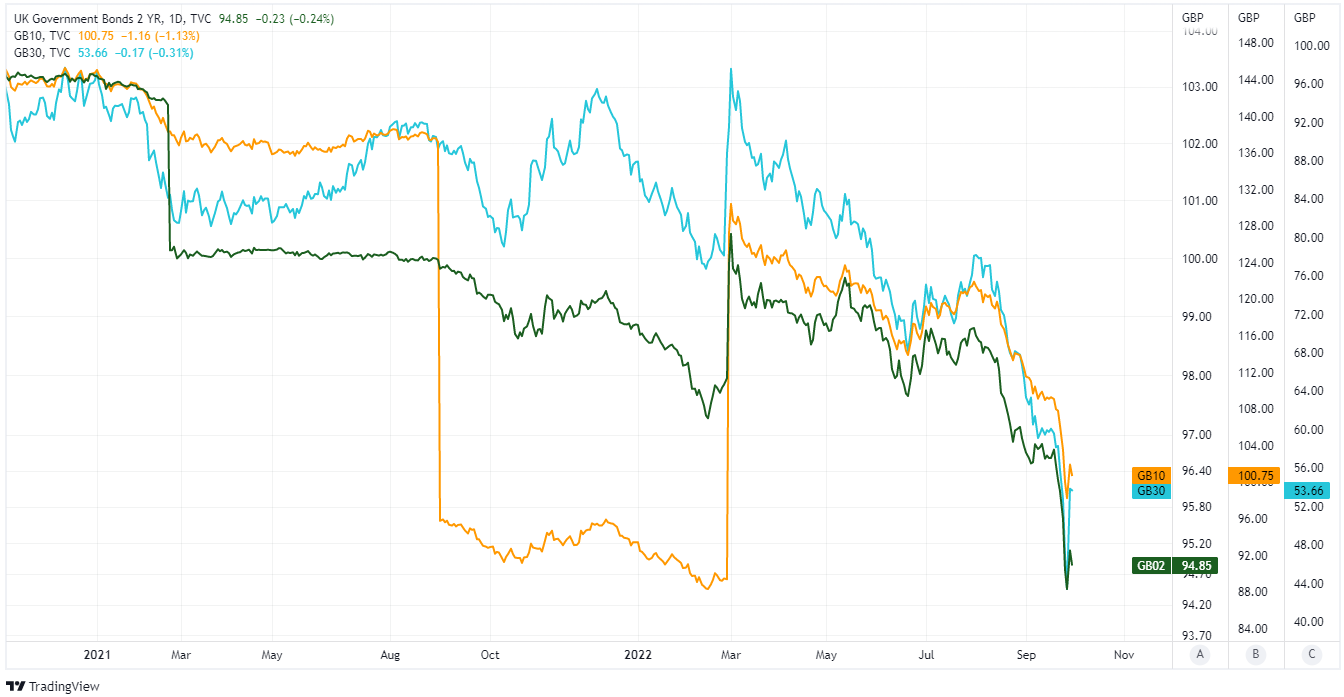

Above: Government bond prices for various maturities. Prices move in opposite direction to borrowing costs known as yields.

Above: Government bond prices for various maturities. Prices move in opposite direction to borrowing costs known as yields.

"The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided," the BoE said on Wednesday.

"The MPC’s annual target of an £80bn stock reduction is unaffected and unchanged," the bank also said later in the statement.

This should matter for the government if the intention of its spending plan is to boost economic growth.

Not least because any growth generated would be partly be offset - if not more than offset - should the BoE's bill for bond market losses then force the government to begin cutting its spending at a later date.

For readers who don't understand why, it's best to think of the economy as being something like the simple sum of all spending within the country.

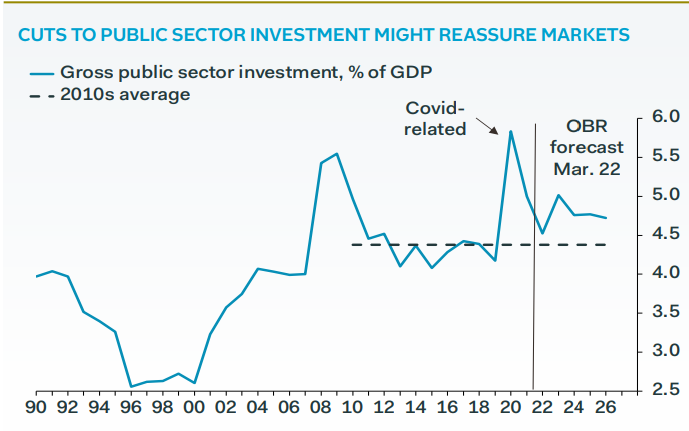

"It is perfectly possible that any spending cuts announced in the Budget could easily offset the limited support to GDP growth from the tax cuts. All told, we believe the outlook for growth in real GDP next year has not been enhanced," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Source: Pantheon Macroeconomics.

Source: Pantheon Macroeconomics.

Whether the BoE's bond market bill grows further will depend to at least some extent on investor interest in those bonds at the time when the bank looks to sell them, although the risk of the new government's spending plan backfiring in a potentially damaging way should be clear for all to see.

This is partly because tax cuts do not have a good track record of generating sustainable growth in GDP and especially when they are aimed at the higher end of the income bracket where there is a greater tendency to save additional income rather than to spend or invest it.

They do, however, have an evident capacity to diminish the spending resources available to governments and could ultimately force the government into new and repeated rounds of expenditure cuts that would then only compromise its very own economic growth objectives.

"Most high earners accumulated large amounts of cash during the pandemic, as they slashed their discretionary expenditure but carried on working. They have held on to this cash over the last year, rather than spent it. Simply adding more to their cash pile will not necessarily prompt them to spend more," Pantheon's Tombs wrote in review of last Friday's spending statement.

"Many high earners also likely will fear that the tax cuts will be reversed swiftly after the next election in 2024, and thus will save most of the windfall. Note that the Labour party—which remains about 10pp ahead of the Conservatives in polls of general election voting intentions—proposed raising the additional rate of income tax to 50% in its 2019 manifesto," he added.