Interest Rate Hikes and the Housing Market: "Hurry if You’re Selling, Halt if You're Buying"

- Written by: Gary Howes

Image © Adobe Stock

The Bank of England will raise interest rates again on Thursday, with Bank Rate to rise by 75 basis points to 2.50%, according to current money market pricing, which will have significant implications for the housing market.

The market meanwhile looks for a further ~125bp over the remainder of the year, implying a terminal rate that could be as high as 3.5-4.0%.

In response, analysts at CMC Markets say of the housing market: "hurry if you’re selling, halt if you’re buying, stay if you've borrowed".

They say the increase in Bank Rate directly impacts mortgages on variable rates, believed to be around 1 in 5 households in the UK.

But another 3.1 million households will be renewing mortgages when their fixed-rate periods expire in 2022-2023, according to UK Finance estimates.

Borrowers whose repayments are directly linked to the base rate, as set by the Bank of England, will now face mortgage repayments at rates between 3% and 4%, up from 1.75% and 2.75% only five months earlier.

This will inevitably spill into rent prices.

"Landlords will likely increase rent prices or sell to cope with increased mortgage repayments," says CMC Markets, in a recent note.

CMC Markets analysed the latest data for June 2022 from HM Land Registry, published on August 17th, and concluded that the likely tendency for house prices is in a temporary slowdown, which is good news for those waiting a little longer to buy a home.

"Houses sold in June 2022 only increased in price by 1% compared to May, whereas, last year, this constituted a much more generous 5.7% surge. This is only the first month this year for prices to slow down at such a fast rate, so some caution before jumping to conclusions is advised," says Michael Hewson, Chief Market Analyst at CMC Markets.

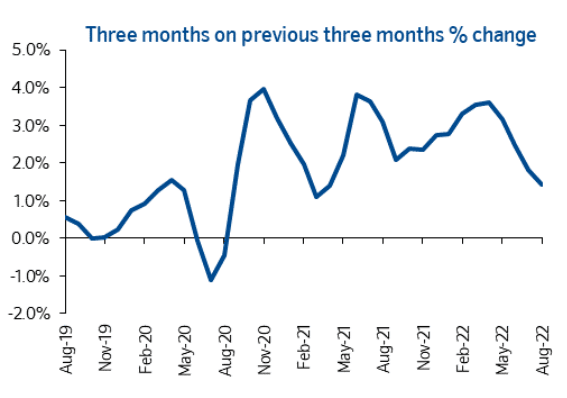

Nationwide said house prices were up 0.8% month-on-month in August, after taking account of seasonal effects

Hewson says although house prices may be slowing down, they are not decreasing.

Image: Nationwide house price index.

But, other analysts are warning of outright declines over the remainder of the year.

"We now expect house prices to fall by around 2% in the second half of the year, rather than just hold steady," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics. "The recent surge in risk-free interest rates and mortgage rates has been so severe that we now doubt that a period of falling house prices can be avoided."

For those still keen to get on the property ladder, Hewson advises there are plenty of fixed-rate banking products that can insulate them from the current spiralling interest rates on mortgages.

"They should, however, prepare for the possibility of being faced with higher-than-expected repayments once the fixed rate period expires, as the new variable rates are at the lender’s discretion. Fixed rates are not a cure-all either, as they may now be set to a higher level to start with," he says.

Turning to the buy-to-let market, landlords are expected to either pass the increased mortgage repayments onto tenants by increasing their rent or simply sell fast to lock in a better price.

"Right now though, those already on the property ladder are generally better off staying put rather than moving or re-mortgaging. They would not get a good deal on their old house in this market and may likely end up losing more money overall," says Hewson.