UK Retail Sales Slump Suggests UK Already in Recession says Analysts

- Written by: Gary Howes

Image © Adobe Images

A sharp decline in UK retail spending suggests the UK consumer is withdrawing in the face of surging prices, tipping the UK economy into recession.

UK retail sales fell 1.6% in the month to August says the ONS, bringing the year-on-year decline to 5.4%, both figures were deeper than the market was expecting (-0.5% and -4.2% respectively).

They also represent a marked slowdown from July's 0.4% and -3.2% and confirm the inevitable slowdown in retail activity as consumers are met with higher prices.

"The 1.6% m/m drop in retail sales volumes in August supports our view that the economy is already in recession," says Olivia Cross, Assistant Economist at Capital Economics.

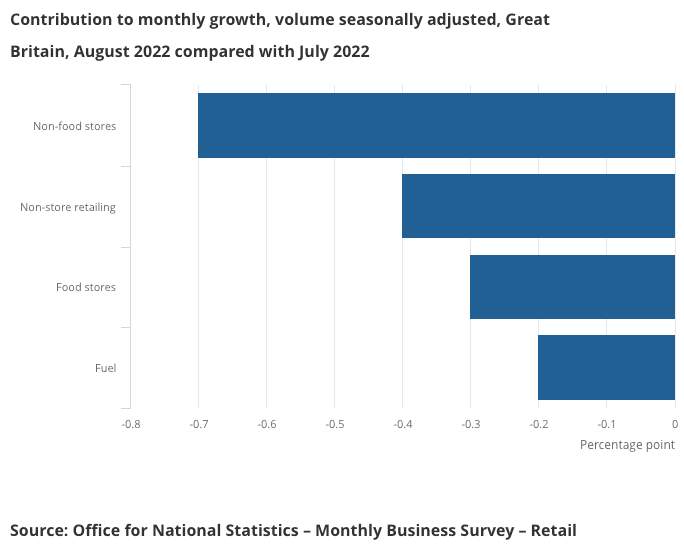

The ONS said declines were registered in all sectors, including online.

Curiously, automotive fuel sales also fell (-1.7%), despite the decline in prices on the forecourt.

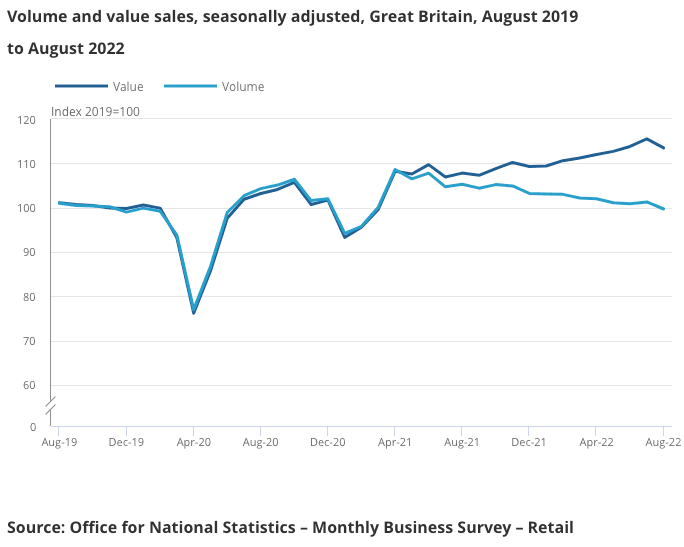

Above: Sales and volumes diverge as inflation spikes.

The ONS said the monthly fall in sales volumes is the joint largest fall in sales volumes (along with December 2021 where sales volumes fell by 1.6% over the month) since July 2021 when all legal restrictions on hospitality were lifted.

"There is also the possibility these figures suggest the UK is already in recession," says Sophie Lund-Yates, Lead Equity Analyst at Hargreaves Lansdown. "There was a notable decline in sports equipment, furniture and lighting. This gives an indication of the types of items consumers push to the bottom of their priority list in difficult times."

Above: All sectors contributed to the decline.

Looking ahead, Olivia Cross at Capital Economics says retail sales will probably continue to struggle as the cost of living crisis hits harder in the coming months.

"But nonetheless the Bank of England will still have to raise interest rates aggressively," she says. "With CPI inflation yet to peak, it will continue to squeeze real incomes and weigh on consumer spending in the coming months."

But Capital Economics says the potentially huge fiscal expansion from the government’s Energy Price Guarantee will offer substantial support to households and consumer spending further ahead.

"We now expect that the recession will be smaller and shorter than we did before," says Cross.

Capital Economics now expect the peak in Bank Rate to be at 4.00%, previously they had expected 3.00%, which is far above the consensus expectation for 2.50%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes