UK Economy Grew in August, But Looks Set to Contract Soon According to PMIs

- Written by: Gary Howes

Image © Adobe Stock

The UK economy expanded in August, according to a much-watched survey of activity.

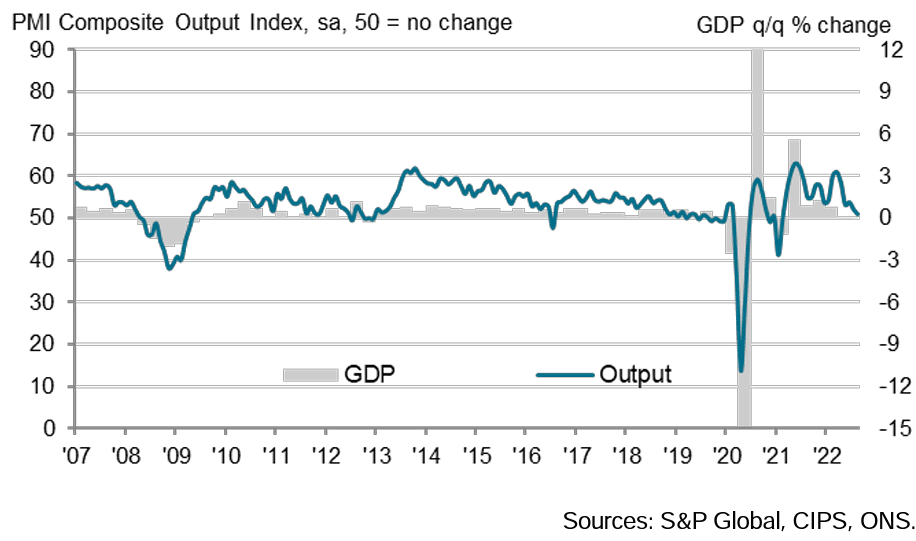

The monthly S&P Global PMI series did however confirm an ongoing slowdown in activity was underway as consumers and businesses grappled with rising inflation levels and the direction of travel is consistent with negative growth in coming months.

The S&P Global PMI for the services industry read at 52.5 in August, which is above the 52.0 the market was expecting and slightly lower than July's 52.6.

Manufacturing did however suffer a notable contraction, reading at 46.0, whereas the market was looking for growth at 51.0. July's figure was set at 52.1.

It was reported manufacturers suffered reduced customer demand, the delayed delivery of inputs and labour shortages.

The composite PMI, which balances the data to account for the broader economy, read at 50.9, below the expected 51.3 and the previous month's 52.1.

S&P Global said the rate of expansion was the weakest for 18 months and pointed to only a marginal increase in output. The loss of momentum was often linked by panel members to relatively muted customer demand as well as shortages of both labour and inputs.

Softer demand conditions led to a renewed drop in outstanding business, while employment expanded at the slowest rate for 17 months.

There was some good news however as inflationary levels faced at the 'factory gate' are cooling.

The report finds the rate of cost inflation softened notably at manufacturers, hitting the lowest since November 2020.

This appears to be the effect of a multi-week decline in commodity prices starting to feed through.

In the service sector, S&P Global reports the rate of cost inflation picked up slightly on the month. Service providers typically noted higher salary payments, often spurred by rising living costs.

This will interest Bank of England policy makers as this suggests inflation is becoming embedded in wage settlements and is therefore broadening.

It is consistent with market expectations for further interest rate hikes at each of the remaining meetings of 2022.