UK Retailers see Light at the End of the Inflationary Tunnel: CBI Survey

- Written by: Gary Howes

Image © Adobe Stock

Under pressure UK retailers say they see easing inflationary pressures ahead, but sentiment and business investment intentions remain resolutely forlorn.

The CBI Distributive Trades Survey said retailers reported average sales for the time of year in May but expect them to dip below seasonal norms again next month.

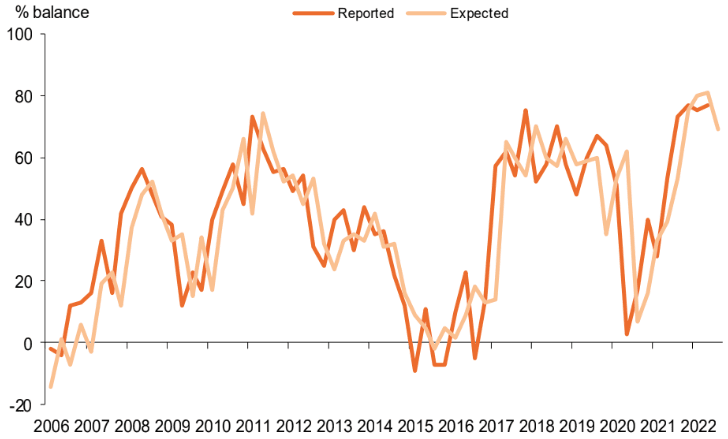

The quarterly survey finds year-on-year selling prices continued to grow at a similarly rapid pace to February, though retailers "expect price growth to ease slightly in the coming quarter".

The Bank of England expects UK inflation to peak close to 10% in October, but this late peak will largely be due to the lifting once more of the household energy cap.

Therefore broader price pressures could be set to plateau sooner in line with the survey's findings.

Above: Average selling prices - CBI.

The findings could be relevant to the Bank of England's interest rate policy as the Bank will likely continue hiking rates as long as they believe wage pressures and business pricing intentions will remain elevated.

Should businesses see a diminishing need to raise the cost of goods in coming months the Bank could see reason to step off the accelerator.

Nevertheless, sentiment in the retail sector deteriorated at its quickest pace since November 2020 and investment intentions for the year ahead stand at their weakest level since the early stages of the COVID-19 pandemic in May 2020.

Retail sales were average for the time of year in May (0% from -24% in April) but are expected to be below seasonal norms next month (-13%).

However, wholesalers (+41% from +39%) and motor traders (+19% from -35%) both reported sales as good for the time of year in May.

Year-on-year retail sales were broadly flat (-1% from -35% in April) and are expected to fall at a modest pace next month (-4%).

Retailers expect their business situation to deteriorate in the next three months (-13%), marking the quickest fall in sentiment since November 2020.

The findings come on the same day the S&P Global PMI survey for May reported its fourth-fastest slump on record as businesses reel under the weight of a cost of living crisis and deteriorating sentiment.

The Pound has fallen sharply on the news.

In a further worrying sign for the UK economic outlook, retailers anticipate less capital spending in the next 12 months compared to the past 12 (-34%) – the weakest investment intentions since May 2020.

“Despite retail sales returning to their average for the time of year in May, the outlook for the sector has worsened due to high inflation and broader economic uncertainty. As a result, retailers are reining in their investment plans for the year ahead to the greatest extent since May 2020," says Martin Sartorius, Principal Economist at the CBI.

“Government action to ensure the economic security of the poorest households and support the investment ambitions of retailers will be crucial to ensure the longer-term prosperity of the UK economy and society,” he adds.