PMIs: Winter Winds Blow Over the UK Economy

- Written by: Gary Howes

Above: Professor Chris Whitty, Chief Medical Officer in the Downing Street media briefing room. Picture by Simon Dawson / No 10 Downing Street.

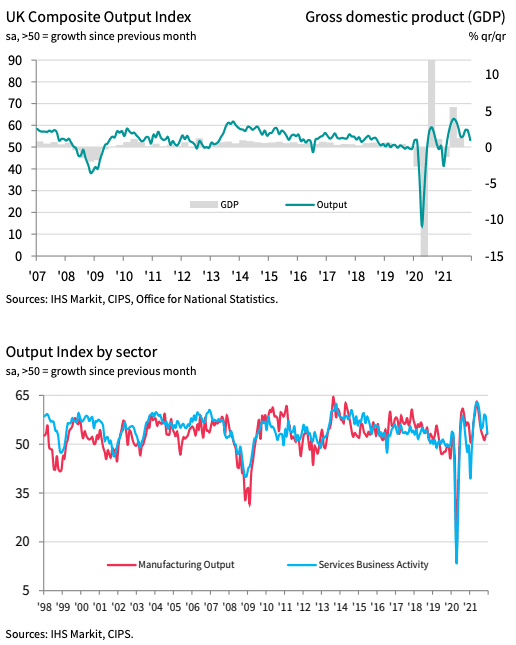

A regular survey of UK economic activity revealed UK businesses saw slowing activity in December as concerns over the spread of the Omicron variant and associated business restrictions emerged.

IHS Markit said private sector output growth eased "considerably" in response to tighter pandemic restrictions and renewed business uncertainty, with the slowdown was centred on the service sector.

The Services PMI for December read at 53.2, down on November's 58.5 and well below the market's anticipated reading of 57.

Manufacturing looked to be more resilient with the reading of 57.6, confirming strong growth and meeting analyst expectations even though it is a shade softer than November's 58.5.

But services account for the vast majority of UK economic activity and the Composite PMI - which rebalances the two readings to give a more accurate reflection on the overall economy - came down to 53.2 from 57.6 in November, underwhelming consensus at 56.4.

"With COVID-19 infections set to rise further in coming weeks due to the spread of the Omicron variant, and more restrictions being introduced, the pace of economic growth looks likely to continue to weaken as we head into 2022," says Chris Williamson, Chief Business Economist at IHS Markit.

"The flash PMIs suggest that the outlook for the economy has darkened in December by a little bit more than we had thought. The composite measure is consistent with GDP being flat over Q4 as a whole," says Adam Hoyes, Assistant Economist at Capital Economics.

The UK government has ordered workers to work from home where possible while also urging people to minimise personal contacts, creating what some have described as a de facto lockdown.

The government has signalled no further restrictions are likely until Christmas but ministers have at no point ruled out further restrictions.

England's Chief Medical Officer (CMO) Chris Whitty on Wednesday said in a televised briefing he expects the numbers of positive Covid cases to break records over coming days.

Optimism regarding the economic outlook has also slumped with IHS Markit reporting a decline in confidence amongst consumer-facing service providers.

Private sector growth expectations for the next 12 months are now at the lowest since October 2020 and considerably weaker than seen during the early stages of the vaccine rollout.

Survey respondents widely cited a negative impact on consumer demand from tighter COVID-19 stringency measures and renewed travel restrictions.

The December survey indicated another strong rise in private sector employment, however weaker rates of output and new business growth meant that the pace of job creation edged down to its lowest since April.

There were however some encouraging signals regarding inflation: the latest increase in average cost burdens was much softer than November's survey-record high.

At the same time, prices charged inflation moderated to its weakest since August.

But the Bank of England won't be able to relax on this message as respondents revealed "sharply rising wages, transport bills and raw material prices remained the main sources of cost inflation".

The UK economy has recovered strongly over the course of 2021 and there are in excess of 1.2 million vacancies according to the ONS, which is expected to maintain upward pressure on wages.

The Omicron wave will have passed by late winter according to scientists which means a more durable recovery is possible in 2022 that will potentially invite the Bank of England to raise interest rates, provided no further variants emerge.