Inflation Forecasts of +4% Still Likely to be Met

- Written by: Gary Howes

Image © Adobe Images

The UK's headline rate of CPI inflation dipped unexpectedly to 2.0% in July from 2.5% in June, a move that puts it smack on top of the Bank of England's 2.0% target.

Does the sudden fall inflation put in jeopardy the forecasts made in early August by the Bank of England's own economists that a rise to 4.0% is likely before the year is done?

A canvass of noted economists carried out in the wake of today's ONS inflation data confirms that prices will soon again push higher with some even saying a persistent period of inflation readings above the Bank of England's mandated 2.0% target is now likely.

Andrew Sentance, Senior Adviser at Cambridge Econometrics and a former member of the Bank of England has long warned hefty inflation readings were in the pipeline and says he still anticipates 4-5% inflation later this year.

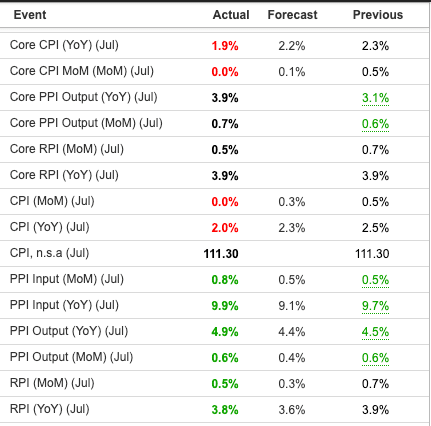

Inflation headlines:

"Different measures of inflation pointing in different directions today. CPI inflation fell back to 2 percent but RPI inflation is 3.8 percent and RPIX inflation is 3.9 percent. factory gate inflation has picked up to 4.9 percent showing more price pressures in the pipeline," says Sentance.

Kallum Pickering, Senior Economist at Berenberg Bank agrees that underlying price pressures are building, but unlike the Bank of England he does not expect a swift decline in inflation in 2022.

"Amid surging input and wage costs, underlying forces of demand and supply point to significant and sustained inflation over the duration of the coming business cycle," says Pickering.

Berenberg's point forecast for the peak in inflation is actually below that of the Bank of England's at 3.7%, but they crucially see price pressures remaining higher for longer than the Bank of England expects.

Significant further price pressures will come from rising labour costs (amid record labour demand) and surging input prices which will likely push consumer price inflation to well above the BoE’s 2% target in the coming months according to Berenberg.

The UK's inflation data comes just a day after the ONS reported a record 1 million vacancies are now unfilled while wage growth of 8.8% was also a record.

Rising wages and a struggle to fill roles is often regarded by economists as a sign that the spare capacity in the economy - i.e. available labour and idle machinery - is limited.

When spare capacity falls away the pressure on wages inevitably grows, and rising wages mean rising inflation.

But, external sources of upward pressure on prices is also unlikely to simply fade given ongoing issues in Chinese ports where shutdowns linked to Covid means shipping rates and container rates are soaring.

Covid's disruption of the global supply chain was the primary driver of global inflationary pressures witnessed in 2021 and the spread of the Delta variant in Asia could mean a second round of such price pressures is now building.

"Producers continue to suffer severe supply chain issues caused by shortages of commodities, key inputs (e.g. semiconductors) as well as labour, while dislocations and delays at ports have apparently worsened in recent weeks. Amid strong domestic demand and significant pricing power, firms will try to pass on cost rises to consumers," says Pickering.

"There’s little doubt that headline CPI will go well above 3% later this year – and in fact, the next set of data may confirm we got close in August," says James Smith, Developed Markets Economist at ING.

He says the "UK inflation dip represents the calm before the storm".

However, price pressures are tipped by ING to cool again in 2022 and Smith says for the Bank of England it is not so much the peak that matters, but how rapid the cool down proves to be.

"Ultimately, whether or not inflation stays higher for longer probably relies on wage growth accelerating," says Smith.

ING expects wage prices to ease over coming months as the UK exits the pandemic and the jobs market returns to normality.

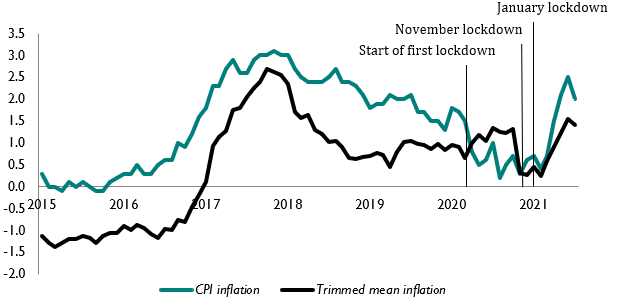

The base effect is also important: this is where today's figures are distorted by happenings in the year prior which injects a great deal of uncertainty and volatility into inflation dynamics.

For example, in 2020 inflation plummeted for some goods and services owing to lockdown. Fast forward a year later and the same goods and services appear to have leapt in price, when in fact the year-on-year comparison is flattered by the previous year's reading.

The National Institute of Economic and Social Research's (NIESR) calculations show that base effects had a notable downward effect in July (lockdowns were ending one year prior) but they will boost headline consumer figures again in August before trending downward in September.

However the NIESR says several additional transitory effects will put additional upward pressure on headline inflation in the remainder of the year: shortages in intermediate inputs and ongoing disruption in supply chains have filtered through to consumer goods prices, while labour shortages and the associated increase in wages could also feed through to headline inflation.

Furthermore, the scheduled increase in OFGEM household energy price-cap in November 2021, in conjunction with the reversal of the 2020 VAT cuts in October 2021 and April 2022, will likely provide further impetus to consumer prices.

Crucially, the NIESR expects that headline CPI may be at 2.4% in the year to July 2022, exceeding the Bank of England’s 2.0% target.

"To prevent the short-term inflation from feeding into a wage and price spiral, we recommend the Bank of England to revise its communication regarding policy rates and continuation of asset purchases," says NIESR economist Janine Boshoff.

The NIESR's Director Jagjit S. Chadha told parliamentarians in June that the rapid recovery now in train gives the Bank of England a perfect opportunity to make a statement as to the need to reverse some of increase in Quantitative Easing it announced in Spring 2020.

"Some move away from the use of this blunt tool ought to allow market functioning and the price revelation process of information flows from bond prices to resume," said Chadha.

For its part the Bank said in August they would only consider doing so once they have raised interest rates, something the market expects to take place towards mid-2022.

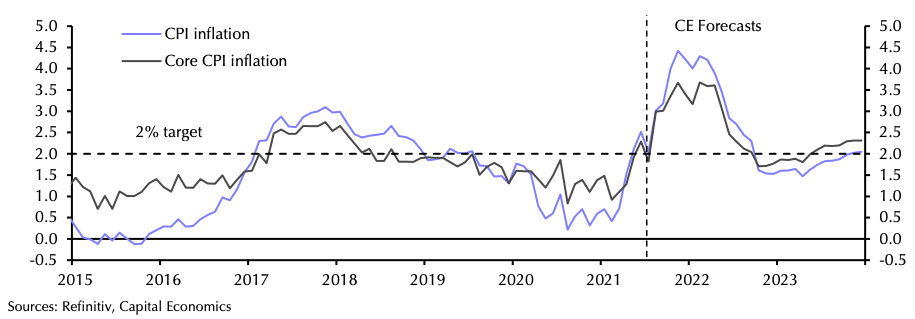

Capital Economics says UK inflation is still on course to reach 4.5% by the end of the year despite the July dip.

But "provided the spike in inflation does not feed through into higher inflation expectations or persistently faster pay growth, we do not think that the Bank of England will respond next year by tightening monetary policy."

Capital Economics agree with the Bank of England's projections in expecting inflation to fall back to the 2.0% target by the end of 2022, therefore relinquishing the pressure on the Bank to raise rates.

But Ruth Gregory, Senior UK Economist at Capital Economics, says the Bank of England could find itself in an uncomfortable position over coming months as there is evidence that price pressures are still building earlier in the price pipeline, evidenced by input producer price inflation which moved from 9.7% to 9.9%) and output producer price inflation which has moved from 4.5% to 4.9%.

"With some signs that underlying pay pressures are rising, the coming months will not be comfortable for the MPC. We think that the MPC will look through the spike in inflation and keep interest rates at their current levels until mid-2023," says Gregory.