Government Borrowing Undershoot Means Tax Hikes can be Avoided

- Written by: Gary Howes

Public Sector Net Borrowing for April came in at £31.7BN says the ONS, an increase on the £28BN borrowed in March but below economist estimates for a reading of £32BN.

The undershoot in borrowing has lead economists to say the fears of swingeing tax hikes in the future to pay for the pandemic are misplaced.

Although the figure was less than the market was expecting, the ONS nevertheless says this is the second highest April borrowing since monthly records began in 1993.

It is £15.6BN less than was borrowed in April 2020, when the first lockdown resulted in a massive economic slump.

That less was borrowed than expected will underpin a view that Chancellor Rishi Sunak is going to borrow far less than he and the Office for Budget Responsibility (OBR) were expecting to cushion the country against the financial impact of the Covid crisis.

"April’s public finances figures showed that the government’s financial position isn’t as bad as the Office for Budget Responsibility (OBR) predicted only two months ago, reinforcing our view that the tax hikes and spending cuts that most fear may be avoided," says Ruth Gregory, Senior UK Economist at Capital Economics.

The need to borrow is likely to start declining once the UK economic recovery is in full swing and government support schemes - such as furlough - are shut down.

With the UK set to experience a surge in growth as covid-19 restrictions are lifted tax receipts should recover.

"We have been saying since the end of last year that rapid economic growth would quickly improve the outlook for the public finances. That means the Chancellor may be spared having to implement his proposed tax hikes/spending cuts before the 2024 general election. It seems that others are just about starting to adopt this view," says Gregory.

Analysis from the FT says Sunak now looks set to "secure a public finances windfall" by the time the Autumn Budget is released as the UK’s strong economic recovery from the coronavirus crisis rapidly improves the outlook for government borrowing.

The OBR predicted the government would need to borrow £233.9BN in 2021-22 to deal with the pandemic, but the FT calculates the figure could now be as low as £150BN.

The ONS estimate Government borrowing in the financial year (FYE) ending March 2021 is £300.3BN, revised down by £2.8BN from last month’s first provisional estimate.

Borrowing in FYE March 2021 is estimated to have been £27.1BN less than the £327.4BN expected by the OBR in their Economic and Fiscal outlook.

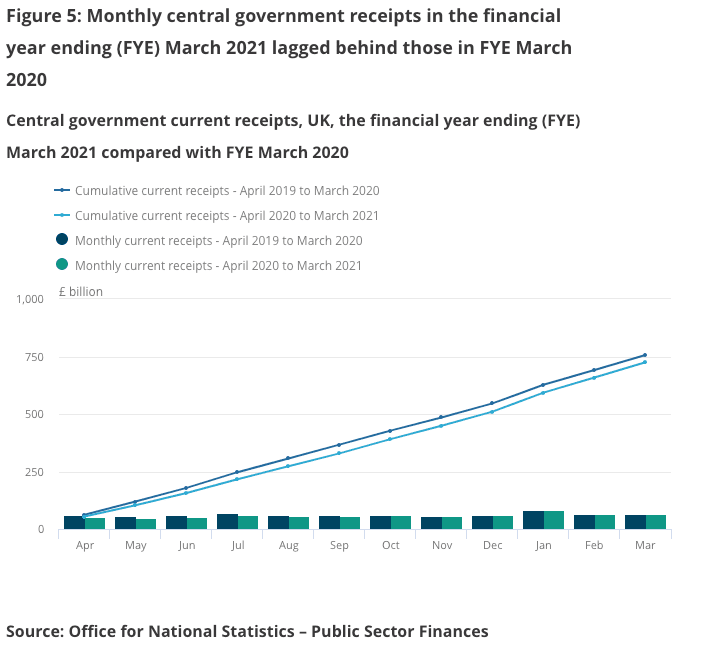

The better turnout in April borrowing figures was driven by an increase in receipts at £58.0BN, up £3.8BN (or 7.0%) compared with April 2020.

The Government meanwhile spent £58.0BN, up £3.8BN (or 7.0%) compared with April 2020.

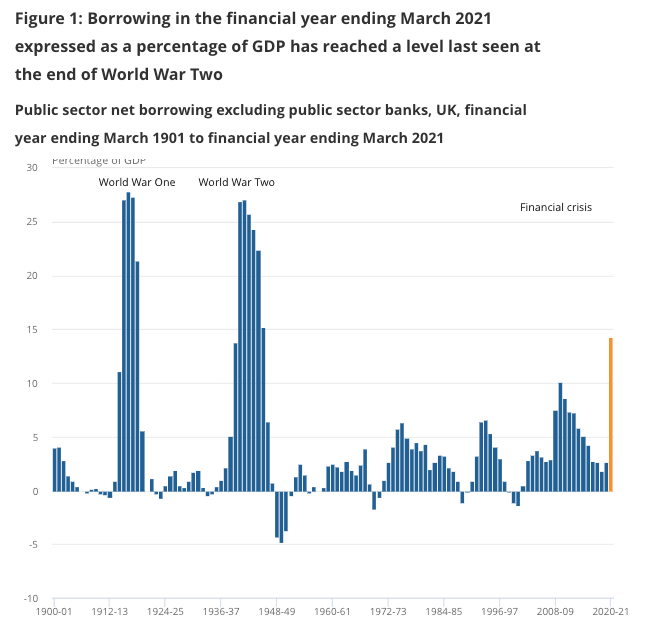

Borrowing in the FYE March 2021 was 14.3% of GDP, revised down by 0.2 percentage points from last month’s first provisional estimate; it remains the highest such ratio since the end of World War Two, when it was 15.2% in FYE March 1946.

According to the ONS, Government support for individuals and businesses during the pandemic contributed to an increase of £204.1 BN (or 27.6%) in central government day-to-day (or current) spending to £942.7BN.

The ONS says at least 50 schemes have been announced by the UK government and the devolved administrations to support individuals and businesses during the pandemic.