Government's Record Borrowing Spree Balloons £35.9BN in August

Image © Adobe Images

The government borrowed £35.9BN from financial markets in August as it continues to count the cost of staving off an economic meltdown due to the lockdown and restrictions it has introduced to try and stem the spread of covid-19.

The figure of £35.9BN is up from the £5.4BN borrowed in August 2019, which takes the current fiscal year to £173.5BN according to the ONS. This is an all-time borrowing record in cash terms and what will concern the Chancellor of the Exchequer is there are still seven months in the fiscal year to go.

The cost of the covid-19 lockdowns and medical response to the virus is likely to balloon further with economist saying unemployment is likely to rise sharply over coming months as the government's job retention scheme ends in October, and new job support measures announced by the Chancellor on Thursday won't be enough to prevent further losses.

In addition, fresh restrictions on movement and economic activity were announced by the Government this week and with the covid-19 caseload continuing to rise sharply there are fears more stringent economy-killing measures will be announced before the year is out.

"The big picture is that fiscal support will fade over the autumn causing many more job losses to be realised," says Andrew Wishart, UK Economist at Capital Economics.

Wishart tells clients that borrowing in the year to date is actually 22% below what the Office for Budget Responsibility projected in July. "If that continued, the government would borrow £290BN this year (14% of GDP)," says Wishart.

Capital Economics are expecting UK GDP growth to stagnate for the remainder of the year as the rebound seen over the summer months fade owing to rising covid-19 cases and restrictions.

Chancellor Rishi Sunak announced fresh measures to support people and businesses on Thursday, which could require an estimated additional £24.3BN of spending.

Capital Economics say the Government’s new Job Support Scheme and the extension of the VAT cut for hospitality and tourism may add up to £10bn to the cost of direct support.

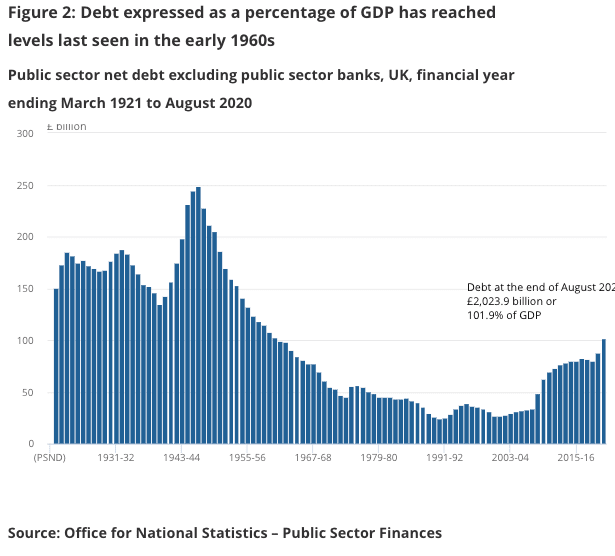

"The result could be that the Chancellor ends up borrowing a whopping £370bn (18.4% of GDP) in 2020/21, pushing up the debt to GDP ratio from 88.4% in 2019/20 to 102% in 2020/21. But with the recovery stuttering and no sign of concern in the gilt market, the government is right to have refocussed on supporting the economy rather than raising taxes," says Wishart.