GBP/AUD Rate Week Ahead Forecast: Downside Favoured, RBA Key Domestic Risk

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate is forecast to come under further pressure in the week ahead, provided UK inflation data undershoots expectations and the RBA delivers 'hawkish' guidance.

The near-term trend in GBP/AUD has softened following three big daily selloffs last week that put paid to any hopes that the technical picture was turning outright bullish.

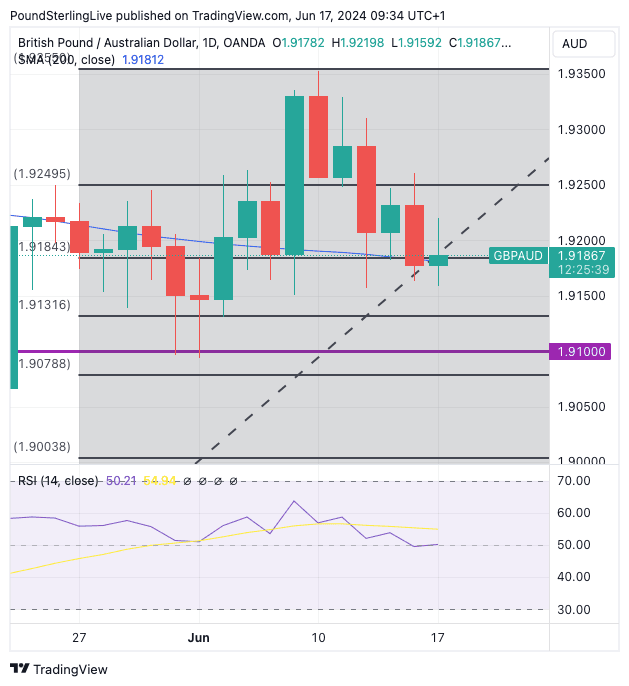

Indeed, as we write on Monday, the exchange rate is on the cusp of breaking below the 200-day moving average at 1.9183:

Above: GBP/AUD at daily intervals. Track GBP/AUD with your own alerts, find out more here.

Note, too, that the 200 DMA is converging with the 38.2% Fibonacci retracement level of the May-June rally.

We expect this support level to break down ultimately and the exchange rate to move towards 1.91 in the coming days.

This can happen if the Reserve Bank of Australia (RBA) says on Tuesday that inflation remains too high to consider cutting interest rates.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The RBA forms the key domestic risk for AUD in the coming week, with analysts expecting no major changes to policy or guidance. This means the RBA will repeat its previous message that interest rates will remain at current levels for the foreseeable future as employment and inflation remain robust.

There is a key sentence from the previous policy meeting that investors will be looking out for: “the Board is not ruling anything in or out."

If the RBA keeps this phrase, it is business as usual for AUD, with limited impact. But if the phrase were dropped, we would receive a clear message that the RBA is on the road to a cut, which can send AUD lower.

The RBA is expected to be the last of the major central banks (Bank of Japan excluded) to cut interest rates, which can support the Aussie Dollar relative to interest rate expectations.

Should this week's UK inflation data beat expectations and the Bank of England express caution about raising interest rates, Pound-Australian Dollar can recover to 1.9250-1.9300 ahead of the weekend.

"My prediction for next week’s CPI inflation figures. Headline 2.3% (unchanged). Services inflation 6% (+0.1). Goods inflation -1% (-0.2). Core inflation 3.8% (-0.1%). Not enough change to prompt a rate cut from MPC," says Andrew Sentance, an economist and former member of the Bank of England's MPC.

In May, Sentance correctly predicted that April's inflation reading would overshoot expectations, and if he is again correct, these upside surprises will likely boost the pound.

The key figure to watch on Wednesday is the services inflation print, as this is running well ahead of levels consistent with a durable fall in UK headline inflation to 2.0%.

The Bank of England and other economists expect a steady pickup in inflation over the remainder of the year owing to elevated services inflation levels. Another above-consensus services inflation reading would raise questions about just how fast the Bank of England can cut interest rates, ultimately supporting the Pound.

There are sizeable downside risks for the Pound this week if inflation comes in softer and the Bank of England is inclined to signal an August rate cut. This is because the market currently sees less than a 50% chance of an August cut, meaning there is scope for repricing in a GBP-negative direction.

Pound-Australian Dollar will likely test 1.91 and below if this occurs.

"The pound may lose some of its recent momentum if UK services inflation comes in cooler than expected next Wednesday, as it would raise the probability of a BoE cut in August and bring rates differentials back to the fore," says George Vessey, Lead FX Strategist at Convera.