Australian Dollar Hits 2021 Low but St George Warns of Fall to 0.70

- Written by: James Skinner

- St George warns of AUD/USD loss to 0.70

- As USD rallies after Fed’s guidance shifts

- St George still forecasts 0.80 by year-end

- RBA policy a deciding factor for AUD/USD

Image © Adobe Stock

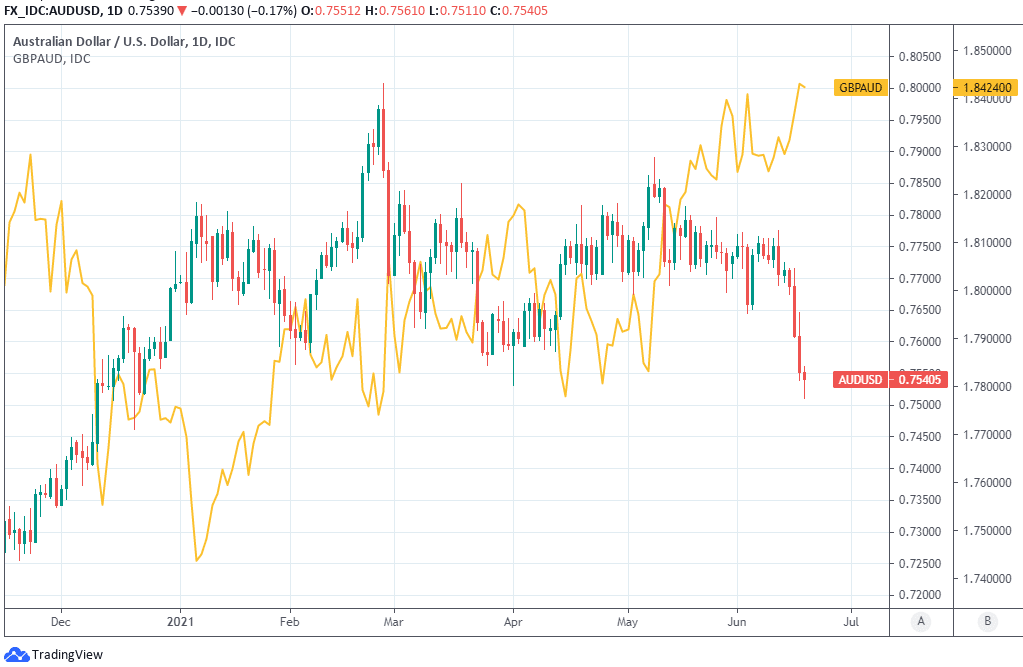

- GBP/AUD reference rates at publication:

- Spot: 1.8457

- Bank transfer rates (indicative guide): 1.7810-1.7940

- Money transfer specialist rates (indicative): 1.8290-1.8328

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Australian Dollar hit its lowest level for 2021 ahead of the weekend, supporting GBP/AUD near year-to-date highs in the process, although St George Bank has warned that an ongoing bounce in the U.S. Dollar could lead AUD/USD to fall as low as November 2020 levels.

U.S. Dollar exchange rates lifted further on Friday with the result being declines for most other currencies when measured against the greenback, although Australia’s commodity-sensitive Dollar was among those which shouldered much of the burden.

With AUD/USD one of the bigger fallers on the day the Pound-Australian Dollar rate was able to hold near to 2021 highs above 1.84, a level around which it could remain comfortable in the absence of any unforeseen trouble in the UK economy.

Sterling was lower by a fraction against many currencies on the day, potentially due to a surprise but only slight decline in May retail sales numbers which followed one of the strongest increases on record from the prior month, although the Pound remained one of the better performers for week.

Australia’s Dollar on the other hand remains more susceptible to the nascent bounce in the U.S. Dollar, which has tentatively undermined closely-connected commodity prices which had all risen by large double-digit percentages in recent months.

“Market expectations that the Fed could begin pulling back policy by early next year are contributing to a rise in the USD and selling in the AUD/USD,” says Besa Deda, chief economist at St George Bank in Sydney.

“It is likely to continue to face more downward pressure and could fall to 70 US cents before demand returns. Our forecasts for AUD/USD have been pared back to 0.8000 for the end of 2021,” Deda adds.

Above: AUD/USD rate shown at daily intervals alongside GBP/AUD.

The Dollar bounce reflects the market’s interpretation of this Wednesday’s Federal Reserve (Fed) policy decision, the highlight of which was a subtle and potentially-misinterpreted shift in the bank’s guidance for its monetary policy.

Wednesday’s update has given rise to much chatter about and emphasis of the Federal Open Market Committee’s so-called dot-plot of policymaker expectations for the Federal Funds interest rate range, which indicated that a majority of the bank’s rate setters now see current economic conditions as warranting an initial interest rate rise in 2023 rather than 2024.

This emphasis indicates however that some key parts of the message from Chairman Jerome Powell’s press conference may have gotten lost in either translation or transmission this Wednesday, and this could in turn mean that the nascent U.S. Dollar recovery is built on fragile foundations.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Rate increases are really not the focus of the committee. The focus of the committee is the current state of the economy but in terms of our tools, it’s about asset purchases, that’s what we’re thinking about. Lift-off is still very far into the future. We’re very far from maximum employment for example,” Powell told reporters.

“The near-term thing is really about the path of asset purchases and as I mentioned we had a discussion about that today and we expect to, at future meetings, continue to think about our progress,” Powell emphasised.

To the extent that the market has misinterpreted the Federal Reserve, it would imply that weakness AUD/USD and other Australian exchange rates is merely a short-term phenomenon, and even more so if the Reserve Bank of Australia (RBA) soon begins to stoke doubt or unease in the market about whether its own ‘dovish’ monetary policy will be sustained for much longer.

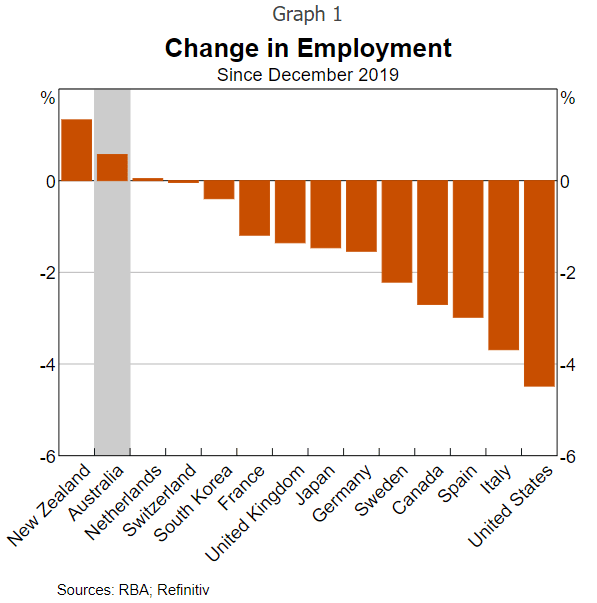

Above: Reserve Bank of Australia graph showing changes in employment across advanced economies.

“Today, the level of employment in Australia is above its pre-pandemic level. Australia and New Zealand are the only advanced economies where this is the case. In the United States, employment is still nearly 5 per cent below the pre-pandemic level and in Spain it is 3 percent below,” says Philip Lowe, Governor of the RBA, in a Thursday address at the Australian Farm Institute Conference.

Australia’s Dollar was handicapped on Friday by strength in the U.S. Dollar and weakness in commodity prices, although it’s been a laggard among major currencies through much of the second quarter and largely due to a host of RBA policies, which are aimed at reviving a long-inadequate inflation pulse.

Governor Lowe noted in Thursday’s address that this more-than decade long battle against lacklustre consumer price pressures has roots in workers’ wage packets which have also long been “less responsive to economic conditions” than they need to be in order to sustainably deliver the bank’s target of 2%-to-3% inflation over the medium-term.

There was welcome news on that front at least for Australian policymakers this week however, when the Australian Bureau of Statistics (ABS) reported that employment had returned pre-pandemic levels in May and the unemployment rate having fallen near to historic lows.

“There are a range of factors that are contributing to limited upward pressure on wages, even in tight labour markets. I have previously talked about the effects of globalisation, technology and industrial relations arrangements. While there is always a degree of uncertainty about the future, we are not expecting the influence of these various factors to wane quickly,” Governor Lowe warned in his address.