We're Cautiously Optimistic on Australian Dollar says BNY Mellon

- Near-term weakness in AUD predicted by BNY Mellon

- Chinese demand for Aussie exports could ease near-term

- But longer-term AUD to be well supported

Image © Adobe Images

The Australian Dollar is being tipped to undergo some near-term weakness by foreign exchange analysts at investment bank BNY Mellon, but they tell clients they remain optimistic on the currency's chances of appreciation over coming months.

The call by the Wall Street-based bank comes following the soft start to 2021 for the Aussie currency which was the second-best performing major currency of 2020 thanks to a strong run in the second half of the year.

"Despite a mixed start, we remain cautiously optimistic on AUD," says Geoff Yu, Senior EMEA Market Strategist at BNY Mellon.

The Australian Dollar has fallen half a percent against the Pound in 2021 but has risen by half a percent against the Dollar and 1.30% against the Euro.

"The AUD has so far failed to extend its strong end-2020 performance into 2021. A wobbly start to the year in Asia, in addition to hopes of an earlier than expected shift in the US recovery expectations, has undermined the external story," says Yu.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound-to-Australian dollar exchange rate fell sharply in the first three days of 2021 but then rose steadily through January before topping out at 1.8023 in early February, from where the Australian Dollar has clawed back some losses to push the rate back to 1.7844.

The Australian Dollar-to-U.S. Dollar exchange rate meanwhile rallied strongly in the latter part of 2020 but has since consolidated, thanks in a large part to renewed bouts of U.S. Dollar strength that has caught many foreign exchange investors and analysts by surprise.

However, against the Euro the Australian Dollar is looking more constructive with the rally of 2020 extending into 2021 and EUR/AUD is back towards the key downside support level of 1.56 as a result.

Analysts are expecting this mixed performance to persist over the near-term.

"In the short term, headwinds may persist for the AUD but we continue to see a robust medium-term fundamental picture. Poor vaccination rates in the Asia-Pacific regions have dashed hopes for stronger and sustained normalisation in the region and will likely result in shut borders for longer than previously expected," says Yu.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Australian Dollar has been a key beneficiary of the so-called reflation trade that dominated the second half of 2020. This saw investors snap up stocks and commodities in anticipation of a strong vaccine-lead economic rebound in 2021, which aided investor sentiment and the Australian Dollar by extension.

Analysts we follow say that the Australian Dollar's reliance on this positive risk environment will likely be maintained, therefore a key risk to the currency is that markets retrace on fears of a slow vaccine rollout or due to complications emerging from mutated forms of the covid-19 virus.

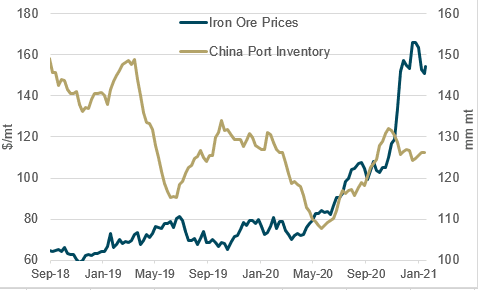

China has meanwhile been an engine of demand for Australian exports, particularly raw materials, of which iron ore is the mainstay.

BNY Mellon say a potential external risk to the Australian Dollar in 2021 is China’s domestic demand picture, which has direct implications for Australian exports.

A deterioration in political relations between Canberra and Beijing also risk spilling over into deteriorating commodities trade, "but behind the scenes the mutual dependency is still strong," says Yu.

He adds the Australian Dollar is currently more exposed to changes in China’s monetary policy, especially on real estate.

"Chinese policymakers are extremely concerned about a property bubble and are tightening that market explicitly through macroprudential measures, with some domestic banks now been forced into outright deleveraging for breaching newly-imposed real estate lending caps," says Yu.

Any slowdown in Chinese construction could have a meaningful impact on iron ore prices, which would matter for Australian Dollar valuations.

We have noted of late how the Australian Dollar is proving highly responsive with moves in iron ore prices.

The below chart shows bulk iron ore prices in China (orange) - the majority of which arrives from Australia - against the Australian Dollar vs. Pound Sterling exchange rate (the inverse of the GBP/AUD):

As can be seen, the Australian Dollar rises against the Pound when iron ore prices are rising, but falls when the opposite is true.

Near-term iron ore dynamics are worth watching says Yu who notes iron prices may have eased from the highs given Chinese ore inventory is well above the lows from last summer "which propelled the iron ore price surge and Australia’s export prices".

Image courtesy of BNY Mellon

"China is unlikely to tolerate a major collapse in housing-related fixed asset investment growth either, not least because growth is so scarce in other sectors," says Yu.

"As such, barring major Chinese policy error, we expect Australian export prices to gradually stabilize but at not too low a level, and certainly not enough to turn around the structural improvement in Australia’s balance of payments," he adds.

The domestic picture is also deemed supportive of Aussie Dollar valuations going forward, with BNY Mellon not expecting the RBA to ease policy again.

The rule of thumb is that a currency tends to fall when its issuing central bank cuts interest rates or boosts quantitative easing. The RBA boosted quantitative easing at their February meeting but the negative impact on the Aussie Dollar has been minimal.

If the risks of further action is removed then it can be assumed this channel could start to become supportive of the currency going forward.

"Fundamentally the Australian economy is well-positioned to heal and the AUD will gradually reflect that," says Yu.

The recent consolidation in Aussie exchange rates could meanwhile allow the market to reposition itself for another bout of strength.

BNY Mellon note flow data is supportive of the market rebuilding "long" positions on the Aussie Dollar, confirming positioning on the currency is now more supportive to a resumption of the gains witnessed during 2020.