Second Interest Rate Rise at BoE in 2018 Unlikely: Bank of America Merrill Lynch

Bank of England Monetary Policy Committee © Elif Miotti

Economists at Bank of America Merrill Lynch Global Research believe that the UK data pulse seen over recent months suggests the Bank of England is unlikely to deliver two interest rate rises in 2018.

A number of economists have seen a second interest rate rise as being likely in November, a scenario they believed to be supportive of a stronger Sterling. Some economists even warned that 2018 might deliver three interest rate rises.

It appears though that data released this week has dented the market's belief that a second interest rate rise might occur in 2018 and have therefore kicked expectations for the move into 2019. This is most evident in the Pound exchange rate complex which has retreated in the wake of this week's trio of employment, inflation and retail sales data.

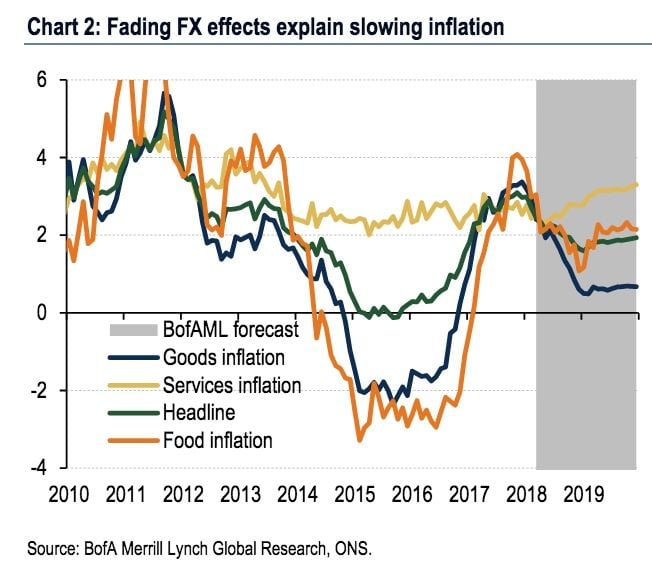

Just two months ago the BoE saw serious risks of inflation rising back above 3%. Rate setter Ian McCafferty last week said risks were skewed towards inflation exceeding the BoE's forecast of 2.4% inflation at year end.

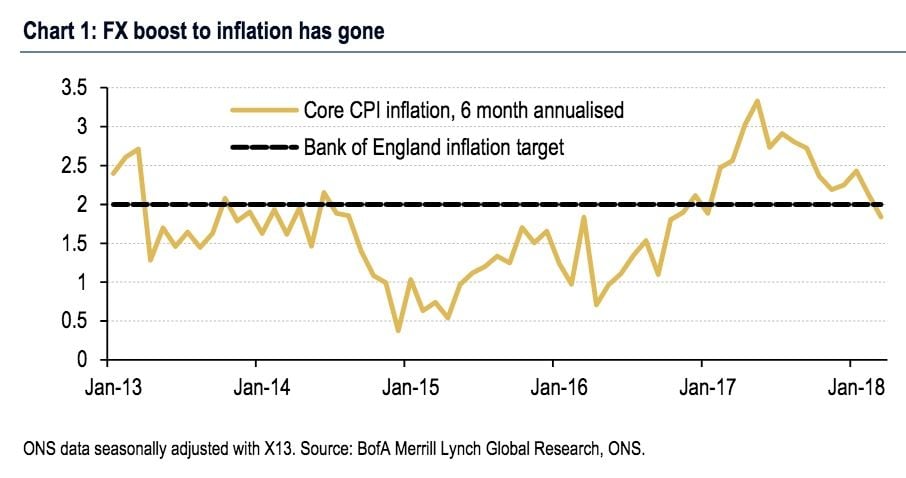

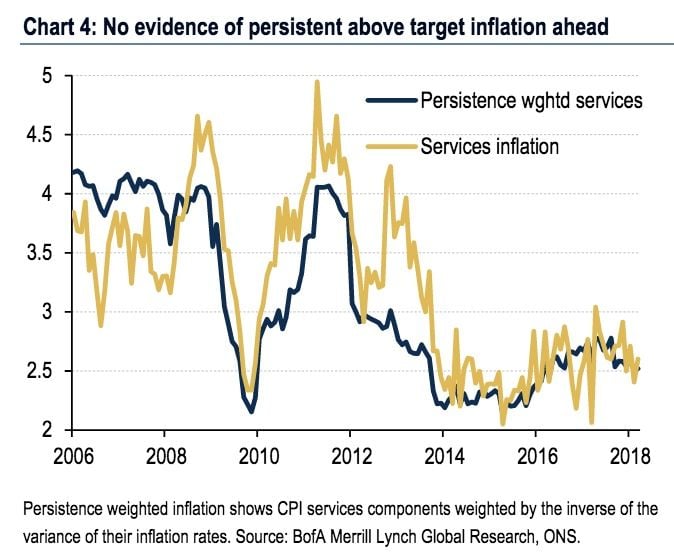

"Inflation sits 30bp below the BoE's forecast, inflation is annualising 20bp below their target, and wage growth seems to be topping out. We don't think today's data change the probability of a May hike," says Robert Wood, UK Economist with BofAML.

"But a second hike in 2018 looks unlikely to us," adds Wood.

It seems to the economist the BoE will be approaching the inflation target from below rather than above, that suggests running the economy slightly hotter than they previously planned and therefore slowing rate hikes.

Samuel Tombs, an economist at Pantheon Macroeconomics has declined to join the consensus view that the Bank of England will raise rates this May, saying it would instead opt to see whether the recent run of lacklustre economic releases are temporary.

"Inflation has undershot the MPC’s forecast, 2.8%, again, suggesting that investors have concluded too hastily that a May rate hike is a done deal. The boost to inflation from sterling’s depreciation is fading much more swiftly than the Committee anticipated," says Tombs. "The MPC likely will conclude that it needs to increase Bank Rate by 0.25% only once this year."

Separate analysis from BofAML does however suggest that the Bank of England is one central bank that has a substantial amount of interest rate lifting to cary out if it is to normalise monetary settings in the UK.

Interest rates at incredibly low levels by historic standards, combined with the quantitative easing programme initiated after the financial crisis, leaves an abundance of cheap money washing around the UK financial system.

This can be dangerous if left for too long as it can tend to lead to asset price bubbles.

"Our results suggest that global monetary policies remain very loose, despite hikes/less loosening; the BoE and Riksbank are the two G10 central banks with, by far, the loosest monetary policies and therefore the most room to tighten," says BofAML FX Strategist Athanasios Vamvakidis.

Nevertheless, with the UK data pulse apparently starting to fade, it will take a sharp improvement in activity over coming months to convince the Bank of England that it needs to speed up the pace at which it raises interest rates.