Shaking Off Brexit Fears: UK Consumers and Businesses Perking Up Show GfK, Lloyds Bank Surveys

- "Spring is in the air" for UK consumers say GfK

- More companies anticipate raising pay for workers

- Survey data hints at robust second quarter

© photobuay, Adobe Stock

UK sentiment readings released at the head of a new month continue point to a resilient UK economy that is likely to pick up some steam heading into the second quarter with surveyors saying caution linked to Brexit uncertainty appears to be receding.

The GfK consumer confidence index improved to -7 in March, while the Lloyds Business Barometer held up at 32 and reported firms were intending to raise pay rates.

GfK’s long-running Consumer Confidence Index increased three points in March 2018 with all five of the constituent measures recorded higher values.

The Overall Index Score in March 2018 is -7, this is better than the -10 forecast by analysts, and an improvement on the -10 recorded in the previous month.

Should consumers become more confident we would expect a positive knock-on effect in the retail sector and wider consumer sector in the UK economy, which bodes for improved economic growth rates in the second quarter of the year.

The improvement in confidence comes despite inclement weather which saw "the Beast from the East" send temperatures plummeting and consumers staying away from the shops.

But "spring is in the air with increases across the board on personal finances, the general economy – over the last year and next year – and on current major purchase intentions," says Joe Staton, Head of Experience Innovation UK at GfK.

GfK say the prospect of wage rises finally outstripping declining inflation, high levels of employment with low-level interest rates, and some movement on the Brexit front appear to have boosted confidence.

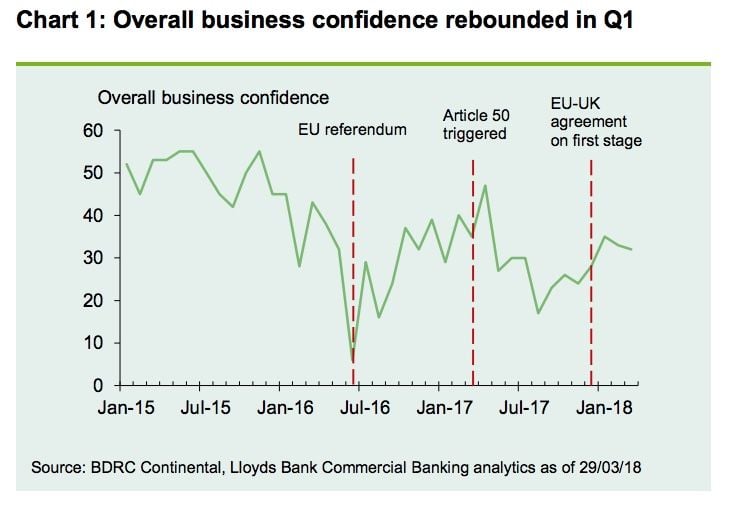

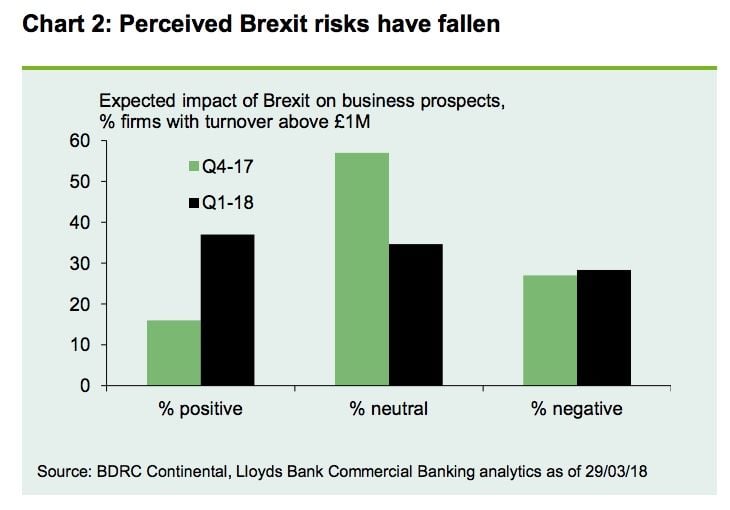

Improved sentiment towards Brexit has also been recorded by the Lloyds Bank Business Barometer which measures business confidence.

The Business Barometer report for March shows "companies were less concerned (or more positive) about the impact of Brexit for their business activity following the December agreement on the first round of negotiations," says Hann-Ju Ho, Senior Economist with Lloyds Bank.

Overall business confidence – an average of firms’ own business prospects and their optimism regarding the economy – fell by 1 point in March to 32%.

Business prospects increased by 1 point to 36%, while economic optimism fell by 3 points to 28%.

But for Q1 as a whole, overall confidence averaged 33%, compared with 26% in Q4 2017.

Lloyds report the improvement over the quarter was led by the increase in economic optimism which, despite the fall in March, jumped to 30% in Q1 from 8% in the prior quarter.

There is good news on the wages front too with the net balance of companies anticipating an increase in their staffing levels increased in March to 27% from 25% in February.

Overall, 44% of companies said that they expect to add to headcount, while 17% plan a reduction.

If the survey is correct and wages do increase over coming months then the case for higher interest rates at the Bank of England becomes further entrenched, particularly as the Bank forecasts wages to rise steadily to 3%.

And higher interest rates make for a stronger Pound Sterling.