Current Account Deficit at Lowest since 2011 on Strong Investment Flows

- Written by: James Skinner

- UK current account deficit at lowest since 2011.

- Lower government transfers, more investment aid deficit lower.

- Trade data disappoints after imports rise faster than exports.

© Winterbilder, Adobe Stock

The UK’s notorious current account deficit narrowed faster than was expected during the final quarter of 2017, according to Office for National Statistics figures released Thursday, while business investment grew by more than was anticipated.

The deficit, which measures changes in the amount of money flowing into and out of the UK as well as changes in British borrowing from the rest of the world, fell to -£18.4 billion during the three months to the end of December when economists had expected it to rise fro -£22.8 billion to -£24 billion.

Office for National Statistics staff cited lower contributions to the European Union budget, rising earnings from investments abroad and higher levels of foreign direct investment into the UK as being behind the lower deficit.

UK nationals earned £23 billion on their investments abroad during the fourth quarter of 2017, which is close to levels not seen since 2012 and marks a continuation of an uptrend that began in the first quarter of 2016.

"The value of earnings on inward FDI (debits) has seen a slight decline in the last two quarters of 2017, falling from £16.7 billion in Quarter 2 (Apr to June) 2017 to £15.5 billion in Quarter 4 2017," the ONS says.

However, this marks the first time since before the financial crisis that inbound foreign direct investment has been above £15 billion for three consecutive quarters, something the ONS attributes to foreign companies buying up UK companies.

Above: Inbound (Yellow) and outbound (Blue) foreign direct investment flows.

As a result, the UK current account deficit was -£82.9 billion, or 4.1% of GDP, for the 2017 year overall. This is the smallest current account deficit since 2011 when the mismatch was equal 2.4% of economic output.

"The current account deficit looks significantly healthier, following revisions to the investment income data. The deficit in investment income now is estimated to have shrunk to average £8.1B in 2017, from £12.3B in 2016; previous data showed the deficit averaging £10.7B in the first three quarters of 2017. The smaller current account deficit also is being financed by a steady flow of finance from overseas," says Samuel Tombs, Chief UK Economist with Pantheon Economics.

Currency markets and economists care about this number because it can paint a telling picture of international demand for the Pound.

"Direct investment in the U.K. rose by £8.7B in Q4 and it has been positive in every quarter since the referendum, suggesting that Sterling’s depreciation has provided overseas investors with enough compensation for the risks posed by Brexit," says Tombs.

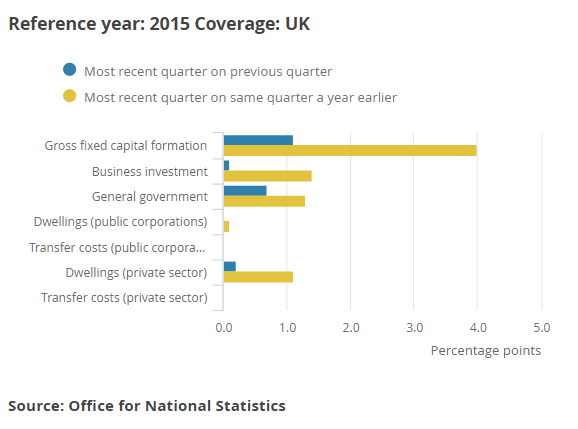

Separately, business investment was shown rising faster than previously thought, at a rate of 0.3% during the second quarter and by 2.6% for the year overall.

The ONS previously said business investment was unchanged, with nil growth, for the fourth quarter. Moreover, total capital expenditure from both the public and private sectors rose by 1.1% in the final months of the year and by 4% for 2017 as a whole, marking the fastest pace of growth among all G7 economies.

Above: ONS graphs detailing contributions to gross fixed capital formation.

However, and on the downside, the post-referendum devaluation of Pound Sterling is yet to deliver a meaningful benefit to UK trade statistics.

This is because, for all of the recent growth seen in the manufacturing sector, imports into the UK are still rising faster than exports. Though this mismatch appears to be the result of an increase the amount of money Britons are spending to import oil. Oil rose some 50% between June 2017 and the end of March 2018.

"The widening in the trade in goods deficit was due to imports increasing by £1.1 billion, along with a fall in exports of £1.8 billion," the ONS says in its announcement. "Imports of goods increased to a record £121.5 billion in Quarter 4 2017; of which, imports of oil increased by £0.9 billion, imports of other fuels increased by £0.4 billion and imports of unspecified goods increased by £0.4 billion."

Above: UK trade in services surplus (Yellow) set against the trade in goods deficit (Blue).

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.