If Geopolitical Tensions Lead to War and Reunification What Will Happen to the Korean Won?

The increasing geopolitical tension between North Korea and the West will probably find a resolution in a battle for reunification, according to RBC Economics's Sue Trinh.

Such a reunification – probably by the South of the North - would probably lead to a rise in the Korean Won according to analysts at RBC Capital Markets.

In such a scenario demand would increase for more infrastructure and public spending in North Korea (NK) to bring it up to the standards of the South, as was the case when Germany reunified.

This would lead to a rapid rise in repatriation flows as well as outside investment, seeking to access virgin territory in NK to take advantage of its growth potential.

These flows back into unified Korea would strengthen the Korean Won.

Sabre-Rattling

Geopolitical tensions reached a new high on July 4 when head of the NK state Kim Yong Un sent a ‘gift’ to the United States on the day of its birthday.

The gift was not a usual state offering but was in fact an ironic attribution to what was, in the end, a display of military strength designed to provoke the US.

The gift was a test of NK’s first Intercontinental Nuclear Missile.

The fact that the country now has intercontinental strike capacity increases significantly its risk potential, and the continued exchange of threats between NK and the US seem to be leading inevitably to a final showdown.

According to analysts at RBC Capital Markets the showdown will most probably result in reunification of the whole of the Korea.

With few friends on the international stage apart from China, which is itself unreliable as it has, at times cut NK adrift, such as in a recent coal embargo, NK looks extremely isolated and vulnerable.

Despite having nuclear potential, the possibility of a war, revolution or some other tinder-stick event leading to a final conflict cannot be ignored.

In such a situation, the most likely outcome would be for the South and its allies to conquer NK and reunify Korea.

Impact of Similar Events on FX

By drawing on similar events in the past RBC build a thesis of what could happen in Korea.

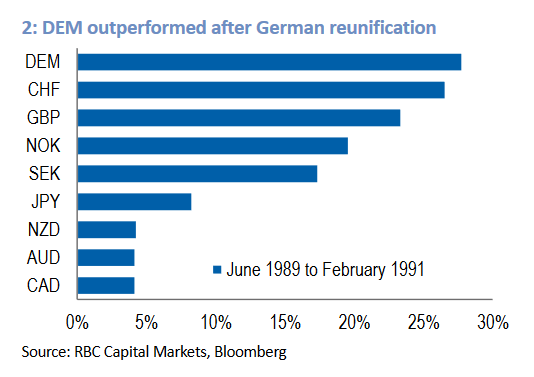

The most obvious example is German reunification in 1990.

German reunification led to a substantial rise in the Deutsch Mark.

“Reunification led to an economic boom fueled by strong domestic demand,” said RBC’s Sue Trinh.

The currency was the best performing over the period of German reunification, that is from June 1989 to February 1991.

This came despite the fall in the Current Account surplus West Germany had enjoyed up until then and the Bundesbank keeping monetary policy highly accommodative – two factors which should have weakened the Mark, but didn’t.

Japanese and New Zealand Earthquakes

Assuming there is a war leading to reunification and even if there is not, the likelihood is that the North of Korea will require substantial inwards investment to bring it up to the level of modern South Korea (SK).

The scenario is in some ways comparable to the rebuilding work which is required after a natural disaster, such as happened in Japan and New Zealand after their recent major earthquakes.

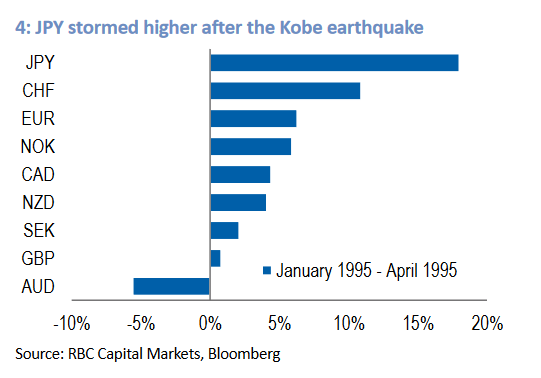

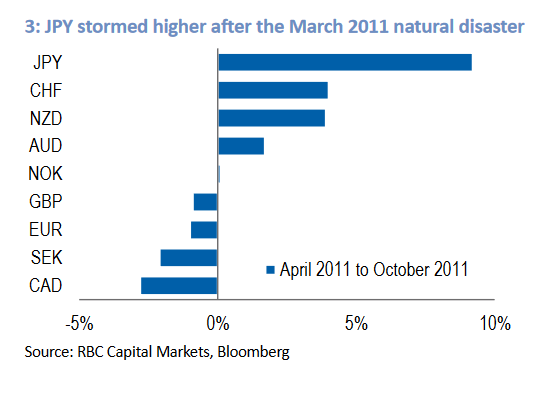

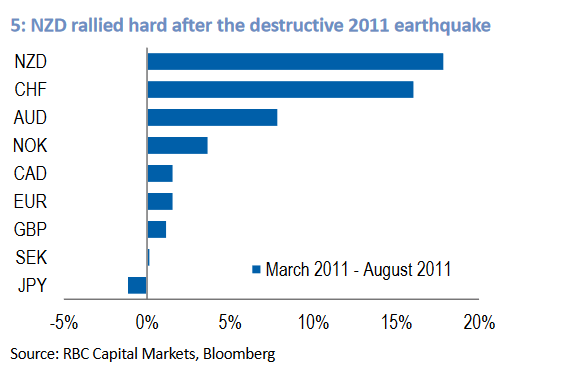

In both countries, investors were somewhat surprised to see their currencies rise following the news of the disasters as common sense would suggest a different reaction, however, in the last two Japanese earthquakes in Tohoku (including Tsunami) and Kobe the Yen outperformed all other major currencies around the time of the disaster.

The explanation is that the demand for infrastructure investment to renovate the damaged areas led to Japanese investors repatriating their money up to then invested in risky foreign assets back into Japan, thereby increasing demand for the yen.

The same was the case when Christchurch needed rebuilding after the earthquake in 2011.

Korean FX Pairs and Reunification

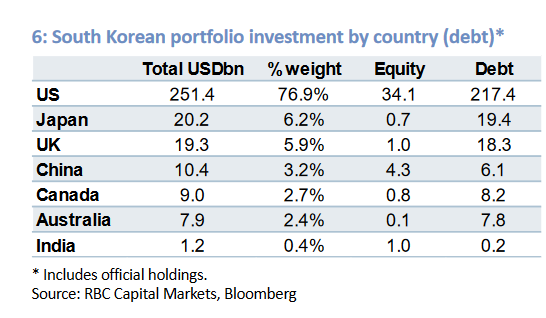

If the hypothesis that Korean union will lead to a repatriation of investment back into Korea – where will the money come from, ie where is it invested now, and how will that impact on specific FX pairs?

The majority of Korean portfolio investments, that is over 85%, are in three main countries, the US (76%), Japan (6%) and the UK (6%), therefore when the repatriation effect takes place the money will mostly come from these countries.

From an FX perspective, this sets up a distinct flow within three separate pairs USD/KRW, JPY/KRW and GBP/KRW.

With the flows predominantly out of the foreign currency and back into Korea, these three currencies are the one most at risk of weakening to the Won, and we would expect downside in the above three pairs.