Global Slowdown Coming say Saxo: What it Means for the GBP, EUR, USD and JPY

The global economy is vulnerable to a slowdown in the third quarter as central banks start to reign in credit, according to Saxo Bank’s Steen Jackobsen.

This is likely to reduce investor appetite for riskier assets and improve the performance of safe-havens.

In such an environment, the Japanese Yen would be expected to outperform on the FX stage, the Dollar might also perform well due to its safe-haven credentials, the Euro might garner uplift from repatriation flows and gold could start a new uptrend.

Global Credit to Tighten in Q3

Central Bank officials may be sounding more confident but this is not likely to last because as they raise interest rates and tighten monetary stimulus economies will experience ‘cold turkey’.

“The basic premise in economic and monetary policy since the low of 2008 has been credit expansion, i.e. increasing the amount of credit to help the economy recover. What was once help, however, has now become an addiction – so much so, in fact, that stopping the flow of credit will lead to a serious hangover,” said Saxo’s Jakobsen.

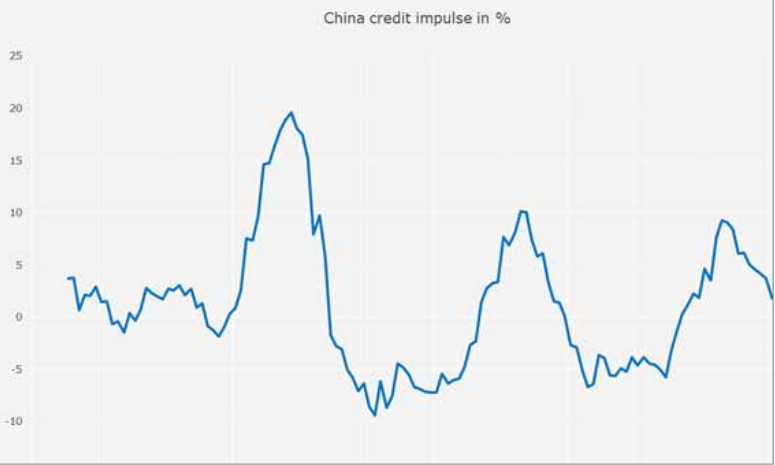

The reason for the Q3 slowdown is a fading ‘Credit Impulse’, according to Jackobsen.

The credit impulse is an economic term which describes the “net change in credit divided into the GDP.”

The reason why Jacobsen is sceptical about the current hawkish commentary coming from central banks, is because the credit impulse leads the economy by a long lag of nine months and suggests a slowdown in Q3.

The credit impulse hit a low in January 2017 and is therefore, taking into account the ‘lag’ is likely to impact on the economy in the Autumn.

A major impact on the global economy is China which contributes 33% of new growth to the globe.

It is in China where the contraction in the availability of credit is likely to impact the most, because it was China which was the greatest user of credit when it was available.

The chart below illustrates the outsized use of credit by China (red).

“This chart illustrates two key things about credit; the left chart shows the massive build-up in credit led by China (and emerging markets) while the right-hand one shows how the net change of credit flow has moved from 3% of GDP to close to minus 1%!” Said Jackobsen.

How Will the Fading Credit Impulse Impact on Foreign Exchange?

Saxo’s dark vision of a global recession in Q3 linked to a drying up of the supply of credit is likely to lead to a fall in demand for risky assets and a move back to safety.

In the FX universe, this means increased demand for the Swiss Franc, the Yen, possibly the Euro and also possibly the Dollar.

“The predominant risk lies toward increasing volatility, a development that would likely support the struggling US dollar at the margin as a safe haven and dampen enthusiasm for emerging-market and the smaller developed market currencies,” said Saxo’s FX analyst John J Hardy.

USD

The US Dollar may experience some weakness in the short-term as it continues to disengage value from the unfulfilled promise of the Trump trade, however, it will probably be supported heading into Q3 by safety demand when the recession bites.

Investors wishing to profit from trading the US Dollar as a safety play, however, should be aware of certain provisos regarding its expected appreciation in Q3.

Firstly, there is a risk the Dollar could fall if the US hits its debt ceiling again, as this would further restrain fiscal stimulus.

Secondary, the start of a global recession in Q3 might put a brake on the Federal Reserve’s hawkish rate hike intentions.

“There is some risk that a showdown over the US budget ceiling in late Q3 could keep the pressure on the greenback, but there is also the question about the Fed’s intentions and whether a less-accommodative-than-expected Fed in Q3 and beyond is a distinct risk,” said Hardy.

EUR

Saxo’s Hardy sees the Euro probably stalling in Q3, mainly because the growth story which has so benefited it does not “dovetail” with the recessionary Q3 vibe.

“As for Q3, euro upside may fizzle when market volatility picks up, partly because much of the enthusiasm for the single currency has been built on a positive story, and our more negative themes for the quarter don’t dovetail with that.”

It may also be time for a pull-back since, “Euro buying, euro sentiment and speculative positioning are already now getting stretched,” says Hardy, who concludes that:

“EURUSD may manage a serious test of the 1.1500, plus resistance in EURUSD that defined the resistance in 2015-16, but we don’t look for a major extension.”

JPY

The outlook for the Yen is broadly positive, given its status as a safe haven, and the habit of Japanese savers repatriating assets where global growth fears persist.

“If inflation stays low and global growth becomes a concern as in our base-case scenario, persistently low bond yields are likely to drive the JPY stronger as the legendary Japanese savers repatriate assets and foreigners lift their Nikkei hedges as it drops,” said Hardy.

GBP

The Pound has many headwinds and uncertainties tied both to the outcome of Brexit negotiations and the worsening economy, so Saxo see upside limited for it when the world takes a nosedive in Q3.

The one light at the end of the tunnel for the analyst is the possibility of another referendum on the negotiated Brexit deal at the end of the process, which could lead to a “Bremain”.

G10 Smalls

The outlook for the G10 ‘Smalls’ which includes AUD, NZD, CAD and the Swedish and Norwegian crowns, is not positive, especially for those with “over-leveraged private debt sectors” such as Australia, New Zealand and Canada.

The tightening of credit conditions in Q3 could hit the ‘sub-prime’ markets in Canada and the antipodes especially.

A fall in demand from China will also hit Aussie and Kiwi exports, which rely heavily on demand from China.

Emerging Markets

The so called ‘Goldilocks Trade’ which combines low inflation and a softer US Dollar is supporting the emerging markets (EMs).

This is because many emerging market countries borrow, trade or are in some way reliant to a high degree on the US Dollar.

If USD rises it increases their costs and can become a considerable burden to profitability, therefore, the subdued USD is helpful.

However, the global recession sparked by a credit crisis in China is likely to reduce risk taking and therefore demand to emerging market assets, which will reduce demand for their currencies too.

The new normal low in the oil market which appears to be in the 40 dollars per barrel mark will hit oil orientated EM’s such as the Rouble.

“EM currencies face the greatest risk of downside in Q3 in our scenario, whether from a growth slowdown and a backup in global risk spreads, from a more hawkish Fed, or both,” concludes Hardy.