Economists at Lloyds Gloomy on UK Economic Outlook

The UK economy will see its growth rate fall below its longer-term trend over coming months warns analyst Nikes Sawjani at Lloyds Bank.

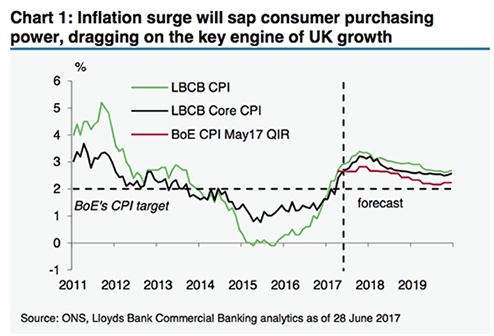

Much of an expected slowdown in UK economic activity will be due to rising inflation which is forecast to breach 3% and surge well beyond the 2.8% peak envisaged by the Bank of England in their most recent projections.

The UK economy is heavily reliant on domestic demand and when the consumer closes their wallet impetus behind the economy tends to fade.

Lloyds warn that a squeeze on consumer purchasing power following Sterling’s post-referendum drop is likely to continue as inflation rises.

This call comes despite the Pound having stabilised and risen against the Dollar through the course of 2017 which suggests imported prices pressures might start easing.

The fall in the Pound is meanwhile not seen offering UK exporters a boost big enough to offset slowing domestic consumption.

Meanwhile, “higher prices of capital goods will act as a deterrent to investment spending,” says Sawjani.

However we heard a more upbeat assessment from Bank of England Governor Mark Carney at an appearance in Portugal mid-week where he said he believes UK businesses are likely to dig into their vast reserves of capital in order to invest.

"The strengthening global economy should tempt them to do so, particularly since UK companies are generally competitive given the fall in Sterling,” says Carney.

The more optimistic tone at the Bank of England provides a notable contrast to that held by one of the UK’s largest high-street banks.

Indeed, Lloyds appear to have little confidence in the Bank of England’s projections and assumptions.

Compared with the BoE’s May projections – where CPI peaks at 2.8% in 2017 Q4 – Lloyds projected an overshoot in inflation by a much higher at 3.4%.

“Inflation is expected to push sharply higher over the course of 2017. While non-energy import costs – including food – will henceforth be the dominant driver, hikes in domestic gas and electricity tariffs will also play a part,” says Sawjani.

However, we would also point out that global oil prices have been coming down of late and the fall in costs at the petrol pump will offer some welcome respite to the UK consumer.

This dynamic also questions the extent of much of the negativity at Lloyds.

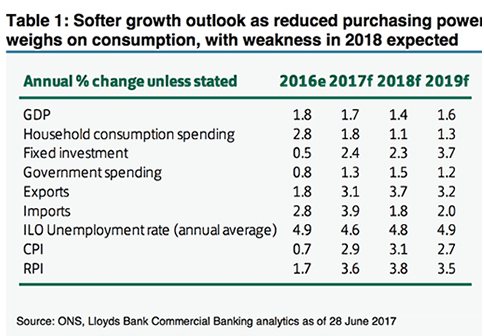

Nevertheless, the UK should see notably softer economic growth in the opinion of analysts:

“As prices rise and the resilience of recent growth momentum fades, we expect GDP growth in calendar year 2018 to ease back to 1.4%, below our estimate of trend,” says Sawjani.

However, 2017 should not be too bad with available data for Q2 so far pointing to some recovery in economic momentum, with the PMIs for April and May all pointing to a modest acceleration in growth in Q2.

Assuming the strength of the surveys is reflected in the hard data, a 0.4%q/q growth pace in Q2 would still set up calendar year growth of 1.7% in 2017 as a whole.

That pace would be only a touch slower than both the 1.8% recorded for 2016 and the 1.9% in the Bank of England’s May Inflation Report.