UK Consumer Slowdown Shouldn’t be too Severe

- Written by: Gary Howes

Has UK borrowing hit a sweet-spot?

Fresh data from the Bank of England shows UK consumers continue to borrow money at levels that should continue to support the economy while not worrying policy-makers that they are overextending themselves.

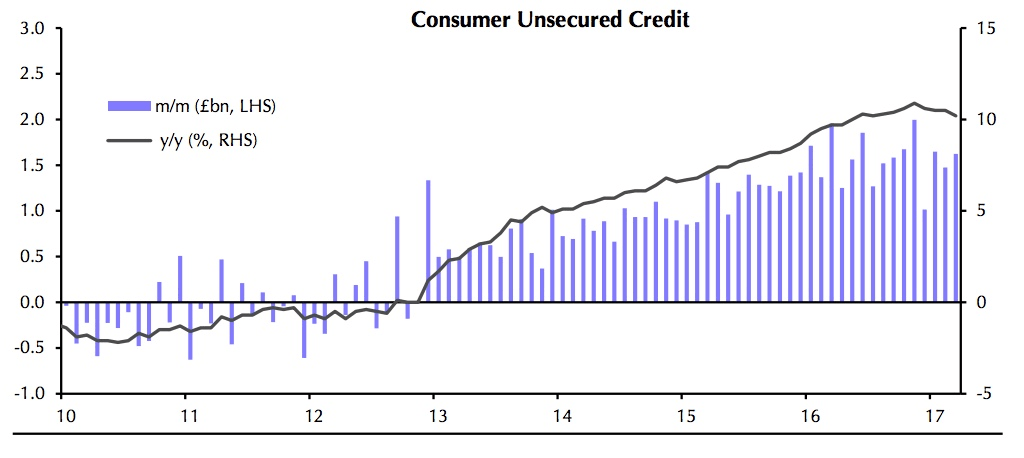

March’s household borrowing figures showed a £1.6bn monthly rise in consumer credit in March, economists forecast a £1.3bn increase.

Last month saw a rise of £1.5bn.

But annualise growth in credit slowed from 10.5% in February to 10.2% in March.

This will have implications for the UK economy that relies heavily on consumer confidence and their spending ability.

“March’s household borrowing figures provide another reason to think that the consumer slowdown shouldn’t be too severe. Moreover, continued strong credit growth shouldn’t panic policymakers into tightening either monetary or macroprudential policy imminently,” says Paul Hollingsworth at Capital Economics.

There may be some temporary factors at play.

We know that car registrations were boosted significantly in March ahead of the change in Vehicle Excise Duty, so some of this increase could be related to car finance.

However, note that credit card lending has held up relatively well too.

But is there a risk that too much borrowing could prove destabilising, particularly as the ratio of unsecured debt to disposable income has risen significantly recently?

“Of course, policymakers will be concerned about unsecured credit growing too quickly,” says Hollingsworth. “Given that the Bank of England is forecasting the saving ratio to fall a bit, it is expecting borrowing to continue to rise fairly robustly. In any case, annual growth in credit slowed from 10.5% in February to 10.2% in March, so the latest figures shouldn’t cause too much additional concern for policymakers.”

Meanwhile, the same data reveals mortgage approvals for new house purchase fell back from (a downwardly revised) 67,936 in February to 66,837 in March.

This was the second consecutive monthly fall, and the weakest monthly outturn since September last year.