Britain's Shop Prices Are Finally Falling

- Written by: Sam Coventry

Image © Pound Sterling Live

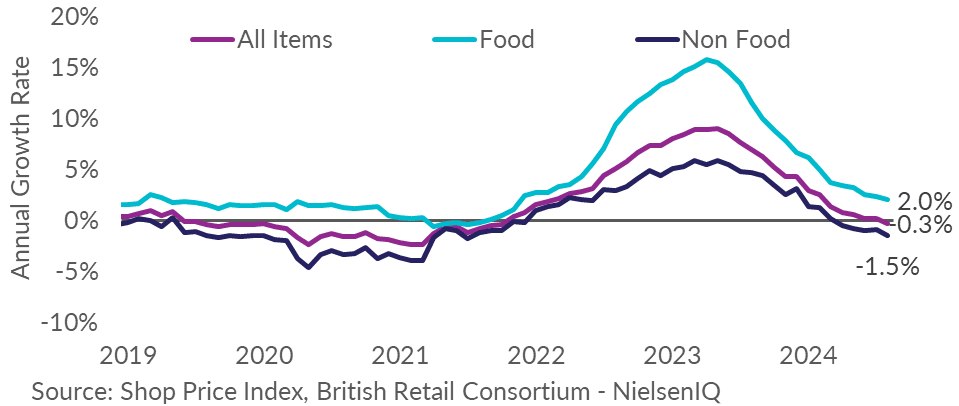

Falling prices are now a reality for UK shoppers, with new data showing deflation in Britain's high street stores.

The British Retail Consortium said its measure of shop price changes revealed prices fell 0.3% in August, down from +0.2% in July.

This is below the 3-month average rate of 0.0%, and shop price annual growth has remained at its lowest rate since October 2021.

Inflation has been falling since 2023, but this means the pace of increase has merely been slowing. Outright price declines offer relief for shoppers as the absolute level of goods caused by a period of extraordinary inflation can start to come down and bolster purchasing power.

"Shop prices fell into deflation for the first time in nearly three years," says Helen Dickinson, Chief Executive of the BRC. "This was driven by non-food deflation, with retailers discounting heavily to shift their summer stock, particularly for fashion and household goods."

Non-Food remained in deflation at -1.5% in August, further down from -0.9% in the preceding month. This is below the 3-month average rate of -1.1%.

Overall, inflation is at its lowest rate since July 2021.

According to the BRC, food inflation slowed to 2.0% in August, down from 2.3% in July, taking it below the 3-month average rate of 2.%. The annual rate continues to ease in this category and inflation is at its lowest rate since November 2021.

Fresh Food inflation slowed further in August, to 1.0%, down from 1.4% in July. This is below the 3-month average rate of 1.3%.

"This discounting followed a difficult summer of trading caused by poor weather and the continued cost of living crunch impacting many families. Food inflation eased with fresh food prices, especially fruit, meat and fish, seeing the biggest monthly decrease since December 2020 as supplier input costs lessened,” says Dickinson.

Looking ahead, she says retailers will continue to work hard to keep prices down, and households will be happy to see that prices of some goods have fallen into deflation.

"The outlook for commodity prices remains uncertain due to the impact of climate change on harvests domestically and globally, as well as rising geopolitical tensions. As a result, we could see renewed inflationary pressures over the next year."