UK Business Confidence Bounces Back to 8-year High

- Written by: Gary Howes

Image © Adobe Images

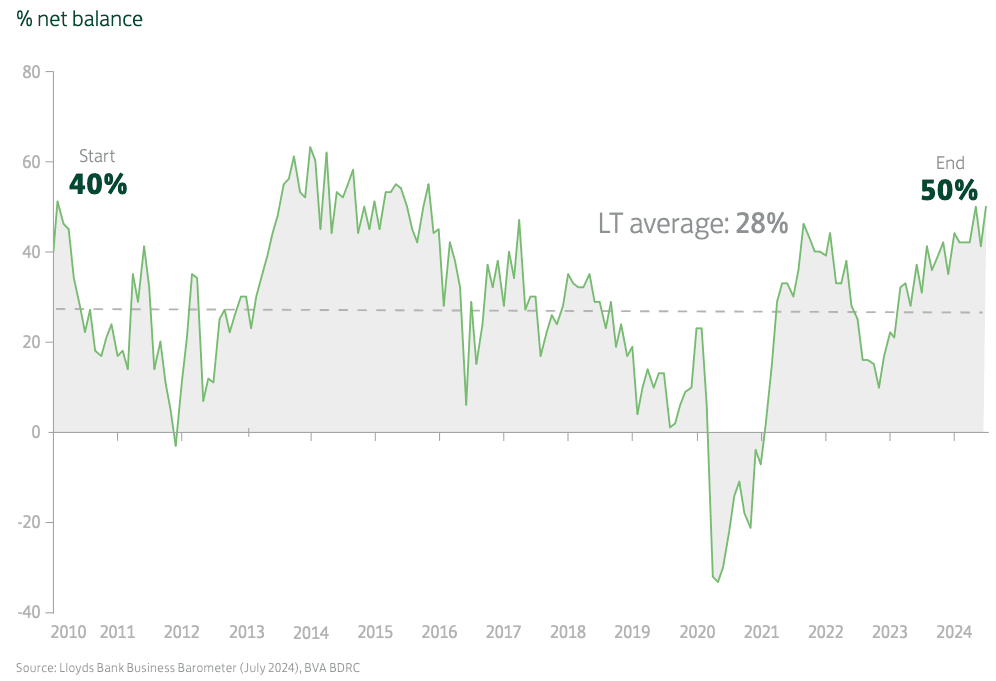

UK business confidence rallied by 9 points to 50% in July, reversing June’s drop and matching May’s eight-year high, according to the Lloyds Bank Business Barometer.

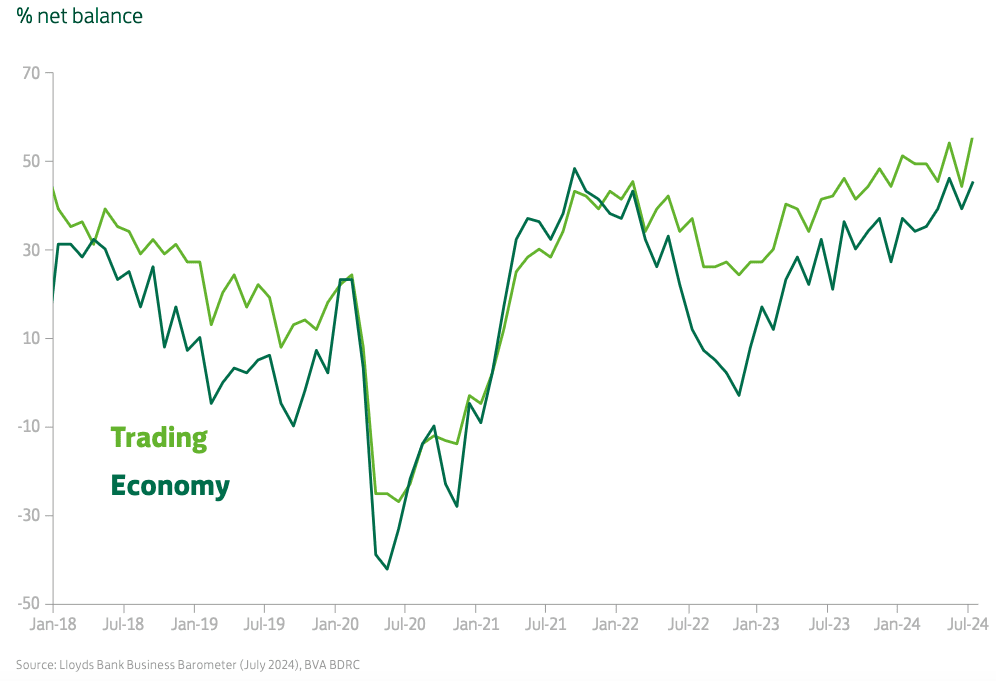

The survey, which has been running for 30 years, revealed firms' trading prospects signalled the strongest output expectations since 2017, while staffing expectations also improved to the joint highest level for seven years.

These findings confirm a robust economic recovery is underway that limits the need for significant support from the Bank of England via interest rate cuts.

The Barometer revealed output expectations in the retail sector leapt to 60% (up 25 points), reaching the highest level since the pandemic.

Above: Overall business confidence bounced back in July by 9 points to 50%.

That matched manufacturing trading prospects, with the net balance gaining 9 points to a two-year high.

"This month shows that businesses are feeling more confident, buoyed by their positive trading prospects confident, buoyed by their positive trading prospects and economic outlook. Retail-focused businesses and economic outlook. Retail-focused businesses were the main driving force behind the positive rise were the main driving force behind the positive rise," says Hann-Ju Ho, Senior Economist, Lloyds Bank Corporate & Institutional Banking.

The labour market remains robust, and will ensure the Bank of England retains a cautious stance when considering interest rate cuts. The survey found net hiring intentions bounced back to reverse June’s fall.

Above: Trading prospects: output expectations at fresh multi-year highs.

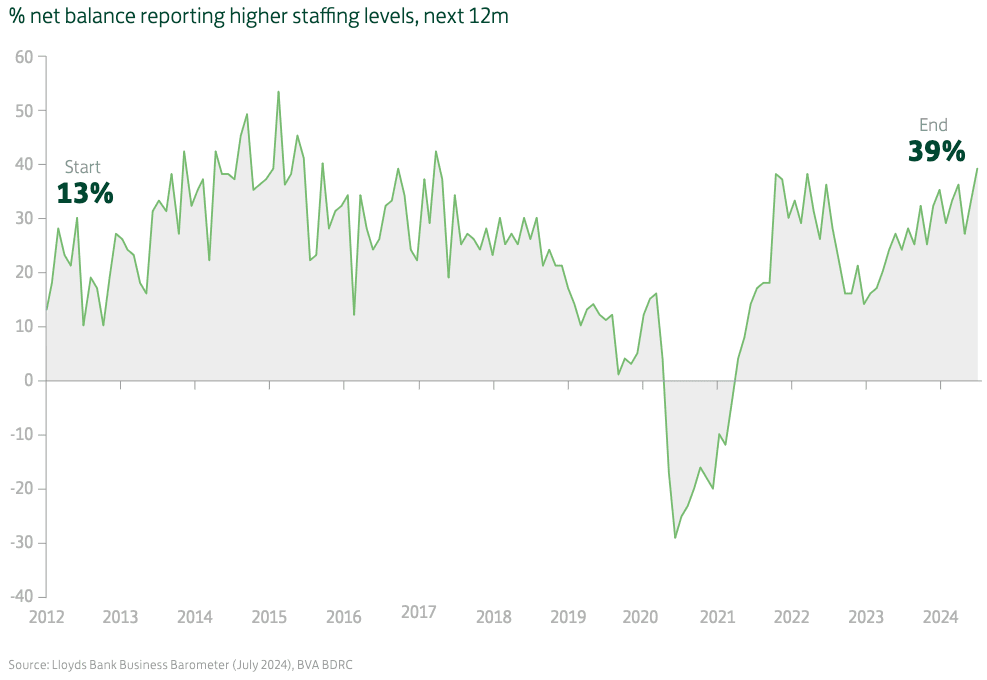

Over half of firms (53%, up from 48%) plan to expand their workforce, while 14% (down from 16%) anticipate a lower headcount. The resulting net balance rose 7 points to 39%, matching the May outcome, which was the highest since March 2017.

Despite strong hiring intentions in recent months, expectations for wage growth have been mixed, according to the Barometer.

Above: Jobs prospects at joint 7-year high.

The proportion of firms anticipating pay growth of above 3% edged up 30% from 28% in June, but nevertheless still lower than 37% in May.

"That may be a tentative sign that factors other than demand are affecting wage expectations. That said, wage expectations remain elevated relative to pre-Covid and pre-furlough levels," says Ho.