Bank of England Will Only Cut in August: Monex Europe

Image © Adobe Images and Pound Sterling Live.

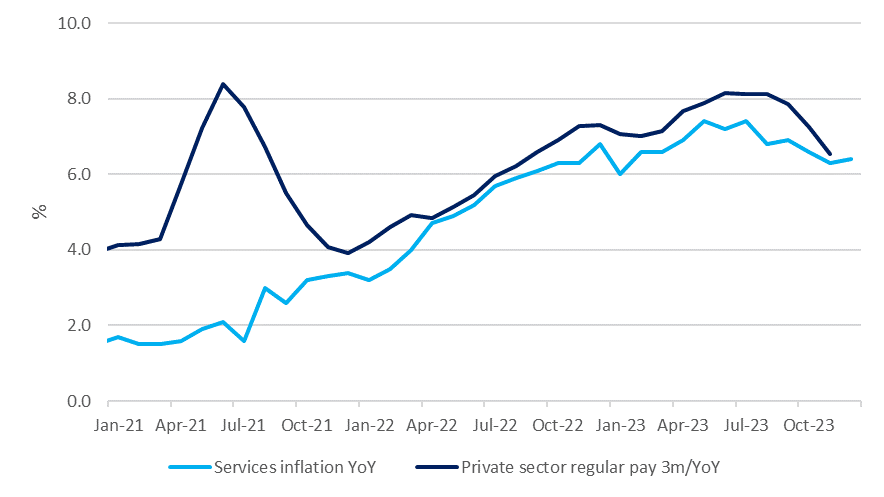

Services inflation should also cool in coming months, writes Nick Rees, FX Market Analyst at Monex Europe, though likely not fast enough to trigger BoE rate cuts before the second half of the year.

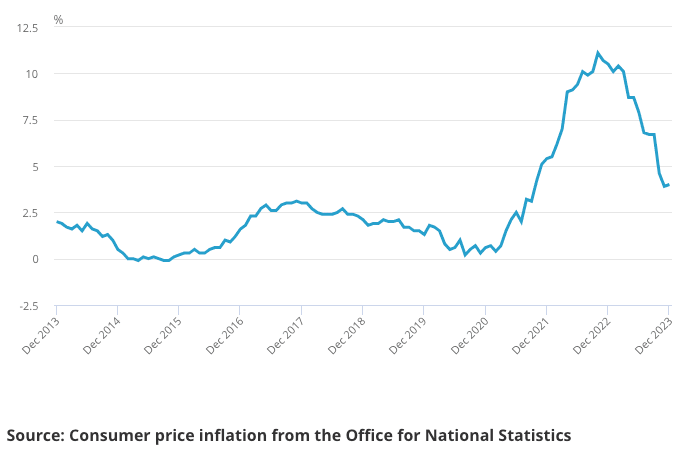

UK inflation reaccelerated in December, with headline price growth rising to 4.0% YoY, up from 3.9% the month prior, surprising the consensus that had expected the measure to cool to 3.8%.

Regardless of how this data is sliced, inflation looks hotter than markets anticipated across the board.

That said, the one saving grace for policymakers at the Bank of England is that following several months of undershoots, inflation is still left tracking below forecasts from the November MPR, which projected headline price growth of 4.6% at the end of 2023.

All told, this supports our view that whilst price growth is set to cool faster than the BoE had anticipated, continued economic resilience will prevent inflation from cooling at a pace that would justify rate cuts in the first half of this year.

As a result, we continue to look for a first rate cut from the BoE in August.

Image courtesy of Monex Europe.

Looking through the headline measures from December’s inflation release, not only was there an overshoot in the YoY figures, but monthly data also printed hot relative to expectations at 0.4% MoM against 0.2% anticipated.

This also showed a notable rise from November’s decline of -0.2%. However, it is particularly noteworthy where these price increases are coming from.

Perhaps unsurprisingly, food inflation remains one of the largest contributors to upwards inflation pressure, accounting for 0.94pp of the headline YoY figure, though price growth in this sub-index continues to cool, with it subtracting -0.14pp from the monthly reading.

More significantly though, restaurants and hotels added 0.97pp to the annual rise in prices, with recreation and culture contributing a further 0.78pp too.

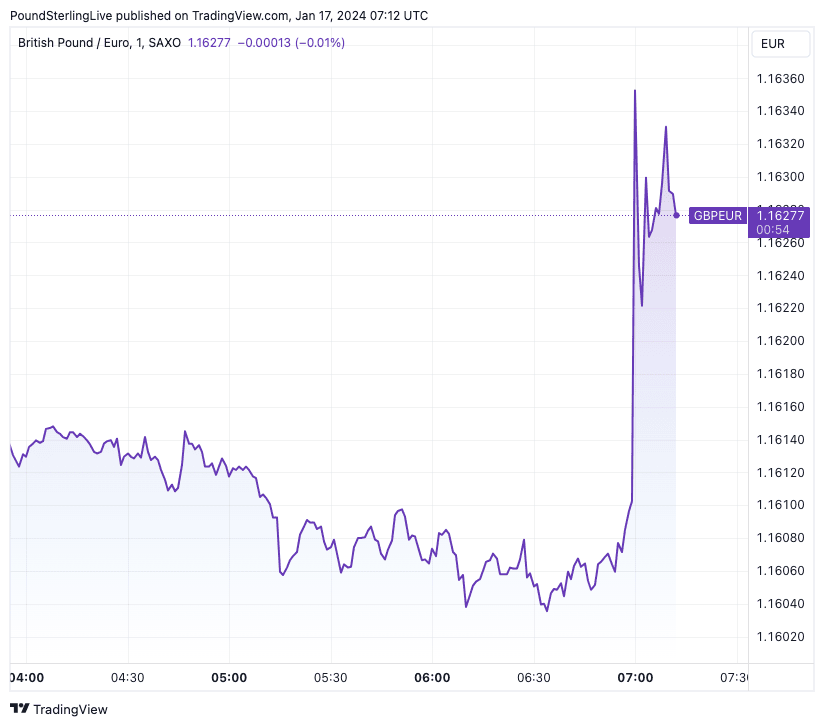

Above: The Pound rose against the Euro (above) and other major currencies on the data's release.

Granted, the former of these fell between November and December, subtracting 0.04pp from the MoM reading, but this was offset by a rise in the latter which added 0.05pp.

Even this trailed the impact of alcohol and tobacco, though this can largely be chalked down to a hefty increase in tobacco duty.

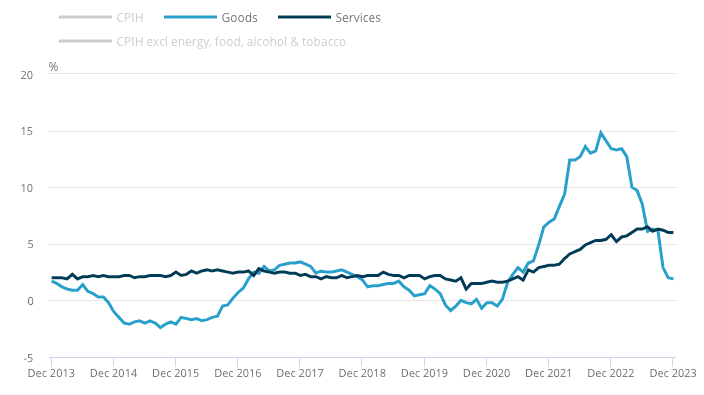

Stripping out volatile energy and food price components, the inflation story remains largely unchanged, with core CPI left treading water at 5.1% YoY.

Perhaps most relevant at the BoE, however, is services inflation, especially given the link that policymakers have drawn between labour market resilience and this measure of underlying inflation pressure. It is notable then that the CPI services reading landed at 6.4% YoY, a 0.1% increase on November's print.

Above: Goods inflation is falling, but services inflation remains 'sticky'. Chart: ONS.

Admittedly, this is still below Bank staff projections that had seen service prices rising by 6.9% in December in the latest round of forecasts.

But it also aligns with the December services PMI release, which pointed to a reacceleration in prices charged in light of rising input costs.

It was notable, however, that this came alongside a note that hiring remained subdued at the end of 2023, a consequence of concerns about wage pressures.

Wage growth also continues to cool in official readings, albeit from a high base, with other indicators also pointing to the labour market easing at the margin, suggestive that whilst wage passthrough continues to push up prices for now, this is also set to cool over coming months.

Taken together, this latest round of data aligns broadly with our view of the UK economy. On the one hand, inflation should fall faster than expected by the BoE in November as a softening labour market weighs on wage growth.

Above: UK headline CPI inflation year-on-year.

On the other, some inflationary stickiness remains, with resilient growth conditions set to keep consumer demand supported at the margin, preventing inflation from cooling fast enough to justify imminent rate cuts from the MPC.

In our view, this dynamic is set to continue playing out in 2024, with real income growth set to keep economic activity resilient.

As such, whilst we expect inflation to continue softening over coming months, the MPC will likely want to be sure the National Living Wage rise in April does not trigger a resurgence in consumer demand and therefore price growth, before feeling comfortable easing policy.

This suggests that the August meeting remains the most likely candidate for the first BoE rate cut to us.

Our outlook for positive growth and rates staying high for some time should be supportive of the pound in the first half of this year, particularly against currencies where growth concerns are likely to trigger more immediate policy easing.

Whilst this is likely to play out most clearly on crosses, particularly against the euro as is visible in the market response to today’s data.