Goldman Sachs Cuts Odds of a U.S. Recession

- Written by: Gary Howes

Image © Adobe Images

Goldman Sachs has lowered its odds that the U.S. will fall into recession saying the disinflation process can continue without the need for a more material economic slowdown.

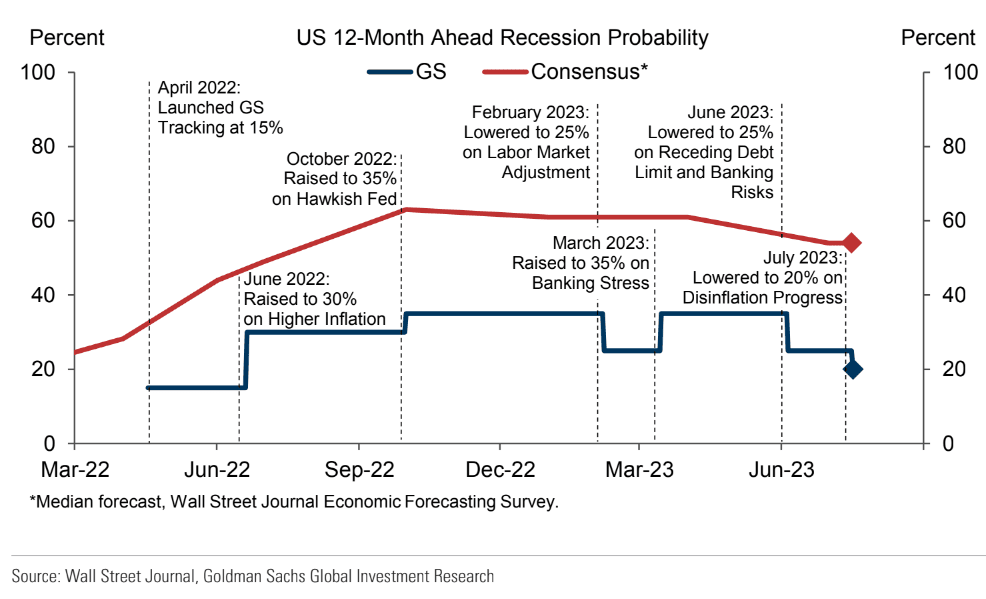

"We are cutting our probability that a US recession will start in the next 12 months further from 25% to 20%," says economist Jan Hatzius.

"This remains slightly above the unconditional average postwar probability of 15%—a recession has occurred approximately every seven years—but far below the 54% median among forecasters in the latest Wall Street Journal survey (which is down from 61% three months ago)," he adds.

Goldman Sachs is more confident that bringing inflation down to an acceptable level will not require the Federal Reserve to engineer a recession via further interest rate hikes, citing a resilient economy.

Goldman Sachs estimates GDP growth for the second quarter at 2.3% and consumer sentiment is seen rebounding sharply from depressed levels. Unemployment retreated to 3.56% in June, and initial jobless claims reversed their most recent mini-spike.

Economists do expect some deceleration in the next couple of quarters, mostly because of sequentially slower real disposable personal income growth from reduced bank lending.

"But the easing in financial conditions, the rebound in the housing market, and the ongoing boom in factory building all suggest that the US economy will continue to grow, albeit at a below-trend pace," says Hatzius.

The U.S. reported last week headline inflation had fallen back to 3.0% in June, down from 4.0% in May. Measures of underlying inflation such as trimmed-mean CPI and PCE have also been easing for quite a while.

The trend of disinflation can continue says Hatzius:

"There are strong fundamental reasons to expect ongoing disinflation. Used car prices are sliding on the back of higher auto production and inventories, rent inflation still has a long way to fall before it catches up with the message from median asking rents, and the labour market has continued to rebalance with an ongoing downtrend in job openings, quits, reported labour shortages, and nominal wage growth."