Bank of England Governor Suggests Market is Mistaken in Outlook for Bank Rate

- Written by: James Skinner

"We had to make really quite a strong move at that point" - Bank of England Governor Andrew Bailey.

Andrew Bailey, Governor at the Bank of England at the policy panel at the ECB Forum on central banking, 28 June 2023 in Sintra, Portugal. © Sérgio Garcia/Your Image for ECB.

Remarks from Bank of England (BoE) Governor Andrew Bailey appeared to suggest on Thursday that financial markets are mistaken in expecting interest rates to rise further as a result of the recent increase in wage growth rates and the rebound in core inflation announced earlier this month.

Governor Bailey told the European Central Bank Forum on Central Banking that last week's decision to raise Bank Rate from 4.5% to 5% was the best way the Bank of England could have responded to recent economic data coming from the UK but also suggested further increases are far from assured.

"The cumulative data, though particularly on the labour market and on the inflation release we had - which to us showed clear signs of persistence - caused us to conclude that we had to make really quite a strong move at that point," the governor said when asked about last week's decision in a panel discussion with other central bank heads.

"My own view on that was that if we're really of the view that we were going to do 25 and then we were really sort of baked in to do another 25 based on the evidence that we had seen, then it was better to do the 50 and then, as Christine said, be evidence-driven so we will wait for the next set of evidence," he added.

Market-based measures have come to imply an expectation of Bank Rate rising further to reach 6.25% by year-end since price-setting in the services sector raised the UK's core inflation rate for a second month running earlier in June and after other figures showed average pay packets growing at almost a record pace in April.

Above: Changes in market-implied expectations for Bank of England Bank Rate between selected dates. Source: Goldman Sachs Marquee.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But Governor Bailey reminded on Thursday that peculiarities of energy pricing in the UK have delayed the pass-through to households of the recent declines in wholesale energy prices, and therefore are slowing the decline of the overall inflation rate, which was unchanged at 8.7% in May.

He also reiterated confidence in the BoE's forecast outlook for inflation to fall further in the months ahead but recognised risks posed by the "very, very robust labour market," which has been a significant contributor to pay growth and has reportedly gotten many companies looking to cling on to staff even in an economic downturn.

The fear is that high levels of wage growth resulting from this enable companies to raise prices and inflation further in their attempts to rebuild profit margins that were damaged by increases in raw materials costs previously, a risk that was flagged by European Central Bank (ECB) President Christine Lagarde earlier in the conference on Tuesday.

"This is pushing up other measures of underlying inflation that capture more domestic price pressures – particularly measures of wage-sensitive inflation and domestic inflation," President Christine Lagarde said when opening the annual conference in Sintra, Portugal.

"And since wage bargaining in many European countries is multi-annual and inertial, this process will naturally play out over several years. In our latest projections, we expect wages to grow by a further 14% between now and the end of 2025 and to fully recover their pre-pandemic level in real terms," she also warned on Tuesday.

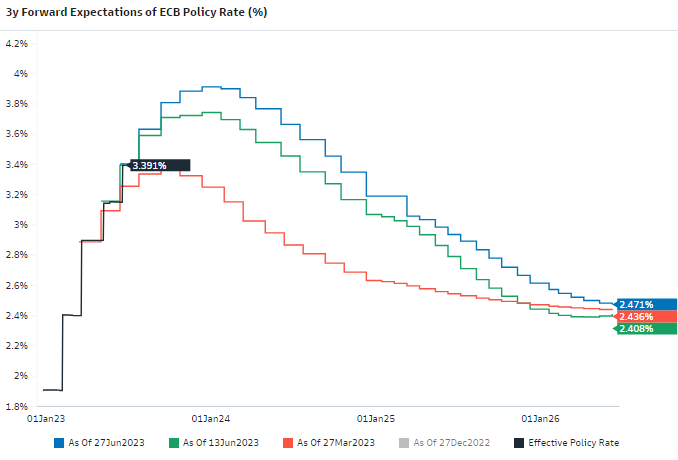

Above: Changes in market-implied expectations for European Central Bank Deposit Rate between selected dates. Source: Goldman Sachs Marquee.

President Lagarde was clear on Thursday when reiterating that Governing Council members see themselves as having further to go with interest rates but reminded that the eventual destination for borrowing costs is yet to be determined by the economic data still to come in the months ahead.

European economic data has deteriorated increasingly over recent months, however, with the Euro Area slipping into a technical recession following on from downward revisions to earlier estimates of first-quarter GDP growth earlier in June.

Previously, she's warned of a risk scenario in which productivity stagnates while workforces recover all of the decline in real or inflation-adjusted income over the coming years, potentially leading inflation to become self-sustaining at higher than desired levels.

"While this “catch up” has long been factored into our inflation outlook, the effect on inflation from rising wages has recently been amplified by lower productivity growth than we had previously projected, which is leading to higher unit labour costs," she said.

"Alongside past upward surprises, this is a key reason why we recently revised up our projections for core inflation, even though our expectations for wages remained broadly the same," she added in opening remarks on Tuesday.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes