Final Kick of a Dying Bear: the S&P 500's Capitulation Event Due in 2003 Warns PIMCO and BNP Paribas

- Written by: Gary Howes

- The market has not yet capitulated

- Current market downturn resembles 2002

- S&P 500 could bottom at 3000: BNP Paribas

- Too early to take on risk: PIMCO

Image © Adobe Images

The U.S. and global economies are widely expected to slip into recession over the coming months, leaving investors wondering as to the scale of the recession and the impact it will have on global equity markets.

Although consensus estimates are looking for a U.S. recession in 2023 the stock market has been rallying since mid-October, leaving some investors and analysts to suggest the bear market is in the process of dying.

But new analysis from PIMCO and BNP Paribas is looking for another down move in U.S. stocks, suggesting the rally of recent weeks is a classic bull trap.

"Recessionary bear markets historically have often ended with a capitulation," says Greg Boutle, Head of U.S. Equity & Derivatives Strategy at BNP Paribas. "We are calling for a capitulation event in equities next year."

The capitulation event would allow investors to time the turning of the market, but it is clear by the recent rally in equities that a good portion of the market asses the bottom has been reached, for the S&P 500 this was on October 13 at 3491.

Above: The capitulation event is yet to come. Image source: BSIC.

The market's current rally has been helped by October inflation data that suggested inflation in the U.S. has peaked, allowing the Federal Reserve to begin considering ending its hiking cycle.

But the Fed itself acknowledges that past hikes are yet to be fully felt by the economy, and regardless, it needs to keep hiking.

PIMCO's business cycle models forecast a recession across Europe, the UK, and the U.S. in the next year, as the major central banks press ahead with policy tightening despite increasing strain in financial markets.

"We therefore maintain an underweight in equity positioning, disfavour cyclical sectors, and prefer quality across our asset allocation portfolios," says Erin Browne, Portfolio Manager for Multi-Asset Strategies at PIMCO.

PIMCO believes corporate earnings estimates globally remain too high and will have to be revised downward as companies increasingly acknowledge deteriorating fundamentals, thereby extending the bear market.

BNP Paribas says the current bear market will have more similarities to the 2002 downturn, as opposed to the 2008 and 2020 events, allowing them to predict its extension.

The current downturn is preceded by a bull market that had notable similarities to the late 1990s when retail investor participation was high. Many of the best-performing corporates at the time were unprofitable and had speculative ambitions, according to BNP Paribas.

Both bull markets were driven by massive P/E multiple expansion, led by the Growth factor and Tech.

Huge government stimulus spending channelled its way into a speculative event on U.S. markets from 2020 to 2021, resulting in a particularly disproportionate growth for financial services and subscription-based companies, according to investfox.

"When we look at the 100 year averages of recessionary crashes, 2002 is quite representative," says Boutle.

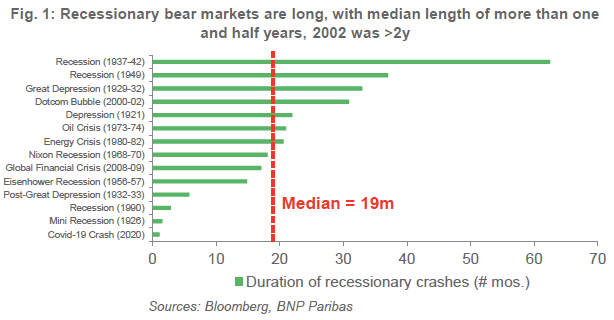

History suggests recessionary bear markets are long, with a median length of 1.5 years; 2002 was 2 years.

They tend to be deep, with a median drawdown of -38; 2002 was -50%, according to BNP Paribas' latest research.

They exhibit lower velocity than non-recessionary crashes with a median of -0.07% per day, 2002 was -0.05%.

The median peak in the VIX was 40.5 with a 26 pt peak to trough move, for 2002 it was a 45.1 peak and a 29 pt peak to trough.

If we apply those averages to the market today, it implies a trough in the middle of next year says BNP Paribas, the S&P bottoming close to 3000 and with the VIX in the low 40s.

Above: S&P 500 with a potential target, as per research detailed here.

The subsequent 5pt P/E multiple compression YTD is the largest valuation contraction since 2002.

In 2002, the SPX troughed with a P/E of 14x. Taking a 2024 EPS forecast of 231 and applying a P/E of 14 x implies ~3250, according to BNP Paribas.

Browne's research finds earnings per share (EPS) estimates have declined by 15% on average during recessions; this would indicate a mild recession could see a smaller drawdown in the mid-single-digits.

PIMCO's Earnings Growth Leading Indicator is looking for a −11% downshift in earnings.

But this is at odds with consensus: Bloomberg's consensus 2023 earnings growth estimate for the S&P 500 is for growth of 6%, or 8% excluding the energy sector.

"In addition, consensus estimates embed expectations of expanding profit margins, even though revenue is likely to slow along with demand while costs stay elevated," says PIMCO's Browne.

Separately, BNP Paribas finds the valuation premium for Growth vs Value has also compressed by 7pts in the current cycle, but this remains 5pts above the 2003 trough.

The Final Kick of a Dying Bear

"Bear markets often conclude with a capitulation," says Boutle.

But what does the capitulation event that would signal the final move of this bear market look like?

BNP Paribas considers a capitulation as a move associated with a sense of panic that involves a rebasing of expectations, analysts aggressively cutting forecasts, volatility spiking, and a repricing of tails.

"Over the last 100 years, the capitulations in volatility have on average come at the same time as the trough in the market," says Boutle.

According to BNP Paribas, a capitulation would event look as follows:

"The last three recessions have seen a pattern of skew and convexity spiking at the same time as volatility peaking. Spikes in skew have tended to swiftly mean revert. A more sustainable pickup in skew generally only manifests later, as the market recovers and volatility declines The average level for spot/VIX correlation at the market lows has been 0 9 VIX points per 1 in spot. This is significantly higher than what we see today at 0.6".

For PIMCO, identifying the bottom is possibly more simple as economists there see a clear turning point being achieved when U.S. rates finally settle following the conclusion of the Fed's hiking cycle.

"Only when rates stabilise and earnings gain ground would we consider positioning for an early cycle environment across asset classes, which would likely include increasing allocations to risk assets," says Browne.