This Bear Market to Last 2-3 More Years: Macro Hive

Written by John Tierney, Global Strategist, Macro Hive.

Image © Adobe Images

So far, the bear market has been following the well-defined script of most previous bear markets of the past seven decades. If past is prologue, we can expect this bear market to end either within two years if inflation soon abates or about three years if the Federal Reserve has to keep hiking interest rates aggressively.

Mark Twain once noted that history does not repeat, but it often rhymes. That is certainly the case with bear markets.

They are each different in many ways – but there are also common patterns that seem to show up most of the time.

Here we examine the 10 bear markets since 1955 to tease out what they have in common, and what that may tell us about where markets may head in coming months. But first, some definitions!

What Is a Bear Market?

A bear market is typically defined as a decline of 20% or more from a recent high. A correction is a decline of 10%.

And a crash is a decline of 50%, although it may also refer to a large and sharp decline in a short period of time.

There is no standard definition of when a bear market ends. Some say it is when the market hits the low point.

Others say it is when the market starts a sustained rally. Those measures are useful for determining when a bull market starts, but for our purpose a bear market ends when the market crosses the previous high.

There are also cases where the stock market falls 20% or more, recovers a bit, then sells off another 20%. We do not examine those bear markets within bear markets.

We focus on the S&P 500 index in this article.

Are We in a Bear Market?

Yes. The S&P 500 is down approximately 20% so far this year, falling from a January 2022 peak of around 4797. It first entered bear market territory on 13 June 2022 and has struggled to exit it since.

The Depression-Era Market

The mother of bear markets started in September 1929 and dragged on for more than 25 years. It lasted through the Depression years of the 1930s, the war and post-war years of the 1940s and into the 1950s before finally ending in September 1954.

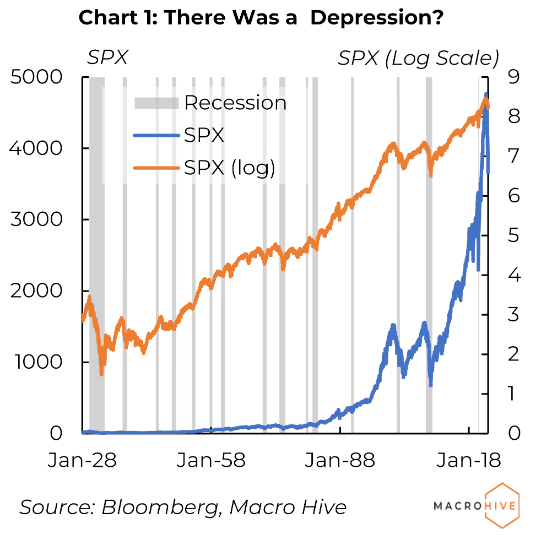

It is impossible to appreciate the extent of that bear market unless we plot it on a logarithmic scale (Chart 1).

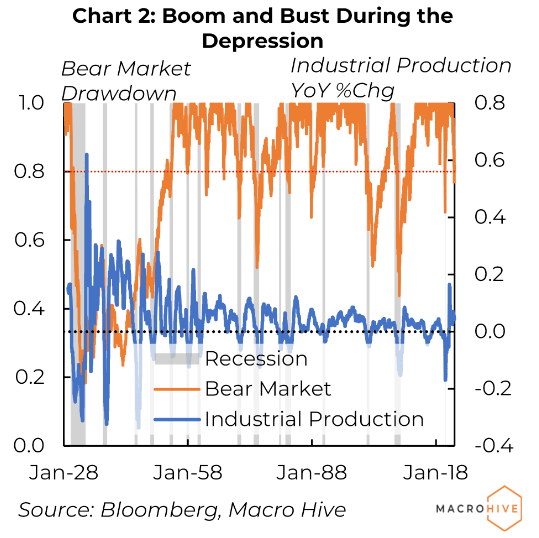

During the initial stock market crash, the index fell more than 85% by July 1932 then tested that low again in 1935 and 1942 (Chart 2).

The economy was highly volatile during those years. Industrial production (the longest readily available economic series) swung from year over year declines of 40% to gains of more than 20%. This was far wider than any point during the post-war years. That uncertainty surely weighed on equities.

We will not study the Depression bear market further. This is partly because we lack data to analyse it as thoroughly as we can from the 1950s onward and partly because that experience was so different from the bear markets that followed.

It is tempting to add that the Depression-era bear market is irrelevant for understanding later periods because we could never repeat the kinds of mistakes that caused it.

But many believe one key mistake that exacerbated the Depression was the Smoot-Hawley Tariff Act of 1930, which imposed tariffs on some 20,000 goods and set off a chain reaction of reciprocal moves by trading partners.

Eight decades later, US President Donald Trump unilaterally imposed various tariffs on trading partners. His belief was that ‘trade wars are good and easy to win’ and that they would spur economic growth.

Again, history rhymes rather than repeats, and the worst that people feared did not happen. But the true lesson is that there is little to prevent some misguided person from pursuing potentially disastrous policies that could crater the economy again, whether out of ignorance or spite.

Bear Markets – The Bare Bones

The modern era of bear markets started in 1956.

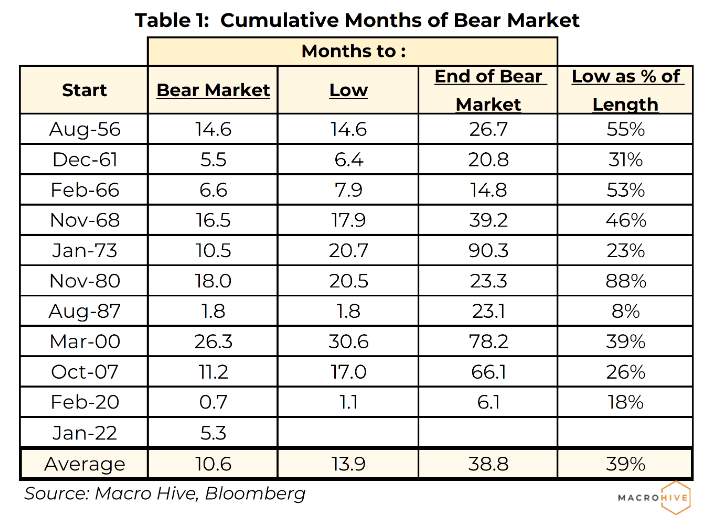

Since then, there have been 10 bear markets plus the one we are in now. On average, they have happened every seven years or so and lasted about 39 months (Table 1). That masks significant variation across bear markets.

- Four lasted less than two years (1961, 1966, 1980, 1987, 2022); several others persisted for five years or more (1973, 2000, 2007).

- Several had drawdowns in the 20-30% range (1956, 1961, 1966, 1980); others had drawdowns near 50% (1973, 2000,2007).

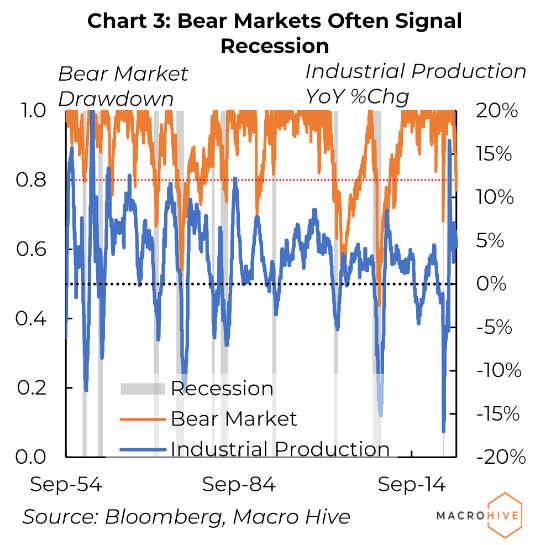

- Bear markets often occur with or around recessions, but not always – exceptions include 1961, 1966, and 1987 (Chart 3).

Bear Market Patterns

One recurring pattern is that bear markets typically hit the low point in the first 25% to 40% of the total bear market (measured as time to return to the previous market high). There were two exceptions.

One exception was the 1980 bear market. It bottomed in August 1982 in response to high inflation and extraordinarily tight monetary policy.

But those policies also cooled inflation, leading Salomon Brothers economist Henry Kaufman (aka Dr. Doom) to predict that interest rates would soon start falling. That set off a massive rally and ended the bear market a few months later.

The other was in October 1987 when equities tanked more than 20% in a single day after a popular portfolio insurance strategy went wrong, triggering wave after wave of selling. In that case, the S&P 500 (SPX) hit a low early in the bear market, less than two months in what would be a two-year bear market.

Those aside, bear markets tend to start gradually then gather momentum. Once they hit bottom it is a long slog back to the previous high.

What Causes a Bear Market?

There are two straightforward reasons why bear markets happened over the past 75 years.

- First, the market was overvalued.

- Second, there was a major crisis. There was also in many cases the buzzsaw of recession, usually brought on by higher interest rates to counter rising inflation or an overheating economy. Absent overvaluation or crisis, any recession-related market selloff probably would have been less severe.

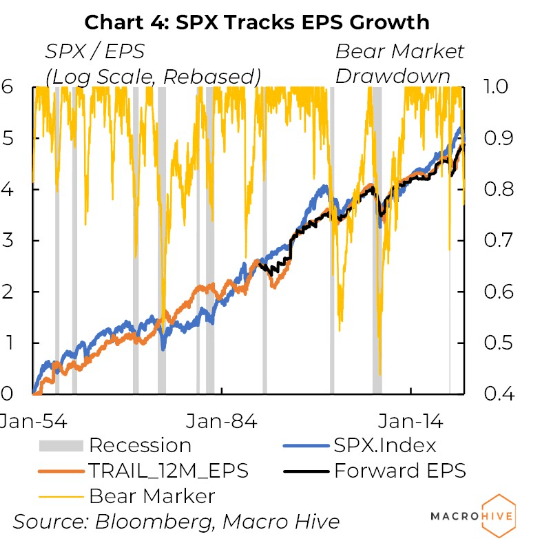

Over time, the SPX index moves roughly in line with growth in earnings (Chart 4).

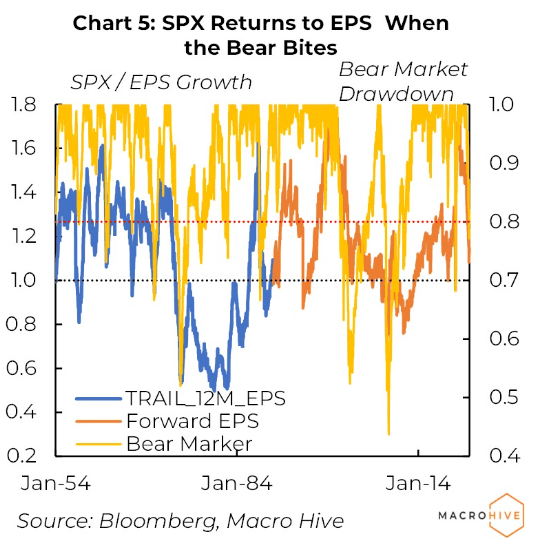

Trailing and forward earnings data became available in 1954 and 1990, respectively. The SPX has tended to move ahead of earnings, and when it gets 30-40% above the earnings trend, bear markets nearly always follow (Chart 5).

Investors are typically nervous at this point – all it takes is some adverse catalyst to set off waves of selling that eventually lead to a bear market.

How Low Do Bear Markets Go?

Once the SPX falls back in line with earnings, it mostly does not go much below it. The driver at that point is earnings.

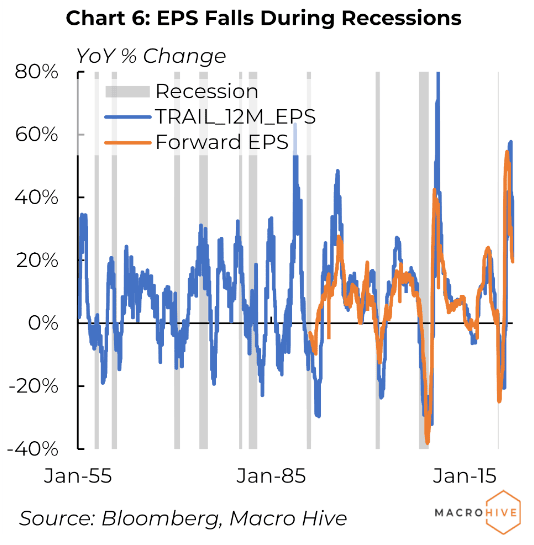

Note, for example, the implosion after the dot-com bubble in the late 1990s. The SPX was more than 75% overvalued by our measure before the collapse then fell to near the EPS trend. From there it followed earnings, which collapsed too, by more than 25% (Charts 5 and 6).

That is a typical recession pattern. Depending on circumstances the low can range from 20%-30% below the previous high to more than 50%.

Times the Stock Market Has Fallen Below Earnings

1970s Stagflation

There are exceptions of course. During the 1970s the SPX meandered in a range below its previous high for 7.5 years, even as earnings were growing 10% or more annually. It was a difficult time. The combination of two oil embargos, stagflation, and high unemployment sapped investor confidence to follow earnings higher.

Lehman Bankruptcy

The second major exception was the bear market of 2008. This is the one case where the SPX did not appear rich relative to earnings before the bear market. Price/earnings ratios actually declined during the boom years before 2008, as investors, still burned by the dot-com collapse, were wary of chasing equities to overly rich valuations.

This bear market was a result of the financial crisis and loss of confidence that followed the Lehman Brothers bankruptcy in mid-September. That crisis spread to the broader economy and greatly deepened what had been a mild recession. Unemployment jumped from 6.1% in August 2008 to 10% by late 2009. That bear market lasted 5.5 years.

Summer 2011

The SPX again dropped well below earnings trend in the summer of 2011. The SPX fell a sharp 17% within weeks when Republicans refused to raise the debt ceiling and brought the US to the brink of default. Again, this was a crisis situation.

What Next for the 2022 Bear Market? Crash or Recovery?

The bear market of 2022 started in classic fashion. Equities had rallied far ahead of earnings expectations and were overvalued by more than 50% by our measure at the end of 2021.

Rising inflation and worries about a more hawkish Fed set off a violent rotation out of growth stocks and into value in January 2022. Further adverse events followed. Russia invaded Ukraine, sending energy and food prices (and inflation) soaring.

China responded to rising Covid infections by locking down large swathes of its economy. This contributed to shortages and supply chain woes that further stoked inflation. The Fed started raising rates. The yield curve steepened sharply, pushing mortgage rates to over 5% and threatening to bring housing to a standstill.

Come mid-June, the SPX entered bear market territory a little more than five months after posting a new high. When it hit the low of 3667 on 17 June, that brought it back in line with the earnings trend. Since then, it has traded in a range near fair value.

A Familiar Pattern

The specifics may be different from previous bear market episodes, but the pattern is quite familiar. One notable difference is the short timeframe it took to reach bear market status; the average is about 11 months.

If this bear market follows form, the SPX will follow earnings going forward. If we have already seen the low, we can reasonably expect to return to the previous high in about 1.5-2 years. In that scenario, economic growth should resume and earnings growth should stabilise If equity markets boom again, we could get there sooner.

On the other hand, if earnings growth slows meaningfully, there will almost surely be a new low. Based on consensus forecasts, earnings are projected to grow about 13% over the next year. But that is unlikely to happen if the economy moves toward or into recession. As Chart 6 makes clear, both trailing and forward earnings projections growth fall significantly around recessions.

Today, investors are weighing the probability of various scenarios. In the more bearish case, inflation remains high and the Fed effectively pushes the economy into recession.

A more constructive scenario is that the forces that pushed inflation up so quickly dissipate, and inflation falls sufficiently to take pressure off the Fed to keep raising rates.

There are any number of scenarios between those possibilities. The key point now is that investors are in a holding pattern, waiting to see what happens with the economy, inflation and earnings.

What Might Go Wrong?

So far, this bear market is broadly similar to most post-war bear markets. But several factors could drive it in different directions going forward:

- The Fed is embarking on quantitative tightening in an effort to unwind 15 years of extraordinary quantitative easing. There is no roadmap of how to proceed or how the economy may react. A major policy mistake is possible.

- The ongoing war in Ukraine could cause new global disruptions.

- China’s battle with Covid could take another turn for the worse, with likely deleterious consequences for the global economy.

The base case is that should any of these events occur, it will be manageable. The economy and any recession will largely follow the typical pattern, with normal variations in length and depth. But as always, investors should be vigilant for signs that something does go seriously wrong and the improbable happens.

Concluding Remarks

Obviously, we cannot call how this bear market will play out. But with some understanding of the common – and unique – features of recessions during the past seven decades, we have a good framework to at least assess where the current one is at.

At Macro Hive, we think the most likely scenario is that the economy weakens during the second half of the year and earnings growth decelerates noticeably. That should drive equities to a new low. How bad it gets will depend on inflation and how the Fed responds to it. In any case, in this scenario, the bear market is likely to last at least three years – or about average. If there is a major policy error or something goes seriously wrong, we could be in for a another of those five-year plus bears.