Impact on Inflation from Cost of Living Spending Boost Not Material: Panmure Gordon's French

- Written by: Gary Howes

Image © Adobe Stock

The targeted nature of the cash boost to UK households from the Government means it is unlikely to be massively inflationary according to analysis from Panmure Gordon.

Assessing the inflationary nature of Rishi Sunak's stimulus package is potentially one of the more difficult tasks facing economists.

Inputing the stimulus into growth models is a relatively straightforward task, but forecasting inflation is a far more difficult question to tackle given there are far more variables and unknowables such as consumer behaviour.

At a basic level dropping £650 directly into the bank accounts of 8.4 million people is stimulatory and will have some upward impact on inflation, which would be an unwelcome development giving it is inflation that forms the crux of the current cost of living crisis.

But how money is spent and on which households will receive it can offer a first step in answering the question of how inflation might react.

"The redistributive nature of the Cost of Living package means less consumption spills into supply-constrained discretionary items with high price sensitivity to demand. Broad based inflation fears from this stimulus feel overdone," says Simon French, Chief Economist at Panmure Gordon.

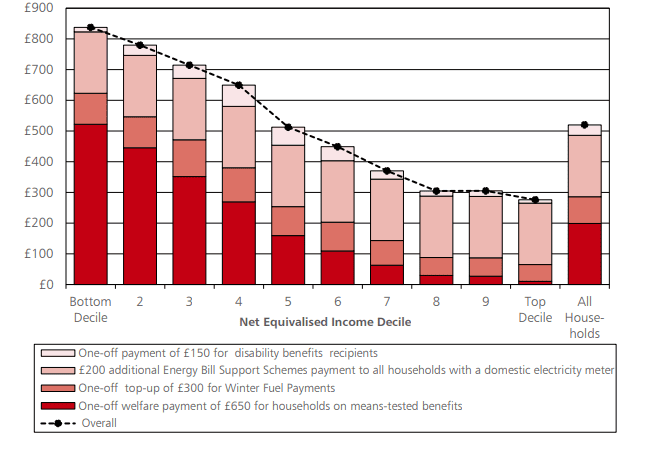

Above: Impact of measures announced in May 2022 on English households in 2022-23 in cash terms (£ per year) by income decile. Image courtesy of Pantheon Macroeconomics.

Analysis shows by far the major beneficiaries of the give away will be the lowest income households who tend to have less discretionary income to direct spending on to a broader category of goods.

Indeed, if the majority of the cash grants go to energy costs the inflationary impact will be negligible.

Economists meanwhile warn that the prospect of any additional inflationary pressures resulting from these new measures will put pressure on the Bank of England to raise interest rates further than they currently might anticipate.

This in turn has implications for the Pound says French.

"If the passthrough of looser U.K. fiscal policy today, is marginally tighter monetary policy - as a number of forecasters have hinted at - then the current composition of inflation (largely imported) gets leant into by a stronger Pound, all else equal," he says.

A weaker Pound is inflationary in the sense it raises the cost of imports, which is highly inflationary for a net-importer such as the UK.

But the market will want to see a stronger economy underpinning higher interest rate expectations before putting a material bid under Sterling, which means the nature of the data following the Government's giveaway will be crucial to the currency's outlook.