UK Consumer Not Collapsing Yet

- Written by: Gary Howes

Image © Adobe Images

New data from the Bank of England show consumers are yet to be put off by the prospect of rising inflation and interest rates.

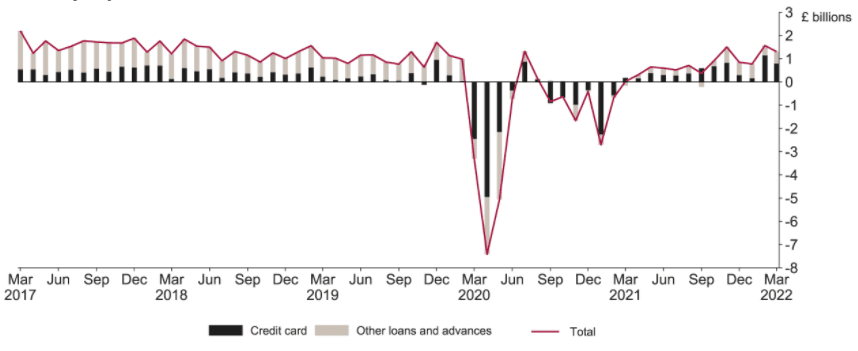

The Bank of England's monthly report on UK money supply trends shows consumers borrowed an additional £1.3BN in consumer credit in March, on net, of which £0.8BN was new lending on credit cards.

Net borrowing of mortgage debt by individuals stood at £7.0BN in March, up from £4.6BN in February, showed the Money and Credit report for March.

In fact mortgage approvals for house purchases were little changed at 70,700 in March, and remains above the 12-month pre-pandemic average up to February 2020 of 66,700.

Sterling money (known as M4ex) increased by £22.6BN in March.

Households’ holdings of money saw net flows of £4.6BN, compared with £4.1BN in February.

"Consumer spending is so far holding up well despite declining real incomes," says Paul Dales, Chief UK Economist at Capital Economics.

Above: Consumer credit, seasonally adjusted. Source: Bank of England.

Dales says part of the strength in borrowing may be because some households are having to borrow as higher inflation means their incomes aren’t stretching as far.

"But most of it probably reflects a continued willingness to spend," says Dales.

The data comes as the Bank of England deliberate whether to raise interest rates, with an announcement due on Thursday May 05.

The consumer data leads Capital Economics to predict that not only will the Bank of England raise interest rates from 0.75% to 1.00% at tomorrow’s meeting, but that it will need to increase them to 3.00% next year.

This is far more than the consensus of analysts are expecting.

"Admittedly, consumer spending may well fall outright in both Q2 and Q3. But we suspect any decline will be much smaller than the fall in real incomes as households adjust their savings behaviour," says Dales.

But Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics, says the data reveal households are in fact loath to touch their savings, and this suggests to him real expenditure is set to fall in the second quarter in response to the squeeze on disposable incomes.

He says the £6.0BN increase in households' liquid assets in March exceeded the £4.9BN average rise in the two years before Covid-19, so the value of "excess savings” increased to £186.4BN, from £185.3BN in February.

Pantheon Macroeconomics anticipate a more cautious path of Bank of England rate hikes than the market is currently expecting.