ECB Rate Hikes: New Report Suggests Analyst Expectations Could be too Aggressive

- Written by: Gary Howes

Image © European Union, reproduced under CC licensing

The European Central Bank is on course to raise interest rates as soon as July according to a new report which has attracted analyst attention at the start of a new week, but there is a concerning detail in the report for Euro 'bulls'.

Reuters are reporting "nine sources familiar with ECB thinking" as saying an interest rate rise is likely to come in July, and no later than in September.

The European Central Bank (ECB) has long been in the slow lane when it comes to 'normalising' policy via raising interest rates, but this looks set to change.

The Euro rose last week after a number of ECB policy makers said a July rate hike was now plausible, therefore on balance the Reuters report is supportive.

However, one source said the neutral interest rate - at which point policy is neither stimulatory nor restrictive - could be around 1% to 1.25%.

It therefore serves as a potential indicator as to where interest rate hikes might stop, and this is an important consideration for currency markets.

"Getting to this level by the end of 2023 could be reasonable," a fifth source said.

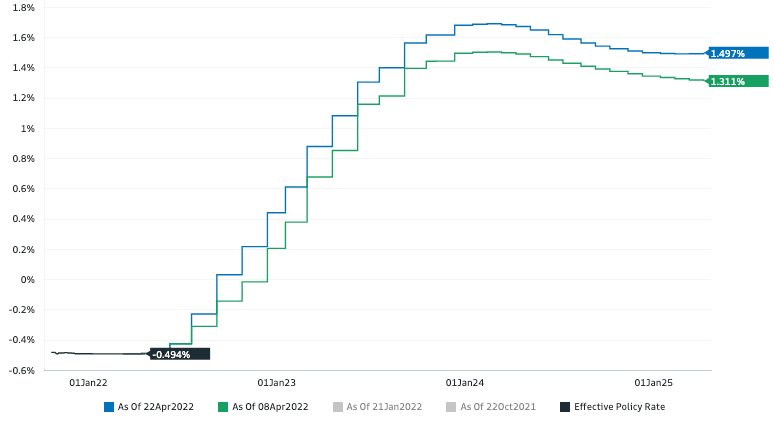

Antoine Bouvet, a rates strategist at ING, says "by far the most interesting information from Reuters 'ECB sources' is their estimate of the neutral rate at 1-1.25% and that it could be reached by end-2023. This compares with forwards pricing of almost 1.75% by that date".

This could mean the market is actually too aggressively priced for ECB rate hikes, which if correct could imply some disappointment and eventual Euro weakness.

Bouvet says the remaining substance of the report "is par with the course, two hikes this year (possibly 3), first move in July or September, end of QE decided in June".

Above: ECB rate hike expectations, image courtesy of Goldman Sachs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB has thus far resisted raising interest rates because its longer-term forecasts showed inflation falling back below the 2.0% target.

But fresh estimates seen by ECB policy makers at their April 14 meeting showed even 2024 inflation over target, several of the sources told Reuters.

"It was just over 2% so in my interpretation all the criteria to raise interest rates have now been met," according to one source who spoke with the newswire.

Nearly all of the sources said that they see at least two rate hikes this year, but some argued that a third is also possible, although highly dependent on how markets digest its moves.

The ECB therefore now looks to be in position to raise rates by the time of its July 21 meeting.

"Unless the outlook changes dramatically, I would go for July," a third source said.

Some of the sources did however tell Reuters they would still prefer to wait until September, partly because new forecasts would be available by then and partly to avoid a major policy move during the summer months, when liquidity is lower.