Return to the Office Boosts UK Economy, But Anxiety Over the Future Builds: March PMIs

- Written by: Gary Howes

Image © Adobe Images

The UK economy continued to show a healthy rate of expansion in March as workers returned to their offices, but inflationary headwinds and the war in Ukraine meant expectations for the future amongst UK businesses fell sharply according to the latest S&P Global PMI report.

The monthly survey of UK business activity and confidence finds that both the manufacturing and services sectors of the economy continue to expand at above-historical trends, even as inflation surged.

The Manufacturing PMI read at 55.5 in March, which is consistent with growth but it did represent a slowdown on the February reading of 58.0 and was below expectations for a reading of 58.0.

But the more significant Services PMI read at 61.0, which represents a slight softening on February's 60.5 but was well ahead of the consensus estimate for a reading of 58.

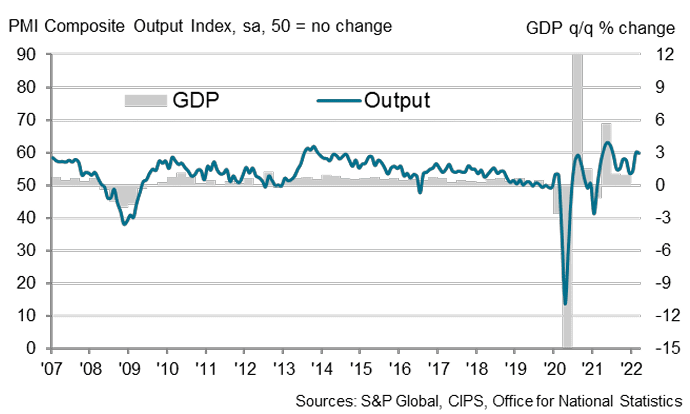

Above: S&P Global / CIPS Flash UK PMI Composite Output Index.

The Composite PMI - which gives a view of the broader economy - read at 59.7, which is ahead of consensus at 58.7 and virtually unchanged on February's 59.9.

The strong service sector reading reflected an increase in activity linked to the full removal of COVID-19 restrictions, delivering the strongest growth since June 2021.

The survey finds a return to offices and customer events had boosted business activity in the service economy, alongside pent up demand for travel, leisure and entertainment.

The strong results from the March survey could however represent a peak for the series given the forward-looking components of the survey hint at a slowdown in growth rates ahead.

S&P Global found escalating inflationary pressures and concerns related to Russia's invasion of Ukraine led to a slump in business optimism to its lowest since October 2020.

The business optimism index dropped from 76.1 in February to 71.4 in March.

"The survey indicators point to potentially sharply slower growth in the coming months, accompanied by a further acceleration of inflation and a worsening cost of living crisis, which paints an unwelcome picture of 'stagflation' for the economy in the months ahead,” says Chris Williamson, Chief Business Economist at S&P Global.

Furthermore, the monthly fall in business expectations (down 4.7 index points) signalled by far the greatest setback since the start of the pandemic said S&P Global, reflecting much weaker year ahead growth projections in both the manufacturing and services sectors.

Manufacturers said a slowdown in growth was related to a greater caution among clients.

The survey finds escalating fuel, energy and staff costs resulted in the steepest rise in prices charged since this index began in November 1999.

Wage pressures are likely to remain elevated given an ongoing robust rise in private sector employment reported by respondents.

In fact the pace of job creation accelerating to its fastest since August 2021.

"Companies reporting an increase in their payroll numbers mostly cited efforts to boost business capacity," said S&P Global.